RIVERHEAD, N.Y. — Chicago-based investment firm Bradford Allen has completed the renovation of the 114-room Hilton Garden Inn Riverhead hotel on Long Island. Renovations included refreshed guestrooms with new beds, bedding, carpet, bathrooms and furniture, as well as the addition of Peloton bikes to select rooms. The lobby, lounge area and front desk all received new flooring, furniture, accents and lighting, while meeting and event spaces were revamped with new carpet, paint, lighting and audio/visual equipment. The project team also added new public restrooms and improved the lobby bar, restaurant and patio. Bradford Allen acquired the hotel in late 2023 and began renovations thereafter.

Hospitality

M.A. Mortenson, McCarthy Complete $1.3B Gaylord Pacific Resort, Convention Center in Chula Vista, California

by Abby Cox

CHULA VISTA, CALIF. — M.A. Mortenson and McCarthy Building Cos. have completed the Gaylord Pacific Resort and Convention Center, a $1.3 billion hospitality project located on the Chula Vista Bayfront, about seven miles from downtown San Diego. The nearly 2 million-square-foot development, construction of which began in August 2022, is the largest hotel project in the United States, according to the development team. Spanning 36 acres, the development consists of a 22-story Marriott hotel with 1,600 guestrooms (including 89 suites) and an 800,000-square-foot convention center that has an open-floor exhibit hall with meeting rooms, elevated ballrooms and areas to host large-scale events. The property also features a 4.3-acre outdoor waterpark with a waterslide, lazy river, wave pool, poolside bars and private cabanas. Guests have access to additional amenities such as a sports bar, fitness center, full-service spa and salon, nine-story parking garage and several restaurants, including Old Hickory Steakhouse, Trēō Kitchen + Bar, Shallow End Grill and Sunny’s. The development team, which includes HKS Architecture, the City of Chula Vista, the Port of San Diego and Marriott International, completed the project in 34 months, creating approximately 3,000 annual jobs during the construction phase. The team also estimates that the project will …

WISCONSIN DELLS, WIS. — HALL Structured Finance (HSF) has provided a first lien construction loan totaling $41.1 million for the Dellshire Resort in Wisconsin Dells, a city in southern Wisconsin. HSF partnered with Nuveen Green Capital, which provided an additional $27.8 million in C-PACE financing. Adrienne Andrews and Jeffrey Bucaro of JLL arranged the financing on behalf of the borrower, Uphoff Ventures LLC. Dellshire Resort will be a 208-room Medieval-themed hotel and represents the initial phase of a 40-acre master-planned resort and attraction development. The four-story hotel will feature a 222-seat restaurant, six pools, a swim-up pool bar, 9,500-square-foot arcade and family entertainment center, ATV rentals and approximately 6,500 square feet of meeting and event space. A 60-foot-tall fire-breathing dragon sculpture will mark the hotel’s entrance, complemented by costumed knights and dragon-themed interactions throughout the property. Located approximately 55 miles northwest of Madison, Wisconsin Dells is known as the “Waterpark Capital of the World,” boasting the highest concentration of indoor and outdoor waterparks globally, according to HSF. The local economy is heavily tourism-driven, drawing more than 4 million visitors annually. Completion of the Dellshire Resort is slated for the second quarter of 2026. Pyramid Global Hospitality will manage the asset. …

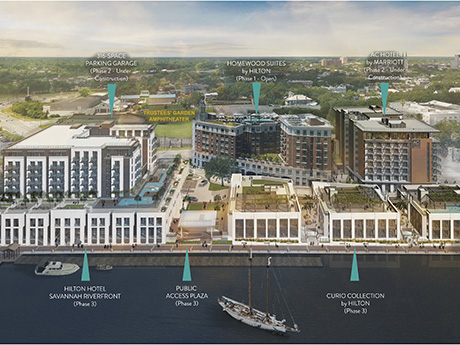

North Point Hospitality Completes $105M Second Phase of River Street East Development in Savannah

by John Nelson

SAVANNAH, GA. — North Point Hospitality has completed the $105 million Phase II of River Street East, a three-phase mixed-use district located along the Savannah River. The second phase includes a 171-unit AC Hotel by Marriott Savannah Historic District hotel and a 316-space public parking garage, which is now open. Additionally, 3,300 square feet of street-level retail space is available for lease. AC Hotel by Marriott features a rooftop restaurant and bar, as well as flexible meeting spaces. Phase I of the development included the Homewood Suites by Hilton Savannah Historic District/Riverfront hotel, which was delivered in 2015 and renovated in 2024. Phase III of River Street East will include a 300-unit full-service, dual branded luxury and lifestyle hotel, which will feature a ballroom for private events, world-class spa and multiple dining experiences.

