VESTAVIA HILLS, ALA. — Matthews Real Estate Investment Services has brokered the $27.2 million sale of Swaid Vestavia Medical Center, a multi-tenant medical facility located at 1021 Montgomery Highway in Vestavia Hills, a southern suburb of Birmingham. The newly built property spans 40,000 square feet and features an ambulatory surgery center and medical office space leased to tenants such as the Surgical Institute of Alabama, Vestavia Diagnostics, Swaid Clinic, Bramlett Orthopedics, Birmingham Vascular Associates, Pain Management Services, Lab First and Champion Physical Therapy. Matthews’ healthcare division sourced the buyer, an institutional healthcare real estate fund based in Dallas. The seller was not disclosed.

Healthcare

CLEVELAND — The Cooper Commercial Investment Group has brokered the sale of a single-tenant medical office building in Cleveland for nearly $1.8 million. Cleveland Clinic occupies the property. Dan Cooper of Cooper Group represented the seller, a Florida-based private investor. The California-based buyer purchased the property at the full asking price, which represents a cap rate of 6.5 percent.

LOS ANGELES — Newmark has brokered the sale of a single-tenant net-leased medical office building in the Eagle Rock neighborhood of Los Angeles. Eastern Real Estate and Atlas Capital Group sold the asset to LaSalle Investment Management for $18.2 million. Sean Fulp, Bill Bauman, Kyle Miller, Mark Schuessler and Ryan Plummer of Newmark represented the seller in the deal. Adventist Health Glendale has occupied the 19,777-square-foot critical outpatient facility, located at 2560 Colorado Blvd., since 2003. The tenant operates a physical therapy and wellness center at the facility. The property is located one mile from the 515-bed Adventist Health Glendale hospital.

LONG BEACH, CALIF. — CBRE has brokered the sale of a medical office building, located at 200-202 W. Wardlow Road in Long Beach. A private seller sold the asset to an undisclosed buyer for $6.6 million. Bill Maher, Anthony DeLorenzo, Bryan Johnson and Gary Stache of CBRE represented the seller in the deal. Originally constructed in 1964 and remodeled in 2017, the single-story building features 8,691 square feet of medical office space. The buyer plans to convert the medical building with operating rooms into an office building to accommodate the expansion needs of the buyer’s business.

TOLEDO, OHIO — Avison Young has brokered the sale of a three-building medical office complex totaling 110,780 square feet in Toledo for an undisclosed price. The Regency Medical Campus features a surgery center, exam rooms, numerous physician and patient amenities, waiting areas and treatment areas. Mike Wilson, Erik Foster and Chris Livingston of Avison Young represented the seller, Barone Enterprises. Global Medical REIT was the buyer.

TOLEDO, OHIO — Avison Young has brokered the sale of a three-building medical office complex totaling 110,780 square feet in Toledo for an undisclosed price. The Regency Medical Campus features a surgery center, exam rooms, numerous physician and patient amenities, waiting areas and treatment areas. Mike Wilson, Erik Foster and Chris Livingston of Avison Young represented the seller, Barone Enterprises. Global Medical REIT was the buyer.

CHULA VISTA, CALIF. — Coseo Properties completed the disposition of an office and medical building, located at 690 Otay Lakes Road in Chula Vista. A private investor acquired the asset for $8.8 million, or $318 per square foot. Built in 1979 and renovated in 2016, the two-story building features 28,700 square feet of office and medical space. Recent renovations include upgrades to the building and common areas. The property features a landscaped entryway, flexible suites ranging from 818 square feet to 4,380 square feet, 11-foot ceiling heights and ample natural light. Situated on 2.9 acres, the property also includes 154 parking spaces. At the time of sale, the property was fully occupied by New American Funding, Life Residential, Eastlake Rejuvenation and Wellness Center, Excel Speech Therapy Center, Boursa Investments and Edward Jones. Matt Pourcho, Anthony DeLorenzo, Matt Harris, Chris Williams and Ramin Salehi of CBRE represented the seller in the deal.

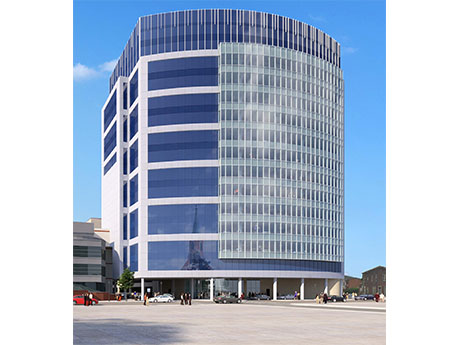

NEW BRUNSWICK, N.J. — New Jersey-based developer AST has topped out a 229,000-square-foot healthcare project in the Central New Jersey community of New Brunswick. The 15-story ambulatory medical pavilion is situated within the Robert Wood Johnson University Hospital campus. Upon completion, which is scheduled for the second quarter of 2023, the facility’s outpatient access to care and clinical experts supporting existing RWJBarnabas Health hospital services will be expanded.

ST. PAUL, MINN. — Kraus-Anderson (KA) has completed a $14 million renovation of the emergency department at Regions Hospital in St. Paul. The 18,000-square-foot project involved the renovation of 12 treatment rooms and the addition of new support spaces in Pod A. KA added 11 new treatment rooms as well as new support spaces in Pod B. Additionally, KA remodeled the existing X-ray room, and added a new X-ray room, CT room and control room. BWBR Architects was the project architect. Regions Hospital is a part of HealthPartners.

NEW YORK CITY — Locally based investment firm Seavest Healthcare Properties has acquired a 57,000-square-foot medical office building located at 355 W. 52nd St. in Manhattan. NYU Langone Health anchors the eight-story building, which was fully leased at the time of sale to an array of specialty care practitioners. The seller and sales price were not disclosed.