DENVER — Malman Real Estate has arranged the purchase of a 6,400-square-foot industrial building located at 3645 Brighton Blvd. in Denver. ARN Land Co LLC acquired the asset from 3645 Brighton LLC for $2.1 million. Jake Malman of Malman Real Estate represented the buyer, while Dallas Landry of LC Real Estate Group, along with Jerry Graham and Jamie Dilts of Coldwell Banker Realty, represented the seller in the transaction.

Industrial

ROSEMOUNT, MINN. — EGA Spectro Alloys, a Midwest-based producer of recycled aluminum alloys, has begun production at its aluminum recycling expansion project in Rosemount. The 90,000-square-foot facility will produce up to 120 million pounds per year of recycled aluminum billets from scrap aluminum. The expansion will add up to 50 full-time jobs once the facility reaches full production capacity in the first quarter of 2026. Aluminum billet, logs of aluminum up to 25 feet long, is used as raw material for extruders, which turn it into products like railings, window and door trim, and structural components for cars, boats, airplanes, trailers and docks. Recycling aluminum requires 95 percent less electricity than producing new aluminum and generates a fraction of the greenhouse gas emissions. Metal from the facility will be sold under EGA’s recycled product brand RevivAL, a nod to the company’s 52-year history of giving used aluminum new life. The facility also features a new laboratory.

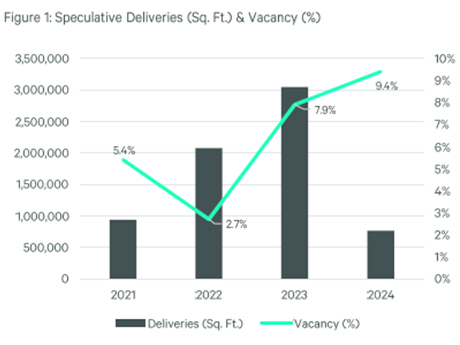

By Harrison Kruse and Ned Turner, CBRE As we near the second half of 2025, the Des Moines industrial market is starting to see a shift in fundamentals, as new deliveries and the pipeline of new big-box speculative warehouse product have come to a complete halt. Like many cities in the upper Midwest post-COVID, the Des Moines MSA saw an influx of out-of-state developers backed by institutional capital go ground up with new big-box product when the economy was stimulated by the Federal Reserve reducing the federal funds rate below 1 percent. This resulted in historically compressed treasury yields and an abundant amount of liquidity injected into the capital markets. This effect on the national economy escalated consumer demand for e-commerce and locally, ag-related products, which are the state of Iowa’s most valuable export on an aggregate basis. The Des Moines MSA between 2021 and 2024 had more than 6.8 million square feet of new industrial space delivered to the market, which is about 10.2 percent of the total market size on a square-foot basis. During those years, net absorption increased on an annual basis between 800,000 and 1.5 million square feet. Pre-COVID, Des Moines’s average net absorption was between …

CORSICANA, TEXAS — Milwaukee-based Phoenix Investors has purchased a 1.5 million-square-foot industrial park in Corsicana, a southern suburb of Dallas. The 172-acre property was originally constructed as a build-to-suit distribution center for K-Mart and later utilized by The Home Depot as a regional logistics hub. The property was fully leased at the time of sale and includes 26- to 28-foot clear heights, 109 dock doors and 983 trailer parking spaces. In addition, the facility underwent major renovations in 2018, including a new roof installation. Pauli Kerr of JLL brokered the deal. The seller and sales price were not disclosed.

DALLAS — Locally based investment firm M2G Ventures has begun the redevelopment of the former Inwood Design District, a 14-building, 740,000-square-foot industrial and retail property in Dallas that also includes showroom space. The redevelopment will create the Inwood Design District for showroom and light industrial uses and Ace on Inwood for retail and restaurant uses. Completion is targeted for late 2025. The company purchased the 38-acre site at 1110 Inwood Road earlier this year. At the time of sale, Inwood Design District was 93 percent leased to tenants such as Crate & Barrel, White Glove Storage & Delivery, Community Coffee, Neiman Marcus and Granimport USA.

NEW YORK CITY — Regional brokerage firm Adirondack Capital Partners (ACP) has arranged the $16 million sale of a 36,000-square-foot industrial complex in the Long Island City area of Queens. Built in 1960, the two-story building at 11-40 Borden Ave. was fully leased at the time of sale to Distribution International, which specializes in construction supplies. Wickersham Realty sold the property to San Francisco-based Terreno Realty Corp. (NYSE: TRNO). Chad Sinsheimer of ACP brokered the deal, which traded at a cap rate of 4.4 percent, on behalf of both parties.

DENVER — United Properties has completed the sale of Enterprise Business Center Building 7 (EBC 7), an industrial building in Denver, to Dream US Industrial Fund, an entity of Dream REIT, for $25.5 million. Located at 9420 E. 40th Ave., EBC 7 features a clear height of 24 feet, ESFR sprinklers, high-end office/showroom build-outs and a large truck court. The 157,942-square-foot building was built in 2017 as part of the Enterprise Business Center campus. MIke Wafer, Tim Richey, Michael Wafer Jr., Mike Viehmann, Jack Richey and Sean Fitzgerald of Newmark represented the seller in the deal.

FULLERTON, CALIF. — Lee & Associates has arranged the acquisition of an industrial building located at 1041 S. Placentia Ave. in Fullerton. An undisclosed buyer purchased the property for $3.4 million. The buyer plans to repurpose the 9,982-square-foot building into a dental laboratory. The property features a clear height of 19 feet, a sprinkler system, two ground-level doors and a parking ratio of 1.9 cars per 1,000 square feet. John Son and Christopher Destino of Lee & Associates represented the buyer in the deal.

TINLEY PARK, ILL. — Venture One Real Estate, through its acquisition fund VK Industrial VII LP, has acquired a 26,173-square-foot industrial building at 18531 Spring Creek Drive in the Chicago suburb of Tinley Park. The property was vacant at the time of acquisition. Situated in the North Creek Business Center, the building offers direct access to I-80 via Harlem Avenue. The property sits on 1.8 acres and features a clear height of 19 feet, two docks, two drive-in doors and parking for 56 vehicles. Venture One plans to make improvements such as office renovations, warehouse painting, parking lot resurfacing and the installation of energy-efficient lighting. Bruce McConnell of Savills represented the seller. Michael O’Leary, Dylan Maher and Ryan Earley of Lee & Associates have been retained to market the building for lease or sale. VK Industrial VII is co-sponsored by Venture One and Kovitz Investment Group.

— By William (Bill) Froelich of Colliers — s of first-quarter 2025, Oahu’s industrial market remains one of the tightest in the nation — but signs of softening are emerging. Our 41.9 million square foot market reported a vacancy rate of 1.2 percent, the highest in over two years, up from 0.9 percent in fourth-quarter 2024 and a near-record low of 0.6 percent in third-quarter 2023. Net absorption was negative at -115,001 square feet in first-quarter 2025, marking the fifth quarter of negative net absorption in the last six. Despite this, direct weighted average asking base rents reached a new high of $1.56 per square foot per month, reflecting continued landlord leverage in a market with severely constrained supply. Industrial operating expenses also rose, averaging $0.54 per square foot monthly, pushing our gross rents over $2.00 per square foot. Raw Land Market: A Race to Buy Before It’s Gone In a typical year, Oahu absorbs 10 to 20 acres of raw industrial land. But in a short period between the end of 2021 and the first half of 2022, over 100 acres had traded, driven by high-profile acquisitions such as Amazon’s 50-acre purchase and Costco’s 45-acre site purchased for almost …