HOUSTON — W-Industries has signed a 241,712-square-foot industrial lease in North Houston. The provider of infrastructural engineering, automation and cybersecurity solutions will use the space within Champions Business Park to support its electrical manufacturing operations. Jason Dillee, Joseph Smith and Gregory Holmes of CBRE represented the undisclosed landlord in the lease negotiations. Wes Williams of Colliers represented W-Industries.

Industrial

Transwestern Acquires Development Site Near Port of Savannah, Plans 528,560 SF Industrial Development

by John Nelson

RINCON, GA. — Transwestern Development Co., along with joint venture partner Transwestern Investment Group, has purchased a 30.7-acre site in Effingham County on behalf of a separately managed account. The ownership group plans to develop two Class A industrial buildings on the site, which is situated within North Gate Industrial Park. The project will include a 240,560-square-foot rear-load building and a 288,000-square-foot front-load building, each designed with 36-foot clear heights, ESFR systems, dock-high doors, multiple points of ingress and egress, 2,500 square foot office suites and ample car parking and onsite trailer storage. Situated near the intersection of Ga. Highway 21 and Old Augusta Road in Rincon, the development will provide direct access to interstates 95 and 16 and offer drayage routes from the Garden City Terminal at the Port of Savannah. The project team includes The Conlan Co., Randall-Paulson Architects and Kern & Co. JLL will provide leasing services. Transwestern plans to begin construction before the end of the year and complete the shell of the two buildings by year-end 2026.

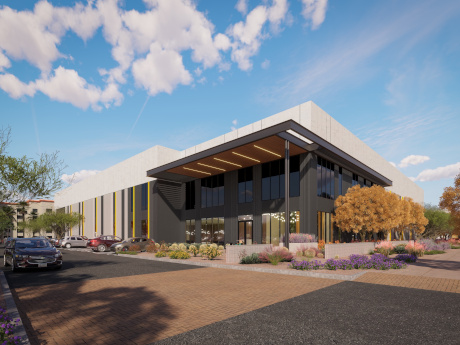

TEMPE, ARIZ. — Creation and LGE Design Build have broken ground on a 6-acre industrial development in Tempe. The project will encompass 120,000 square feet across two buildings, with joint venture partner Pacific Office Automation preleasing one building as its Southwest market headquarters. LGE Design Build is serving as architect and general contractor of the project, overseeing the ground-up construction of Pacific Office Automation’s 75,000-square-foot headquarters, in addition to a 45,000-square-foot building available for lease or sale. The development will feature 32-foot clear heights, a shared truck court and 185 parking spaces, including eight electric vehicle charging stations and 14 bike parking spaces. The project is located at 1400 W. 3rd St. Construction is underway, with completion slated for late 2026.

STAFFORD, VA. — Matan Cos. has signed DSV, a global transport and logistics firm headquartered in Denmark, to a full-building lease in Stafford. Named Crossroads Industrial, the 219,456-square-foot building features 32-foot clear heights, 50- by 52-foot column spacing, 64 dock doors, LED lighting, ESFR sprinklers and 20 trailer and 323 car parking spaces. The facility sits within the region’s I-95 industrial corridor and lies equidistant between Richmond and Washington, D.C. Matan, which is based in Frederick, Md., plans to soon launch Venture Industrial, another industrial facility located in Stafford County.

Viking Partners, Decker Capital Purchase Industrial Portfolio in Jacksonville for $26.5M

by John Nelson

JACKSONVILLE, FLA. — A joint venture between Cincinnati-based Viking Partners and Decker Capital has acquired an eight-building industrial portfolio in Jacksonville for $26.5 million. The multi-tenant portfolio spans 198,360 square feet and is situated in the city’s Southside industrial submarket near the Port of Jacksonville. The portfolio was roughly 90 percent leased at the time of sale and represents Viking’s second industrial acquisition in Florida this year.

ROBERSONVILLE, N.C. — Marcus & Millichap Capital Corp. (MMCC) has arranged an $8.9 million loan for a 206,369-square-foot industrial property located at 201 E. 3rd St. in Robersonville. Flagstone Foods, a private healthy snack maker and distributor, fully occupies the facility. Chad O’Connor of MMCC’s San Diego office arranged the 10-year loan through a local credit union on behalf of the undisclosed borrower. The loan features a 6.09 percent interest rate and a 30-year amortization schedule.

INDIANA — Amazon has unveiled plans to invest an estimated $15 billion in northern Indiana to build new data center campuses to support artificial intelligence (AI) and cloud computing technologies. The company says that generative AI is driving increased demand for advanced cloud infrastructure and compute power. The investment is in addition to the $11 billion investment announced last year in St. Joseph County and will expand Amazon’s infrastructure to new sites across Indiana. The new project will add 2.4 gigawatts of data center capacity in the region. The investment is expected to create more than 1,100 new high-skilled jobs while supporting thousands of other jobs in the data center supply chain. Amazon has partnered with NIPSCO to power its data centers. Through its newly created subsidiary NIPSCO Generation LLC, Amazon will pay fees to use existing power lines and cover the costs for any new power plants, power lines or equipment needed to serve the data center project without additional cost to local residents and businesses. These cloud computing and AI innovation campuses join Amazon’s operations footprint across Indiana that now includes 15 fulfillment and sortation centers, 11 delivery stations and data centers in New Carlisle, Ind. Since 2010, …

HOUSTON — Texas-based developer Constellation Real Estate Partners has sold Constellation Post Oak, a 424,011-square-foot industrial complex in southwest Houston. Announced in March 2022 and developed in partnership with a fund advised by Crow Holdings Capital, the property comprises a 304,400-square-foot, cross-dock building with 36-foot clear heights and a 121,800-square-foot, front-load building with 32-foot clear heights. Nathan Wynne of CBRE represented Constellation in the sale. The buyer, LBA Realty, was self-represented.

LAREDO, TEXAS — Industrial investment firm AKRE Partners has purchased a 16,945-square-foot warehouse within Milo Distribution Center in the Rio Grande Valley city of Laredo. According to LoopNet Inc., the small-bay building at 310 Union Pacific Blvd. was completed in 1994 and features 20-foot clear heights, 22 trailer parking spaces and 1,200 square feet of office space. The seller and sales price were not disclosed.

RADNOR, PA., AND CHEVY CHASE, MD. — EQT Real Estate, on behalf of its EQT Real Estate Industrial Core-Plus Fund II, has sold a 25-property logistics portfolio totaling 8.7 million square feet across 13 markets. The sales price was not disclosed, but the transaction marks the largest U.S. industrial sale so far in 2025, according to Radnor-based EQT Real Estate. Chevy Chase-based Artemis Real Estate Partners was the buyer. The portfolio spans distribution markets such as Atlanta, Chicago, New York, Phoenix and Texas. The assets feature an average clear height of 31 feet, cross-dock and rear-load configurations, expansive truck courts and generous parking accommodations. Most of the properties were developed after 2000, and EQT Real Estate began assembling and managing the portfolio in 2020. The properties are more than 95 percent leased to 25 tenants active in distribution, e-commerce, food and beverage and manufacturing. EQT Real Estate says the transaction marks the culmination of its multi-year strategy to assemble and scale a national logistics platform in high-growth, supply-constrained U.S. markets. Additionally, the sale reflects investor appetite for stabilized, institutional logistics properties with long-term demand drivers and limited new supply. John Huguenard, Trent Agnew and Will McCormack of JLL represented EQT …