GREEN BAY, WIS. — NAI Pfefferle has brokered the sale of a 39,548-square-foot industrial building located at 1836 Sal St. in Green Bay. The sales price was undisclosed, but the asking price was $1.6 million. John Roberts of NAI Pfefferle arranged the sale. Bartlett Capital Group was the buyer.

Industrial

BELLEVILLE, N.J. — Cushman & Wakefield has arranged a $53.5 million construction loan for a 204,407-square-foot industrial project in the Northern New Jersey community of Belleville. The site at 681 Main St. spans 15.3 acres, and the building will feature a clear height of 36 feet, 33 loading docks, four drive-in doors and parking for 160 cars and 43 trailers. John Alascio, Chuck Kohaut, T.J. Sullivan and Jason Blankfein of Cushman & Wakefield arranged the loan through Los Angeles-based PCCP on behalf of the borrower, Lincoln Equities Group.

Taiwanese Semiconductor Manufacturer to Build Third Factory at Phoenix Plant Using $6.6B from CHIPS Act

by John Nelson

PHOENIX — Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) has announced plans to build a third semiconductor plant on its TSMC Arizona campus in North Phoenix. In connection with the announcement, the U.S. Department of Commerce has entered into a preliminary memorandum of terms (PMT) with the Taiwanese company to provide $6.6 billion in direct funding through the CHIPS and Science Act. The PMT also allows for the federal government to provide TSMC with up to $5 billion in loans. The company plans to apply for U.S. Treasury Department Investment Tax Credits of up to 25 percent of the qualified capital expenditure at TSMC Arizona. Additionally, $50 million of the CHIPS funding at TSMC Arizona will be used in the training and development of the local workforce, according to a statement issued by President Joe Biden. The third factory will increase TSMC’s investment at the Arizona manufacturing site to more than $65 billion. TSMC is making the site the largest foreign direct investment in Arizona history and the largest foreign direct investments in a greenfield project in U.S. history. The company estimates that the three facilities will employ roughly 6,000 direct high-tech jobs, 20,000 construction jobs and tens of thousands of …

HOUSTON — Versal, a self-storage brokerage firm with offices in Austin and Los Angeles, has arranged the sale of A&B Boat & RV Storage, a 279-unit facility located approximately 14 miles southeast of downtown Houston. The facility spans 121,328 net rentable square feet. Bill Bellomy, Michael Johnson, Logan Foster and Hugh Horne of Versal represented the seller, California-based Sunbelt Storage II, in the transaction. The team also procured the buyer, Dallas-based RecNation.

HOUSTON — California-based investment firm KBS has sold Clay Crossing Business Center, a 222,750-square-foot light industrial complex in West Houston. Built between 2000 and 2002, Clay Crossing Business Center consists of four buildings that house flex suites ranging in size from 3,105 to 44,883 square feet. Trent Agnew, Charles Strauss, Lance Young and Brooke Petzold of JLL represented KBS in the transaction. The buyer was an Houston-based entity doing business as HPI Holdings II LLC.

WYLIE, TEXAS — Chint Power Systems, a manufacturer and distributor of solar energy products, has signed a 76,433-square-foot industrial lease in Wylie, a northeastern suburb of Dallas. The space is located within Wylie Business Center, a 274,416-square-foot development that features 36-foot clear heights and parking for 154 cars and 80 trailers. Kurt Griffin, Nathan Orbin and Dalton Knipe of JLL represented the owners, Lovett Industrial and Cresset Real Estate Partners, in the lease negotiations. Christian Moore of Mercer Co. represented Chint Power Systems, which plans to take occupancy this summer.

MCCALLA, ALA. — Graham & Co. Inc. has arranged the $32.3 million sale of a 303,730-square-foot distribution and manufacturing facility in McCalla, about 20 miles southwest of Birmingham. The seller, an entity doing as AMR REIT Prestige Industrial II LLC, developed the property in 2022 as a build-to-suit for Lear, a Tier 1 auto parts supplier. Located at 6700 Jefferson Metropolitan Parkway, the property is situated on nearly 25 acres within the Jefferson Metropolitan Industrial Park along the I-20 corridor. The facility features 32-foot clear heights, ESFR sprinklers, 45 dock-high doors, a 185-foot truck court and 21,000 square feet of office space. Sonny Culp of Graham & Co., along with Doug Longyear of Cushman & Wakefield, brokered the transaction.

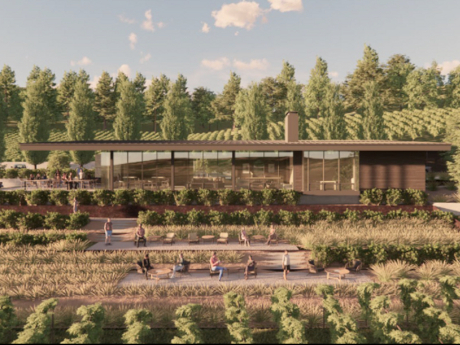

Gantry Secures $7.1M in Financing for Auteur Wines Facilities in Healdsburg, California

by Amy Works

HEALDSBURG, CALIF. — Gantry has arranged a $7.1 million construction-to-permanent loan for the build-to-suit development of dedicated facilities for Auteur Wines, a vintner-founded winery specializing in Pinot Noir and Chardonnay. Located at 10520 Wohler Road in the Sonoma County city of Healdsburg, the project will include a production winery, tasting room and vineyard on 8.2 acres. Jeff Wilcox and Andrew Ferguson of Gantry’s San Francisco production office represented the borrower, a private real estate investor. The 20-year, construction-to-permanent, fixed-rate loan was provided through one of Gantry’s banking relationships and features an initial interest-only period transitioning to an 18-year amortization.

HOUSTON — Partners Real Estate has brokered the sale of a 35,622-square-foot cold storage building located at 12634 East Freeway in Houston. The property, which was originally built in 1960 and expanded in the early 2000s, is located east of the downtown area and features 28-foot clear heights. Wyatt Huff and Hunter Stockard of Partners represented the seller, Mims Investment Inc., in the transaction. The buyer and sales price were not disclosed.

CYPRESS, TEXAS — Lone Star Downhole Products has signed a 10,000-square-foot industrial lease in the northwestern Houston metro of Cypress. The manufacturer of energy equipment parts is taking the entire building at 19615 Juergen Road, which according to LoopNet Inc. is under construction and will feature 20-foot clear heights. Georges Montes of Cypressbrook Co. represented the tenant in the lease negotiations. Nick Bergmann and Cape Bell of CBRE represented the landlord, Mesquite Realty & Investment Group.