PACKWOOD, EATONVILLE AND ASHFORD, WASH. — Crystal Investment Property (CIP) has arranged the sale of a four-hotel portfolio in Washington. Terms of the transaction, including the names of the seller and buyer and the acquisition price, were not released. The portfolio includes Cowlitz River Lodge and Crest Trail Lodge in Packwood, Mill Village Motel in Eatonville and Nisqually Lodge in Ashford. All four properties are independent, mid-scale hotels each with 25 to 32 rooms. Cowlitz River Lodge, Nisqually Lodge and Crest Trail Lodge feature large lounges, stonework fireplaces and various guest amenities throughout the properties. Mill Village Motel is the only exterior-corridor property and offers a business center, guest library and meeting/event space. CIP President Joseph Kennedy and team handled the transaction.

Hospitality

DALLAS — Dallas-based NewcrestImage has agreed to purchase four La Quinta by Wyndham-branded hotels, totaling 696 rooms. A joint venture between Highgate and Cerberus sold the properties for an undisclosed price. The hotels include La Quinta Inn & Suites by Wyndham LAX in Los Angeles; La Quinta Inn & Suites by Wyndham Anaheim in Anaheim, Calif.; La Quinta Inn by Wyndham Phoenix North in Phoenix; and La Quinta Inn & Suites DFW Airport South/Irving in Irving, Texas. The acquisition of the LAX property marks NewcrestImage’s first gateway location in California.

ST. LOUIS — Newmark has arranged a $72 million loan for the refinancing of the Marriott St. Louis Grand hotel in the central business district of St. Louis. The 917-room hotel features 77,000 square feet of meeting space and is situated adjacent to the Americas Center Convention Complex, which is currently undergoing a $210 million renovation. The hotel was originally developed in 1917 as a Statler Hotel. Jordan Roeschlaub, Dustin Stolly, Nick Scribani and Tyler Dumon of Newmark arranged the loan on behalf of the undisclosed borrower, which acquired the hotel in 2014 and renovated it.

MADISON, WIS. — Repvblik LLC has purchased the Madison Plaza Hotel in Madison for an undisclosed price and plans to convert the hotel into workforce housing. Repvblik intends to fully renovate and repurpose the property into roughly 155 to 190 affordable studio and one-bedroom units. Completion is slated for 2023. Repvblik builds workforce housing for renters who earn 60 to 120 percent of the area median income (AMI). At the Madison property, rents will be affordable for those who earn 60 percent of AMI. In cooperation with HotelBrokerOne, Jameson & Co. brokered the sale of the 197-room hotel. Construction is expected to last 10 to 12 months.

ATLANTA — Peachtree Hotel Group has purchased the Canopy Atlanta Midtown, a 176-room hotel that opened in December 2018. A joint venture between Greystar, Concord Hospitality and Whitman Pearson sold the hotel to Peachtree Hotel Group for an undisclosed price. Lou Plasencia, Robert Wiemer, Nick Plasencia and Chris Plasencia of The Plasencia Group represented the seller in the transaction. The hotel opened at the same time as the adjacent Ascent Midtown Apartments, which was also developed by Greystar. Canopy Atlanta Midtown features an onsite restaurant, fitness center, business center and meeting rooms.

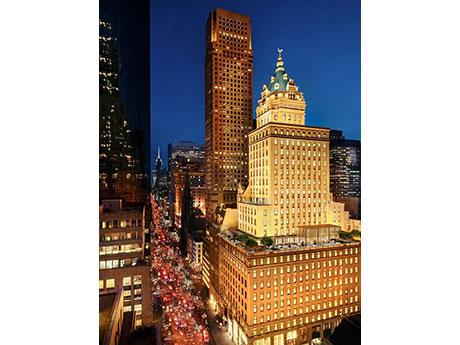

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

LAS VEGAS — Shopoff Realty Investments and Contour, in partnership with Dream Hotel Group, have broken ground on Dream Las Vegas, a 20-story lifestyle hotel and casino at the south end of the Las Vegas Strip. Designed by DLR Group within interiors by AvroKo, Rockwell Group and DLR Interior, the $550 million development will feature 531 guest rooms, seven experiential dining and nightlife venues, 12,000 square feet of meeting and event space and a 20,000-square-foot casino. Additional amenities will include a third-level resort pool and day club, two bar and lounge concepts on the gaming floor, a lobby bar, craft coffee café and gelateria on the street level, as well as a sporting club, boutique nightclub, signature restaurant and 24-hour diner on the third floor. The hotel portion’s event and meeting space will include a 5,000-square-foot ballroom, 90-seat live entertainment theatre, a fitness center by TechnoGym and onsite parking. Peninsula Pacific Entertainment will operate the casino and gaming components of the property. The property, located at 5051 S. Las Vegas Blvd., is slated for completion in late 2024. McCarthy Building Cos. is the design-build contractor for the project.

JONESBORO, ARK. — Mumford Co. has brokered the sale of a 98-room Courtyard by Marriott hotel in Jonesboro. An entity doing business as McCain Lodging Jonesboro LLC purchased the hotel from Hunt Properties of Jonesboro LLC. The sales price was not disclosed, but Mumford Co. says the hotel sold for full list price. Steve Kirby, Ed James and George Arvantis of Mumford Co. represented the seller in the transaction, and Arvantis procured the buyer. Built in 2018, the four-story Courtyard by Marriott features meeting space, laundry services, a convenience store, restaurant and a fitness center, according to the property website.

PLYMOUTH MEETING, PA. — New Jersey-based Cronheim Mortgage has arranged a $22 million loan for the acquisition of a Doubletree Suites hotel in Plymouth Meeting, a northern suburb of Philadelphia. The borrower, Kingsbury Hospitality REIT, plans to renovate the property and rebrand it as an Embassy Suites. An undisclosed balance sheet lender provided the loan. Kingsbury has tapped Newport Hospitality Group to manage the asset.

LINCOLN AND TIVERTON, R.I. — Bally’s Corp. (NYSE: BALY) has agreed to sell two of its casino resorts in Rhode Island to an affiliate of Gaming & Leisure Properties Inc. (NASDAQ: GLPI) for $1 billion. The properties in question are Bally’s Twin River Lincoln Casino Resort in Lincoln and Bally’s Tiverton Casino & Resort in Tiverton. A timeline for the closing of the sale-leaseback deal was not disclosed. Under the terms of the agreement, Rhode Island-based Bally’s will continue to operate the gaming operations and will pay a $9 million transaction fee at closing. GLP Capital, the acquiring entity of the Pennsylvania-based REIT, has agreed to pre-fund a deposit of up to $200 million that will be credited or repaid either at closing or on Dec. 31, 2023, whichever comes first. Ballly’s Twin River Lincoln features 136 hotel rooms and suites and a total of 162,000 square feet of gaming space, including 4,100 slot machines, 125 table games and a sportsbook. In addition, the resort houses four restaurants, three food courts, nine bars, three live entertainment venues, two VIP lounges and a retail store. Bally’s Tiverton comprises an 83-room hotel and 33,600 square feet of gaming space with 1,000 slot …