For a little more than a year now, Americans have gone on a collective road trip, making up for time stolen during the lockdowns. In turn, that has fueled a rebound in the hotel industry, which was decimated in 2020 and much of 2021. Revenue per available room (RevPAR), a key measure of hotel profitability, is expected to end 2022 at an average of $93, up nearly 8 percent versus 2019, according to a hotel forecast update in late November by STR, a hospitality research organization based in Hendersonville, Kentucky. Meanwhile, the projected average occupancy of 62.7 percent will mark an increase of 5.1 percentage points over 2021, and the estimated average daily rate (ADR) of $148 will best last year’s number by $23, STR reports. Select service lodging properties in particular are helping to lead the recovery, says Steven J. Martens, chairman of NAI Martens, a Wichita-based commercial real estate brokerage that is one of five brands under the Martens Companies umbrella. “The majority of the midscale and upper midscale assets are very dependent upon leisure travel, and they are seeing a rebound throughout the country,” he adds. “Most good operators with strong hotel brands have seen very healthy …

Hospitality

HYANNIS, MASS. — Linchris Hotel Corp., a Massachusetts-based hospitality owner-operator, has acquired the 266-room Cape Codder Resort & Spa in Hyannis. The resort houses four food-and-beverage concepts, a waterpark, fitness center, indoor and outdoor pools, a pickleball court and 18,000 square feet of meeting and event space. Alan Suzuki and Matthew Enright of JLL represented the seller, Catania Hospitality Group, in the transaction. Greg LaBine and Amy Lousararian, also with JLL, arranged acquisition financing through HarborOne Bank on behalf of the buyer.

Sonnenblick-Eichner Negotiates Sale of Hotel Development Site in Dana Point, California

by Amy Works

DANA POINT, CALIF. — Sonnenblick-Eichner Co. has arranged the sale of the fee simple interest in the Cannon’s Hotel development site in Dana Point. The former home of Cannon’s Restaurant, the site is fully entitled and has received California Coastal Commission approval for a 100-room hotel. A private investor acquired the asset for an undisclosed price. Located on a bluff-top overlooking the Dana Point Harbor and Marina, the site is one block south of Pacific Coast Highway and approximately 2.5 miles west of Interstate 5. The Dana Point Harbor and Marina features more than 2,400 boat slips, several restaurants and various marine-oriented activities. The harbor and marina are undergoing a $338 million revitalization, including the addition of approximately 110,000 square feet of destination retail, restaurant, hotel and office space. Todd Bedingfield and David Sonnenblick handled the transaction.

BLACK RIVER FALLS, WIS. — Marcus & Millichap has arranged the sale of Comfort Inn and Suites Black River Falls I-94, a 75-room hotel property located in Black River Falls, approximately 45 miles northeast of La Crosse. Ebrahim Valliani and Michael Gantman of Marcus & Millichap represented the seller, a private investor, in the transaction. Valliani and Gantman, with Todd Lindblom of Marcus & Millichap, also represented the buyer, an undisclosed private investor. Chris Gomes and Allan Miller of Marcus & Millichap also assisted the deal as brokers. The property, located on 6.8 acres at N6295 Holiday Drive, was originally built in 1997. The sales price was not disclosed.

JLL Arranges $110M Refinancing for Two Adjacent Beachfront Hotels in Pensacola Beach, Florida

by John Nelson

PENSACOLA BEACH, FLA. — JLL has arranged the $110 million refinancing for two adjacent beachfront hotels totaling 481 rooms in Pensacola Beach. The properties include the 275-room Hilton Pensacola Beach and the 206-room Holiday Inn Resort Pensacola Beach. Located at 12 and 14 Via De Luna Drive, both hotels have approximately 300 square feet of frontage along Pensacola Beach. Jeff Bucaro, Maddie Blount and Mark DesLauries of JLL’s Hotels & Hospitality team represented the borrower, Innisfree Hotels, in securing the five-year, fixed-rate loan with flexible repayment options through an unnamed regional bank. The loan proceeds were used to pay off a maturing CMBS loan that JLL secured 10 years ago. In addition, the loan included over $18 million for future capital improvements and $23 million of cash back to the sponsorship. This transaction represents over $500 million that JLL has secured on behalf of Innisfree Hotels.

