THOUSAND OAKS, CALIF. — JLL Capital Markets has arranged the all-cash sale of Lakeview Innovation Center, a flex campus on 22.1 acres in Thousand Oaks. An undisclosed seller sold the asset to a partnership between Alta West Partners, an affiliate of Glendon Capital Management and A2 Capital Management for an undisclosed price. Michael Leggett, Jeffrey Bramson, Andrew Harper and William Poulsen of JLL represented the seller in the transaction. Renovated in 2023, Lakeview Innovation Center offers 276,529 square feet of research-and-development (R&D) and office space. The campus includes an onsite Equinox fitness club, Earthbar, pickleball court, walking trails, a tenant lounge and multiple outdoor patio and collaborative spaces. The tenant roster includes Marvell Technologies and Rawlings, which benefit from the property’s infrastructure, including lab-grade HVAC, excess power capacity, ample clear heights, loading docks and backup generators. Additionally, the asset offers expansion opportunities with M2 zoning, supporting up to 123,000 square feet of additional density for life sciences, R&D or office uses. The new ownership team plans to upgrade the common areas, restrooms, signage and landscaping.

Industrial

DENTON, TEXAS — JLL has arranged an undisclosed amount of construction financing for a three-building, 451,856-square-foot industrial project in the North Texas city of Denton. Denton Point III, IV and V will feature rear-load configurations, 28- to 32-foot clear heights, 114 total dock doors and bay depths ranging from 160 to 280 feet. Campbell Roche, Will Mogk, Tom Weber, Luke Rogers and Jordan Buck of JLL arranged the five-year loan through First United Bank on behalf of the borrower, Holt Lunsford Commercial Investments, which is developing the project in a joint venture with Dallas-based Silverado Interests. Completion is scheduled for the third quarter of 2025.

MABANK, TEXAS — Marcus & Millichap has brokered the sale of Pego Self Storage, a 568-unit facility in Mabank, about 55 miles southeast of Dallas. The complex consists of 12 buildings that span 72,262 net rentable square feet of space, including drive-up and climate-controlled units. Danny Cunningham and Brandon Karr of Marcus & Millichap represented the seller, a local owner-operator, in the transaction and procured the Austin-based buyer. Both parties requested anonymity.

DALLAS — Locally based brokerage firm Holt Lunsford Commercial has negotiated a 60,000-square-foot industrial lease in West Dallas. According to LoopNet Inc., the building at 3306-3310 Quebec St. was originally built in 1971. Canon Shoults and Maddy Coffman of Holt Lunsford represented the landlord, AEW Capital Management, in the lease negotiations. Turner Peterson with Mercer Co. represented the tenant, a company doing business as SCIGV Inc.

GLASSBORO, N.J. — Inland Private Capital Corp. and Devon Self Storage, which are both part of The Inland Real Estate Group of Cos., have completed an 870-unit facility in Glassboro, about 25 miles south of Philadelphia. The site at 124 Delsea Drive S formerly housed the facilities of Liscio’s Bakery. The two-story, elevator-served facility features 86,700 net rentable square feet of 100 percent climate-controlled space and includes a vehicle drive-thru area with high-speed roll-up doors, as well as multiple unloading locations and epoxy finished flooring.

PALATINE, ILL. — S&C Electric Co. has opened a new 275,000-square-foot manufacturing facility in Palatine, a northwestern suburb of Chicago. The expansion created 200 production and engineering jobs. The property is situated about 25 miles from S&C’s headquarters and manufacturing campus in Chicago’s Rogers Park neighborhood. Production in Palatine includes circuit-washers, devices that protect transmission substation transformers and other grid-hardening equipment.

MICHIGAN — District Capital has arranged a $20 million loan for the refinancing of a 240,000-square-foot flex industrial building in Southeast Michigan. Dave Dismondy of District Capital arranged the loan through a life insurance company. The nonrecourse loan allows for a further relaxed amortization if the lease is extended during the loan term.

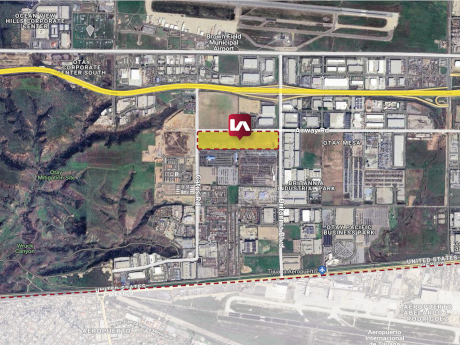

Lee & Associates Negotiates $58M Purchase of Industrial Land in San Diego’s Otay Mesa District

by Amy Works

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

SEATTLE — Gantry has secured a total of $34.3 million of loans to refinance four Seattle-area assets owned by different and unaffiliated entities. Each transaction was placed with one of Gantry’s life company correspondent lenders and each structure provided the borrowers with non-recourse, fixed-rate loans. Mike Wood of Gantry represented three of the borrowers. The financings included:

SUNNYVALE, TEXAS — California-based CapRock Partners has acquired 32.5 acres in Sunnyvale, an eastern suburb of Dallas, for the development of a 518,000-square-foot industrial project that will be known as Clay Road Business Park. The development will consist of three shallow-bay buildings with 32-foot clear heights, dock-high and ramp loading doors, ESFR sprinklers and trailer parking. Construction is scheduled to begin in 2025 and be compete in 2026. Kurt Griffin, Nathan Orbin, Dalton Knipe and Weston King of JLL represented CapRock in the land acquisition.