CORPUS CHRISTI, TEXAS — Self-storage brokerage firm Versal has arranged the sale of Overflow Garage, a 204-unit automotive storage facility in Corpus Christi. The facility is located about 15 miles south of the downtown area and totals 16,880 net rentable square feet. Bill Bellomy, Michael Johnson, Logan Foster and Hugh Horne of Versal represented the seller, Plano-based Cumbia Real Estate Holding LLC, in the transaction. The team also procured the undisclosed, Corpus Christi-based buyer.

Industrial

DALLAS — Lee & Associates has brokered the sale of a two-building, 50,000-square-foot industrial property in northeast Dallas. According to LoopNet Inc., the buildings at 11550 Plano Road were originally built in 1979. Building features include rear-load configurations, multiple renovated office suites, 16-foot clear heights and 108 surface parking spaces. Taylor Stell of Lee & Associates represented the undisclosed seller in the transaction and procured the buyer, RAM Capital Texas.

Wespac Construction Completes 445,000 SF First Phase of Industrial Park in Glendale, Arizona

by Amy Works

GLENDALE, ARIZ. — Wespac Construction has completed Marbella Northern Parkway Phase 1, a LEED-certified industrial development in Glendale. Developed by Panattoni Development Co. and designed by Ware Malcomb, the master-planned industrial park will offer six buildings spread across 51 acres. The first phase includes three tilt-panel buildings totaling 445,000 square feet. Each building features two storefront entrances and a north-facing speculative suite, as well as docking sides with automatic ramp-up doors, dock doors with mechanical levelers and designated semi-truck parking.

Storm Properties Buys Industrial Outdoor Storage Property in Santa Ana, California for $5.9M

by Amy Works

SANTA ANA, CALIF. — Storm Properties, a subsidiary of Torrance, Calif.-based Storm Industries, has acquired an industrial outdoor storage (IOS) property in Santa Ana from an undisclosed seller for $5.9 million. Located at 4320 W. 1st St. and 201 S. Mountain View St., the 2.5-acre site features an 11,300-square-foot industrial building and a large and fully fenced concrete yard. The building offers 800 amps of 120/208 volt power, ground-level loading, 16-foot ceiling clearance, as well as infrastructure for food-related operations, such as a walk-in closet and freezer and two commercial ice-making towers. Storm Properties has retained Scott Read of Newmark to market the currently vacant facility for lease.

CHICAGO — SVN Chicago Commercial has brokered the sale of a 6,200-square-foot industrial building at 1802-1806 W. Chicago Ave. in Chicago’s West Town neighborhood for $1.3 million. The property is slated for an adaptive reuse conversion to multifamily. Tim Rasmussen and Marcus Sullivan of SVN represented the undisclosed seller.

LEBANON, TENN. — CRG has broken ground on the first building within The Cubes at Sparta Pike, a 198-acre industrial park in Lebanon. Known as Building B, the new 520,000-square-foot facility will be the first of four buildings at the park and will feature 40-foot clear heights, staging bays with grade-level doors, deep truck courts, trailer storage, car parking, ESFR sprinklers and high-efficiency LED lighting. The Cubes at Sparta Pike is situated within a mile of I-40 and roughly 24 miles from the Nashville International Airport and will accommodate up to 2.8 million square feet of Class A industrial space. CRG has retained Jim Rodrigues and John Zeffery of Lee & Associates’ Nashville office to market and lease the development. The project team includes CRG’s parent company, Clayco, as the design-builder and Lamar Johnson Collaborative as the project architect. Construction at Building B is expected to be completed in early 2026.

TINICUM TOWNSHIP, PA. — Cushman & Wakefield has arranged a $34 million loan for the refinancing of Airport Logistics Center, a 627,252-square-foot industrial facility located within the Philadelphia metro area. The property, which was 83 percent leased to 20 tenants at the time of the loan closing, consists of four buildings with clear heights ranging from 30 to 65 feet and three acres of outdoor storage space. John Alascio, Chuck Kohaut and Meredith Donovan of Cushman & Wakefield arranged the loan through private equity firm Blue Owl Capital on behalf of the borrower, a partnership between Ivy Realty and institutional investment firm Lubert-Adler.

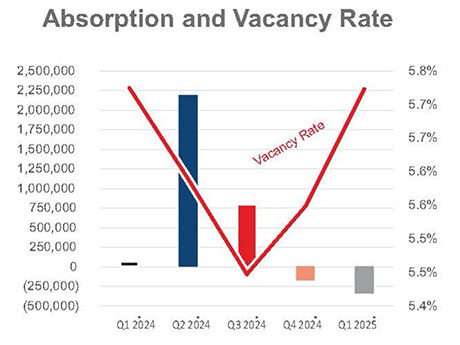

By James Barry III, The Barry Company The Southeast Wisconsin industrial real estate market has been having a very good run for the past several years. Vacancy rates have continued to stay at historically low levels, absorption of space has declined a bit, but remains consistent, and rental rates and sale prices have climbed steadily upwards. According to the latest statistics gathered by the Commercial Association of Realtors – Wisconsin (CARW), the overall vacancy rate for industrial space in Southeast Wisconsin is 5.7 percent, well below the historic “natural” vacancy rate of 7 to 8 percent (see chart above). Certain major submarkets have astonishingly low vacancy rates: 1.3 percent in Waukesha County, 0.5 percent in Sheboygan County and 0.6 percent in Walworth County. These submarkets have almost no industrial space available, and any newly available space tends to be snatched up very quickly at premium lease rates or sale prices. Given the lack of available industrial land in many of Southeast Wisconsin’s submarkets and the lack of new speculative construction, this low vacancy environment promises to continue for the foreseeable future. South I-94 Corridor The major exception to this low vacancy rate scenario in Southeast Wisconsin is the South …

PLANO, TEXAS — Aligned Data Centers LLC, a data center developer and operator based in Plano, has partnered with Lambda Inc., a cloud computing company backed by Nvidia. Lambda will occupy DFW-04, Aligned’s newest data center under construction in its home market. The Dallas Morning News reported that the facility represents an investment of $700 million. Lambda’s AI Cloud platform will be integrated into the new data center, which is anticipated to be available in 2026. Situated at 401 N. Star Road, DFW-04 will comprise 425,000 square feet and support Lambda’s highest-density graphics processing units (GPUs), essential tools for AI and machine learning users. The new 44-acre facility will have an onsite substation and will feature Aligned’s proprietary air and liquid cooling technologies. DFW-04 will also have more than 5,000 megawatts of future capacity. The new facility will be situated within three miles of DFW-01 and DFW-02, which also serves as Aligned’s corporate headquarters. Aligned is also currently underway on DFW-03, a 27-acre data center project in Mansfield, Texas, that is set to deliver later this year. “Aligned is the ideal partner to help Lambda build large, flexible space that meets the AI demands of today and tomorrow,” says Ken …

DALLAS — RAF Pacifica Group, a Southern California-based investment firm, has purchased a 15,750-square-foot warehouse in the Trinity Groves area of Dallas. According to LoopNet Inc., the building at 2200 Evanston Ave. was built in 1961 and renovated last year. The building comprises 13,231 square feet of warehouse space and 2,241 square feet of office space and features 16- to 20-foot clear heights. RAF has also negotiated a 10-year lease extension with the tenant, Gallery DeFi, an operator of immersive art experiences.