SOUTH FULTON, GA. — Ascent Hospitality Management LLC has broken ground on two new hotels in South Fulton, approximately 20 miles southwest of Atlanta. Home2 Suites by Hilton will comprise 100 suites in studio and one-bedroom layouts and feature health and wellness amenities as well as work and meeting spaces. The second property, TownPlace Suites by Marriott, will feature 96 rooms furnished with full kitchens. Amenities will include a convenience store open 24 hours, a fitness center, swimming pool and an outdoor patio. The City of South Fulton estimates the new properties will drive $2 million of annual economic impact.

Inspire Development Begins Construction of $2B Mixed-Use Pearson Ranch Property in Austin, Texas

by Jeff Shaw

AUSTIN, TEXAS — Austin-based Inspire Development has begun construction of Pearson Ranch, a $2 billion, 156-acre mixed use project located just off State Highway 45 in northwest Austin. The master plan for the project includes 48 acres of land for a corporate campus, including 2.6 million square feet of office space. Upon completion, the mixed-use property will also include approximately 200,000 square feet of retail, restaurant and community/cultural spaces; two hotels; thousands of residential units; and 30 acres of parks and green space. Phase I of Pearson Ranch will center on The Eden, an apartment community that will feature 306 one-, two- and three-bedroom units that will range in size from 672 to 1,511 square feet. Residences will be furnished with technology such as smart locks and thermostats, gas appliances, built-in kitchen islands with quartz countertops and in-unit washers and dryers. Residents will have access to amenities such as a fitness center, rooftop deck, coworking lounge, golf simulator, dog spa, community gardens, a three-acre park and a pool area with barbeque grills, day beds, cabanas and a bocce ball court. The general contractor for The Eden is NRP Group. The project’s architect is Austin-based Davies Collaborative. Vertical construction on The …

JERSEY CITY, N.J. — A partnership between New York City-based Taconic Capital Partners and HEI Hotels & Resorts has purchased the 351-room Hyatt Regency Jersey City hotel. The property was originally built in 2002 and has undergone $15 million in capital improvements since 2010. Amenities include a pool, fitness center, restaurant and lounge and 20,000 square feet of meeting and event space. Affiliates of Hyatt and Veris Residential sold the hotel for an undisclosed price. The new ownership will continue to enhance guestrooms and amenity spaces.

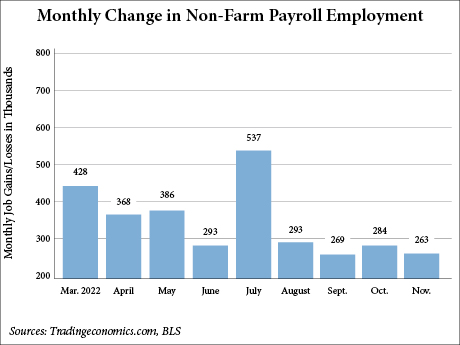

WASHINGTON, D.C. — The U.S. economy added 263,000 jobs in November, and the unemployment rate remained unchanged at 3.7 percent, according to the U.S. Bureau of Labor Statistics (BLS). The employment gains beat Dow Jones economists’ expectations of 200,000 new jobs, reports CNBC. Meanwhile, average hourly wages jumped 0.6 percent for the month, according to the BLS, double the estimate of economists. Furthermore, the 5.1 percent annual growth in wages exceeded the expectation of 4.6 percent. CNBC also reports that the better-than-expected wage growth may put even greater pressure on the Federal Reserve to continue its path of rate hikes, which Fed officials have been signaling as likely ahead of the December Federal Open Markets Committee (FOMC) meeting. Many media outlets report that economists are expecting the central bank to boost the federal funds rate by 50 basis points before the end of the year, raising the target range to between 4.25 and 4.5 percent. However, some other media sources indicate that strong wage growth is another sign of inflation and could push the Fed to boost the rate by 75 basis points. Big gains in leisure and hospitality In November, the employment sector with the biggest surge was leisure and …

DETROIT — Bedrock has acquired the Roberts Riverwalk Hotel located at 1000 River Place in Detroit’s East Riverfront neighborhood. The purchase price was undisclosed. The seller was Michael Roberts, a St. Louis-based business mogul, according to Crain’s Detroit Business. The 108-room hotel features 5,500 square feet of banquet and event space as well as 126 parking spaces. Bedrock says this acquisition aligns with its mission to further position the riverfront as an ideal site for sustainable urban development. In the East Riverfront area, Bedrock has previously purchased the former UAW-GM Center for Human Resources and a portfolio of properties previously owned by the Stroh family. Bedrock plans to make additional updates regarding the riverfront in 2023. Bedrock, the real estate arm of Rocket Mortgage founder Dan Gilbert, maintains a portfolio of more than 19 million square feet of office, retail and residential space.