ODESSA, TEXAS — Self-storage brokerage firm Versal has arranged the sale of a 578-unit facility in the West Texas city of Odessa. The facility, which is operated under the Lone Star Storage brand, comprises 70,210 net rentable square feet of space across 389 non-climate-controlled units and 189 climate-controlled units. Bill Bellomy, Michael Johnson, Logan Foster and Hugh Horne of Versal represented the seller, Texas Lone Star Storage Centers Ltd., in the transaction. The team also procured the buyer, a joint venture between AVAD Capital and Etude Capital.

Industrial

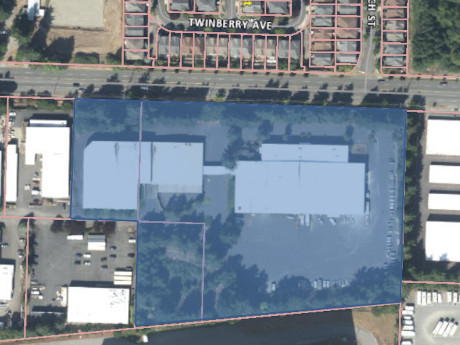

Tacoma Public Schools Acquires Two-Building Industrial Property in Washington for $12.1M

by Amy Works

TACOMA, WASH. — Tacoma Public Schools (TPS) has purchased a two-building industrial property in Tacoma from Broadstone Cable LLC for $12.1 million. Located at 4401 S. Orchard St. on 6.1 acres, the asset offers 86,000 square feet of industrial space. The buyer plans to use the property for its construction and operational plans. Vladimir Olyanich and Bob Frederickson of Coldwell Banker Commercial Danforth managed the transaction for TPS.

RIVERSIDE, MO. — Gantry has secured a $25.5 million permanent loan to retire maturing construction debt from the development of Riverside Logistics Centre II, a 328,000-square-foot, multi-tenant logistics facility in the northwest Kansas City suburb of Riverside. The building features a clear height of 36 feet, 36 overhead dock doors, four drive-in doors and parking for 88 trailers. Mark Reichter and Alec Frook of Gantry represented the borrower, a private real estate investor. A life insurance company provided the nonrecourse loan, which features a seven-year term, fixed interest rate and 27-year amortization.

Cushman & Wakefield | Thalhimer Arranges Sale of 927,500 SF Industrial Property in Danville, Virginia

by John Nelson

DANVILLE, VA. — Cushman & Wakefield | Thalhimer has arranged the sale of a 927,500-square-foot manufacturing facility located at 100 Morgan Olson Way in Danville, a city in south Virginia on the border of North Carolina. The property is situated within Cane Creek Park and offers ample space for manufacturing and/or distribution tenants. Ben Brenner and Jake Hermann of Cushman & Wakefield, along with Davis Stoneburner, Price Gutshall and Rett Turner of Cushman & Wakefield | Thalhimer, represented the seller, an unnamed private individual, in the transaction. The buyer and sales price were also not disclosed.

KENNESAW, GA. — Yamaha Motor Co. Ltd. has announced plans to move its U.S. headquarters to the northern Atlanta suburb of Kennesaw after nearly 50 years of operation in Cypress, Calif. Yamaha Motor, which manufactures ATVs, boat engines, jet skis and other motorized products, has a strong presence in Georgia already. The Japanese-based company employs 2,300 Georgians at its 1.3 million-square-foot factory in Newnan and its marine and motorsports divisions in Kennesaw, which includes the 75,000-square-foot Marine Innovation Center that opened in 2023. Yamaha Motor Co. will begin its corporate relocation from California to Kennesaw this year and complete the process in 2028.

Lincoln, Principal Purchase Land Near Nashville Airport, Plan 167,133 SF Industrial Project

by John Nelson

NASHVILLE, TENN. — Lincoln Property Co. and Principal Asset Management have purchased a 13.5-acre site at 41 Rachel Road in Nashville. The buyers plan to develop Skybridge 40, a two-building, 167,133-square-foot industrial project at the site, which is located directly across I-40 from Nashville International Airport. Demolition at the site recently concluded and sitework is underway. The co-developers plan to deliver Skybridge 40 by the end of the year or early 2027. The design-build team includes Catamount Constructors (general contractor), Alliance Architects (architect) and Kimley-Horn (civil engineer). Lincoln and Principal have selected John Ward and Abigal Rieck of Cushman & Wakefield to lease the industrial project, which will comprise a 100,597-square-foot building and a 66,536-square-foot building.

TEMPE, ARIZ. — ViaWest Group and Walton Street Capital have completed the disposition of Farmer Industrial Center, a two-building industrial park in Tempe. Speed Bay acquired the asset, located at 9185 and 9245 S. Farmer Ave., for $24.5 million. Totaling 93,903 square feet, the property features a clear height of 20 feet, six dock-high and 13 grade-level doors, with additional capacity through two punch-outs, wet-pipe sprinkler systems and ample parking at 2.6 spaces per 1,000 square feet. At the time of sale, the property was 94.1 percent leased to seven tenants, including aerospace, third-party logistics, home improvement services and electrical testing industries. Ben Geelan, Greer Oliver, Bryce Beecher and Gigi Martin of JLL Capital Markets represented the seller in the deal.

COLUMBUS, OHIO — MMR Group Inc., an electrical specialty manufacturing and technical firm, has leased 2300 McGaw Road, a 214,000-square-foot industrial property in Columbus. The facility is situated near Rickenbacker International Airport and Norfolk Southern Intermodal as well as I-270, Route 317 and Route 23. Weston Devore and Jennifer Jordan of CBRE represented the tenant, while Philip Pelok, Shane Ellis and Jeff Lyons of CBRE represented the landlord, Minneapolis-based Founders Properties.

SLINGER, WIS. — Allegis Hardware has received approval to build a 90,000-square-foot production, warehouse and office facility within Slinger Merchant Village, a development by Three Leaf Partners in Slinger, about 35 miles northwest of Milwaukee. Groundbreaking is slated for April. The project will consolidate Allegis Hardware’s production, warehousing and administrative operations into a single facility. The building is permitted under the Planned Unit Development governing Merchant Village, which allows up to 66.9 acres for business and light manufacturing uses. The site plan includes parking along the northwest portion of the parcel and a loading dock area on the southeast side of the building. Founders 3 Commercial Services is the broker for the project.

BOSTON — Shaving products company P&G Gillette has unveiled plans to purchase 232 A Street in South Boston as the future home of its nearly $1 billion Grooming Headquarters and Technical Innovation Center. The company is also expanding its Andover, Mass., manufacturing facility and redeveloping its 31-acre South Boston campus. The new headquarters announcement marks the single-largest investment made by Gillette in Boston, according to the company. The site is currently owned by Breakthrough Properties, a joint venture between Tishman Speyer and Bellco Capital. It is permitted for a 324,315-square-foot research-and-development facility with ground-floor retail space. Jonathan Varholak of CBRE led the brokerage team that facilitated the land sale. Gillette says the purchase of the site unlocks multiple project benefits agreed to when the site was permitted by Breakthrough Properties in 2024. Once complete, the project will contribute 1.5 acres of publicly accessible open space along the Fort Point Channel, including new sidewalks, bike lanes, a waterfront park and improvements to the South Boston Harborwalk. The parcel also includes monetary allocations for public art and shuttle services. “This new development will keep hundreds of high-tech research-and-development jobs in the city and serves as a testament to the strength of our …

Newer Posts