CHARLESTON, S.C. – Capital Development Partners has delivered Shipyard Creek, a new 160,250-square-foot transload industrial facility that offers direct access to the Port of Charleston. Situated on a 42-acre site adjacent to the port’s new $1.3 billion Hugh K. Leatherman Terminal, the property was designed to handle container movement from users including retail importers. Shipyard Creek features 153 dock doors, 724 trailer parking spaces and onsite storage parking that can accommodate five stacked shipping containers. Capital Development Partners has tapped Lee Allen, Kevin Coats and Tyler Smith of JLL to handle the project’s leasing assignment. Shipyard Creek enjoys access to the port’s marine terminals, as well as interstates and the upcoming SC Ports Navy Base Intermodal Facility, which will be dual-served by Norfolk Southern and CSX.

Industrial

GARLAND, TEXAS — Nashville-based brokerage firm Matthews Real Estate Investment Services has arranged the sale of a 7.5-acre industrial outdoor storage (IOS) site in Garland, a northeastern suburb of Dallas. The property at 2660 Market St. houses an 87,780-square-foot building that was originally constructed in 1991 and features eight dock-high doors and four grade-level doors. Alexander Harrold of Matthews represented the buyer, Alterra IOS, in the transaction. The name and representative of the seller, as well as the sales price, were not disclosed.

NEWARK, DEL. — CBRE has negotiated a 128,000-square-foot industrial lease in Newark, Del. The tenant is an undisclosed medical technology group, and the space is located within Building F of First State Logistics Park, a three-building, 1 million-square-foot industrial development that sits on a 149-acre site. Paul Touhey and Dan Rattay of CBRE, along with internal agents Mark Glagola and Tim Shaw, represented the landlord, Chicago-based Logistics Property Co., in the lease negotiations. The deal brings the park to about 75 percent occupancy.

HAWTHORNE, N.Y. — Locally based developer Robert Martin Co. has broken ground on a 71,098-square-foot industrial flex project in Hawthorne, located north of New York City in Westchester County. The site at 14-16 Skyline Drive is located within Mid-Westchester Executive Park, and the development will consist of two buildings totaling 34,738 and 36,360 square feet. Completion is scheduled for the third quarter of 2025.

PHOENIX — Santa Monica, Calif.-based Karney Properties has purchased a freestanding cross-dock industrial building in Phoenix for $69.5 million. Will Strong, Michael Matchett and Molly Hunt of Cushman & Wakefield’s National Industrial Advisory Group – Mountain West represented the undisclosed seller in the deal. The Home Depot fully occupies the 400,000-square-foot property as a return center. Located at 7200 W. Buckeye Road, the building features a fully air conditioned warehouse, high-speed fans, equipment on every door, a gated and security station-controlled yard area, approximately 4.5 percent of office space and four acres of excess trailer parking that was customized by and for the tenant.

Redfearn Capital Secures $18.7M Acquisition Loan for Industrial Facility in South Jacksonville

by John Nelson

JACKSONVILLE, FLA. — Redfearn Capital has secured an $18.7 million acquisition loan for a 363,000-square-foot industrial facility located at 12751 Gran Bay Parkway in south Jacksonville. South Point Capital Management provided the loan. Redfearn Capital acquired the property from Brookfield for $27.2 million. The property was fully leased at the time of financing to Saddle Creek Logistics, an omnichannel supply chain provider. Constructed in 1997, the facility features 24-foot clear heights and 30 dock doors.

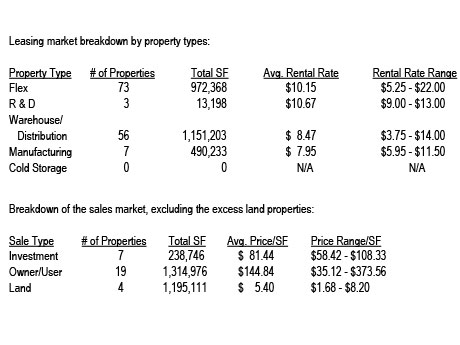

By John Dickerson, OMNE Partners Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year. In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well. Leasing pace Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year. Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.) One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square …

TEMPE, ARIZ. — Leon Industrial, a subsidiary of Dallas-based Leon Capital Group, has purchased the Tempe Freestanding Industrial Portfolio, an infill industrial portfolio situated on more than 9 acres in Tempe. Terms of the transaction were not released. Totaling 175,723 square feet, the portfolio includes a 116,516-square-foot building at 525 W. 21st St., a 33,400-square-foot building at 1917-196 W. 1st St. and a 25,807-square-foot building at 1401 S. Siesta Lane. At the time of sale, the buildings were each 100 percent leased to single tenants. Phil Haenel, Will Strong, Foster Bundy and Katie Repine of Cushman & Wakefield’s Private Capital Group represented the buyer and undisclosed seller in the transaction. Additionally, Mike Haenel and Andy Markham of Cushman & Wakefield provided leasing advisory services.

LAS VEGAS — MCA Realty has acquired a single-tenant industrial building located at 2124 Industrial Road in Las Vegas for $4.2 million in an off-market transaction. The asset was purchased within the firm’s MCA Realty Industrial Growth Fund II, the first acquisition with the fund. Hajoca Corp., the parent company of Kelly’s Pipe & Supply Co., fully leases the 32,000-square-foot building that was built in 1962. Kevin Higgins and Garrett Toft of CBRE represented the undisclosed seller and buyer in the transaction.

WASHINGTON, D.C. — The Biden Administration has announced a $3 billion investment from the Inflation Reduction Act to improve port infrastructure and support an estimated 40,000 “good-paying and union jobs” at 55 ports across 27 states. According to The White House press, U.S. ports employ more than 100,000 union workers. The initiative, named The Clean Ports Program, is headlined by a $147 million investment for the Maryland Port Administration via grants and awards that will support 2,000 jobs, as well as fund the installation of zero-emission equipment, charging infrastructure and power improvements. Biden made the announcement yesterday at the Port of Baltimore, site of the Francis Scott Key Bridge collapse in March. The Clean Ports Program is expected to increase the demand for American manufactured electric cargo handling equipment and eliminate more than 3 million metric tons of carbon pollution over the first 10 years of implementation, which is equivalent to 391,220 homes’ energy use for one year. The program will fund new battery-electric and hydrogen-powered cargo handling equipment, drayage trucks, locomotives and vessels, as well as charging/fueling infrastructure and solar power installation.