COLONIAL HEIGHTS, VA. — Lingerfelt has sold Port 801, a 239,448-square-foot industrial facility located at 801 Port Walthall Drive in Colonial Heights, a suburb of Richmond. The buyer and sales price were not disclosed. JLL represented Lingerfelt, which delivered Port 801 in 2022, in the sale. The property was fully leased at the time of sale to two investment-grade tenants. Last fall, Lingerfelt executed a 106,376-square-foot lease with PECO Pallet at Port 801.

Industrial

NORTH LAS VEGAS, NEV. — EBS Realty Partners and Hartford, Conn.-based Penwood Real Estate Investment Management, in a joint venture, have purchased a 91-acre industrial development site at 9150 N. Terryl B. Adams St. within Apex Industrial Park in North Las Vegas. EBS and Penwood acquired the site from Ball Metal Beverage Container Corp. for $31 million. The partnership plans to develop Apex Ridge, a two-building, 1.4 million-square-foot logistics campus on the site. Groundbreaking is slated for second- or third-quarter 2025. Gregg Haly and Garrett Toft of CBRE handled the land acquisition.

SPARKS, NEV. — CapRock Partners has acquired 55 Vista Boulevard, a freestanding industrial building in Sparks, for an undisclosed price. The transaction marks CapRock’s third acquisition in Northern Nevada, increasing the firm’s total statewide investment and development pipeline to 5.4 million square feet of industrial space. Built in 1995, 55 Vista Boulevard is a single-tenant warehouse offering 117,000 square feet on 5 acres. The asset features a clear height of 24 feet, 26 dock-high doors, two grade-level doors and a 0.5-acre trailer parking yard. The property is fully leased to a national provider of commissary goods to prisons and jails. Joel Fountain and Nick Knecht of Dickson Commercial Group, as well as Jeff Huberman of Lee & Associates, facilitated the transaction. The name of the seller was not released.

WEST MILWAUKEE, WIS. — An affiliate of Phoenix Investors has purchased a 56-acre industrial campus totaling approximately 750,000 square feet in West Milwaukee. The property, located at 4701 W. Greenfield Ave., was previously owned by industrial giant Regal Rexnord. The campus, which is available for lease, features numerous dock doors, clear heights up to 47 feet, heavy power infrastructure and ample trailer and car parking. The nine buildings were constructed between 1920 and 1973. The site also has surplus land available for new residential and commercial development. Jeff Cartwright of First Financial Bank originated senior financing.

MIDLAND AND ODESSA, TEXAS — Dallas-based investment firm AVAD Capital has purchased a portfolio of nine self-storage facilities totaling 5,180 units in the West Texas cities of Midland and Odessa. Utah-based REIT Extra Space Storage sold the portfolio, which totals 782,998 net rentable square feet. Steve Mellon, Brian Somoza, Adam Roossien and Matthew Wheeler of JLL represented Extra Space Storage in the transaction. The sales price was not disclosed. Avid Storage, the buyer’s wholly owned subsidiary and operating brand, will operate the portfolio. John Bauman, Kris Lowe, Luke Rogers and Scott Cole, also with JLL, arranged an undisclosed amount of fixed-rate acquisition financing for the deal through 3650 Capital and Goldman Sachs.

CYPRESS, TEXAS — Trammell Crow Co. (TCC) has broken ground on a 628,012-square-foot industrial project in Cypress, a northwestern suburb of Houston, that represents the third and final phase of Weiser Business Park. Designed by Seeberger Architecture with construction to be handled by A&F General Contractors, Buildings 5 and 6 at Weiser Business Park will feature 36-foot clear heights, 54-foot-wide column spacing and ESFR sprinkler systems. Colliers is marketing the buildings for lease. Cadence Bank is financing Phase III. Weiser Business Park currently consists of four buildings totaling approximately 1 million square feet.

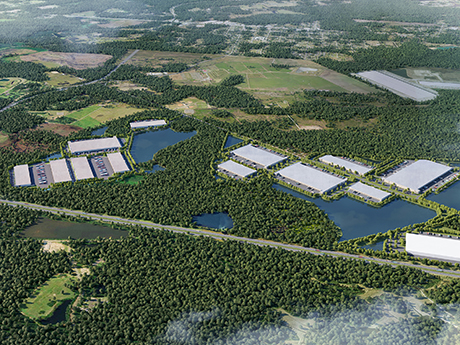

SAVANNAH, GA. — Barings and Charlotte-based Trinity Capital have broken ground on Phase II of Horizon 16 Industrial Park, a logistics park located at Jimmy Deloach Parkway and I-16 in Savannah. The second phase will span six buildings totaling 1.5 million square feet. Phase I of the park spans 1.1 million square feet across three buildings and is currently 74 percent leased to tenants including Ferguson and Harbor Freight. The design-build team for Phase II includes general contractor Evans and architectural firm Atlas. The co-developers have tapped William Lattimore of CBRE to lease the second phase of Horizon 16. Barings and Trinity Capital previously partnered to develop 85 Exchange, a 1.3 million-square-foot industrial park near Charlotte that is leased to tenants including Amazon.

HOUSTON — Locally based brokerage firm Oxford Partners has arranged the sale of a 41,450-square-foot industrial building in northwest Houston. According to LoopNet Inc., the building at 14199 Westfair Drive E was constructed on 2.7 acres in 2008 and features 28-foot clear heights. Perry Mazzone and Matt Rogers of Oxford Partners represented the buyer, Immobile Industrial LLC, in the transaction. Wyatt Huff, Hunter Stockard and Gray Gilbert of Partners Real Estate represented the undisclosed seller.

Mack Real Estate Group Breaks Ground on Phase I of 1.2 MSF Industrial Park in Scottsdale, Arizona

by Amy Works

SCOTTSDALE, ARIZ. — Mack Real Estate Group, with Willmeng Construction as general contractor, is developing Mack Innovation Park Scottsdale (MIP Scottsdale), a 1.2 million-square-foot industrial project in Scottsdale. The team has started vertical construction of the 305,400-square-foot Phase I of the project. Phase I of MIP Scottsdale will consist of two buildings with 32-foot clear heights, 53 dock-high doors, 20 grade-level doors and 516 parking stalls. Financing for the project includes $43 million in first mortgage construction debt provided by Bank OZK, and $19.8 million in construction mezzanine financing provided by PGIM Real Estate. Lenga Partners, a Chile-based real estate investment firm, is Mack’s equity joint venture partner in the project. The development team includes Butler Design Group and Withey Morris Baugh PLC. Mitch Stravitz and Rusty Kennedy of CBRE, James Cohn of Stream Realty and Randy Shell of Shell Commercial are handling leasing for the project.

PORTLAND, ORE. — Norris & Stevens has arranged the sale an industrial manufacturing/storage facility at 9348 N. Peninsular Ave. in Portland. Anlekus LLC acquired the asset from Miscoe Properties LLC for $2.3 million. Originally constructed in 1932 with additions in the 1950s and 1970s, the property consists of a main industrial building, a maintenance building and two separate outbuildings totaling 75,000 square feet. Formerly used for food production and storage, the asset features six loading docks, one drive-in door, 18- to 20-foot clear heights and a large office area. Greg Nesting of Portland-based Norris & Stevens represented the buyer and seller in the transaction.