PLANO, TEXAS — Eastern Union has arranged $20.4 million in financing for a seniors housing conversion project in Plano. Built in 1984 and renovated in 2005, the six-story, 137-room building at 700 Central Parkway E. was most recently operated as a Deluxe Inn hotel. The borrower plans to convert the property into a facility with 100 assisted living units and 40 memory care units that will be operated under the Parkdale Senior Living brand. Meir Abrahamson of Eastern Union arranged the financing, which consists of a $15.8 million construction-to-permanent loan and $4.7 million bridge loan. The direct lender was not disclosed. The conversion is slated for a mid-2026 completion.

Hospitality

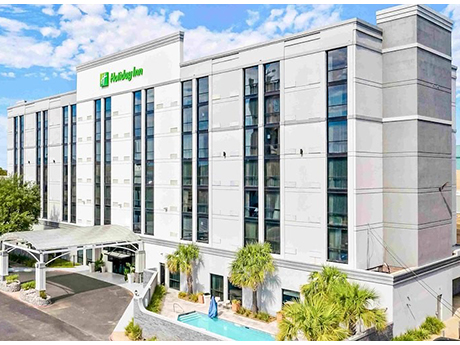

Coldwell Banker Arranges $38M Sale of Holiday Inn & Suites Hotel in Monterey Park, California

by Amy Works

MONTEREY PARK, CALIF. — Coldwell Banker Commercial George Realty, on behalf of the private investor seller, has arranged the $38 million sale of the Holiday Inn & Suites hotel at 400 S. Atlantic Blvd. in Monterey Park. Details of the sale were not released. Completed in 2024, the six-story property features 136 guest rooms and 2,000 square feet of meeting space. The hotel is part of the Atlantic Times Square project, which has brought new development to the area south of I-10, west of downtown Los Angeles.

SOUTHAVEN, MISS. AND BUFORD, GA. — JLL has negotiated the $25 million sale of a hotel portfolio in the Memphis suburb of Southaven, as well as the $11 million sale of a hotel in Buford. The properties included the Courtyard Memphis Southaven (85 rooms), the Residence Inn Southaven (78 rooms) and the Fairfield Inn & Suites Buford (94 rooms). C.J. Kelly and Bobby Norwood of JLL represented the buyer, Woodvale Opportunity Fund I, in the transaction. The seller was Chartwell Hospitality.

AUGUSTA, GA. — Miami-based Flacks Group has purchased Crowne Plaza North Augusta, a 180-unit hotel in Augusta. Built in 2019 near the Augusta GreenJackets’ Minor League Baseball ballpark, the hotel features meeting spaces, the Salt + Marrow steakhouse and a rooftop bar called Jackson’s Bluff. Hodges Ward Elliott represented Flacks Group in the transaction. The seller and sales price were not disclosed, but the Post and Courier North Augusta reports that Ackerman Greenstone sold the property. Blue Lotus Ventures was a consultant in the transaction, and J.P. Morgan provided an undisclosed amount of acquisition financing.

SYRACUSE, N.Y. — Virginia-based private equity firm Excel Group has acquired the 209-room Embassy Suites by Hilton Syracuse Destiny USA. The name stems from the property’s location adjacent to Destiny USA, a 2.4 million-square-foot shopping, dining and entertainment destination. The hotel opened in 2017 and offers amenities such as a indoor pool, fitness center, business center and meeting rooms. The seller and sales price were not disclosed. The new ownership has tapped Island Hospitality Management to manage the hotel.

PARK CITY, UTAH — Hyatt Hotels Corp. has opened Grand Hyatt Deer Valley, a 436-key resort at Extell Development Co.’s Deer Valley East Village in Park City. Grand Hyatt Deer Valley provides direct access to Deer Valley Resort, including more than 300 skiable acres, 20 debut runs and three chairlifts, and is expected to open for the 2024/2025 season in December, conditions permitting. Designed by Denver-based OZ Architecture, Grand Hyatt Deer Valley offers 381 guest rooms and 55 residences. All rooms are equipped with flat-screen HDTVs, Nespresso coffee makers, blackout curtains, individual climate control, hair dryers, bathrobes and minifridges. The resort also features a heated outdoor pool, three oversized hot tubs, a pool deck and a nighttime entertainment program. The property offers four restaurants, Remington Hall, Hidden Ace, Living Room and Double Blacks; nearly 30,000 square feet of indoor and outdoor event space, including a 10,000-square-foot ballroom; skier services; pet-friendly programming; Camp Hyatt Kids Club; and The Spa at Grand Hyatt Deer Valley.

ALEXANDRIA, LA. — Marcus & Millichap has brokered the $9.8 million sale of Holiday Inn Alexandria Downtown, a 169-room hotel located at 701 4th St. in downtown Alexandria that fronts the Red River. The seller was Sharpco Hotels, an investment firm based in Natchitoches, La., that purchased the formerly vacant hotel from the City of Alexandria and revitalized and rebranded the property. A partnership between Tennessee-based VJ Hotels and Texas-based ARK Hospitality purchased the hotel. David Altman of Marcus & Millichap represented the seller in the transaction. Steve Greer served as Marcus & Millichap’s broker of record in Louisiana for the transaction. Holiday Inn Alexandria Downtown features 11,000 square feet of meeting space, a restaurant and Tesla car chargers, as well as direct access to the Randolph Riverfront Convention Center.

BUFORD, GA. — Locally based Hunter Hotel Advisors has brokered the sale of Fairfield Inn & Suites Atlanta Buford Mall of Georgia, a 96-room hotel located off I-85 in the Atlanta suburb of Buford. Woodvale acquired the property from Hotel Equities for an undisclosed price. Lee Hunter and David Perrin of Hunter Hotel Advisors facilitated the transaction. The hotel is situated in close proximity to its namesake mall, as well as other attractions including The Exchange & Gwinnett, which features a Topgolf, and Lake Lanier. Woodvale plans to fully renovate all guest rooms and public areas, including the hotel’s fitness center, meeting spaces and an indoor pool. Hotel Equities had owned the Fairfield Inn & Suites hotel for nine years.

SEATTLE — CBRE has secured $27 million in refinancing for the Hampton Inn & Suites by Hilton Seattle Downtown. James Bach, Connor Lemley, Regina Wang and Griffin Walker of CBRE’s Pacific Northwest Debt & Structured Finance team facilitated the five-year, fixed-rate refinancing on behalf of the undisclosed owner. Located at 700 Fifth Ave. North, the six-story hotel features 199 guest rooms with in-room kitchens. Hotel amenities include free breakfast, free Wi-Fi, a fitness center, laundry facilities, parking, a 24-hour business center and conference spaces. This financing represents the first refinancing of the property in 20 years and follows a significant interior and exterior renovation completed by the owner in 2020.

Marcus & Millichap Negotiates Sale of 94-Room Extended-Stay Hotel in Westminster, Colorado

by Amy Works

WESTMINSTER, COLO. — Marcus & Millichap has negotiated the sale of Residence Inn by Marriott Denver North Westminster, Colorado in Westminster, a suburb 12 miles north of Denver. Dallas-based NewcrestImage sold the extended-stay hotel to Archer Capital Group for an undisclosed price. Chris Gomes of Marcus & Millichap represented the seller. Gomes, along with Allan Miller and Christy McDougall of Marcus & Millichap, procured the buyer. Adam Lewis is Marcus & Millichap’s broker of record in Colorado. Located at 5010 W. 88th Place, the four-story Residence Inn by Marriott offers 94 extended-stay suites with kitchens, separate living areas and modern amenities.