FARGO, N.D. — Marcus & Millichap has negotiated the $8.3 million sale of Comfort Suites Medical Center, an 82-room hotel in Fargo. Allan Miller, Chris Gomes, Huberth Marak and Skyler Cooper of Marcus & Millichap represented the buyer, a limited liability company, while the brokerage firm’s Jon Ruzicka assisted in closing the transaction. The buyer was part of a hospitality group completing a 1031 exchange after selling a hotel in Montana. The deal closed with conventional financing from a local lender. The property is located at 4417 23rd Ave. S.

KEY BISCAYNE, FLA. — Locally based Gencom has begun the $100 million overhaul of The Ritz-Carlton Key Biscayne, Miami resort. The 13-story, 275,000-square-foot hotel is located on a 17-acre site at 455 Grand Bay Drive on Key Biscayne, a barrier island situated south of Miami. Originally built in 2001, the property offers 420 guestrooms and 600 feet of direct beach access. The design team for the resort’s first major renovation includes Hart Howerton (master), Design Agency (public spaces) and Chapi Chapo Design (guestrooms). The overhaul includes new exterior paint and façade elements, a new glass façade in the lobby, redesign of the spa and a new restaurant that will join the existing lineup of eateries that will be refreshed: RUMBAR, Cantina Beach, Dune, Scoop, Stefano’s and Key Pantry. Amenities that will be overhauled include the resort’s swimming pools, fitness center, The Club Lounge and the Cliff Drysdale Tennis Center, which is the largest tennis facility of any Ritz-Carlton resort. Gencom, which co-developed the hotel, expects the renovations to conclude by the end of the year.

Cronheim Hotel Capital Arranges $23.6M Refinancing for Holiday Inn Resort in Surfside Beach, South Carolina

by John Nelson

SURFSIDE BEACH, S.C. — Cronheim Hotel Capital has arranged a $23.6 million loan for the refinancing of Holiday Inn Resort, a 206-room, beachfront hotel in Surfside Beach, a city in the Myrtle Beach metropolitan area. The borrowers, Innisfree Hotels and RREAF Holdings, purchased the 11-story property as an independent hotel in late 2023 and invested capital to convert the asset to a Holiday Inn Resort. The direct lender was an undisclosed regional bank. According to the property website, the hotel features an onsite restaurant, fitness center, pool and a kids splash pad.

SAN ANTONIO — Atlanta-based brokerage firm Hunter Hotel Advisors has negotiated the sale of the 106-room Hilton San Antonio North Stone Oak hotel on the city’s north side. Rooms feature kitchenettes, and amenities include a fitness center and outdoor pool. A San Diego-based investor purchased the property from an institutional investment firm, with both parties requesting anonymity. Kami Burnette and Mason McDavid of Hunter Hotel Advisors brokered the sale. The firm’s Adeel Amin arranged acquisition financing for the deal.

LAKEWOOD, N.J. — Hotels Unlimited, an affiliate of New Jersey-based developer TFE Properties, has completed the $5 million renovation of the 110-room Hilton Garden Inn hotel in Lakewood, located in Ocean County. The renovation delivered an overhaul of all guestrooms and suites, as well as the lobby and amenity spaces, which include meeting rooms, an indoor pool, fitness center and an onsite restaurant. In addition, the project team applied fresh paint to the building’s exterior. A grand re-opening ceremony will take place on Tuesday, May 13.

KARA Hospitality Opens 92-Room Extended Stay America Hotel in Charlottesville, Virginia

by John Nelson

CHARLOTTESVILLE, VA. — KARA Hospitality has opened Extended Stay America Premier Suites – Charlottesville, a 92-room, four-story hotel in Charlottesville. The hotel features free Wi-Fi, complimentary breakfast, cable TV, a 24-hour fitness room, onsite guest laundry and a lobby with additional vending options. All suites include fully equipped kitchens with full-size refrigerators, microwaves, stovetops, cookware, utensils and dishes, as well as recliners and work areas.