HOUSTON — Dallas-based investment firm Sealy & Co. has acquired The Great 290 Distribution Center, a newly built, 500,840-square-foot industrial property located near the intersection of The Grand Parkway and I-290 in northwest Houston. Designed by Powers Brown Architecture and developed by Pagewood, The Great 290 Distribution Center occupies 41 acres within a 64-acre site, allowing tenants additional space for outdoor trailer parking or materials storage. The property was fully leased at the time of sale to HVAC systems provider Daikin Comfort Technologies. Trent Agnew and Charlie Strauss of JLL represented Pagewood in the transaction. Sealy & Co. was self-represented.

Industrial

LEANDER, TEXAS — Locally based firm Freehill Development Co. has broken ground on Hero Way West, a 227,200-square-foot industrial project in the northern Austin suburb of Leander. The development will consist of three shallow-bay buildings that will range in size from 24,500 to 129,000 square feet. The buildings will feature 28-foot clear heights and will be situated on a 16.8-acre site. JLL arranged construction financing and joint venture equity for the project, and Transwestern has been appointed as the leasing agent. Construction is expected to last about 12 months.

FORT WORTH, TEXAS — Green Courte Partners, a Chicago-based real estate private equity firm, has acquired a 40-acre industrial outdoor storage site in Fort Worth. The parcel is located at 5301 Wilbarger St. on the city’s southeast side. Green Courte plans to operate the site as a managed truck storage facility. The land seller was a joint venture between Timber Hill Group and Champion Realty Advisors. The sales price was not disclosed.

FORT WORTH, TEXAS — Ambiance Textiles has signed a 14,775-square-foot lease renewal in Fort Worth. The 49,130-square-foot industrial flex building at 200 N. Vacek St. is located on the northwest fringe of the downtown area and was originally constructed in 1950, according to LoopNet Inc. David Cason and Jake Neal of Holt Lunsford Commercial represented the tenant in the lease negotiations. The landlord was not disclosed.

READING, PA. — Cushman & Wakefield has brokered the sale of a 250,955-square-foot distribution center in Reading, about 60 miles northwest of Philadelphia. The property at 615 Aviation Road features 10,383 feet of office space, a clear height of 32 feet, 58 dock doors, 15 van dock doors and 10 drive-in doors. Chris Sheldon, Gerry Blinebury and Brendan McGeary of Cushman & Wakefield represented the developer and seller, SunCap Property Group, in the transaction. The buyer and sales price were not disclosed. At the time of sale, the property was fully leased to an undisclosed transportation and logistics company.

Ares Management, CapRock Partners Sell 230,899 SF Spanish Ridge Industrial Park in Las Vegas for $54.8M

by Amy Works

LAS VEGAS — Ares Management and CapRock Partners have completed the disposition of Spanish Ridge Industrial Park in Las Vegas. EastGroup Properties bought the Class A facility for $54.8 million. Spanish Ridge consists of three single- and multi-tenant buildings totaling 230,899 square feet in the southwest of the city. The park’s 133,075-square-foot, 75,836-square-foot and 21,988-square-foot buildings feature clear heights ranging from 24 feet to 30 feet, ESFR sprinklers, warehouse evaporative coolers, ample power, 128-foot to 180-foot concrete truck courts, and a combined 50 dock-high doors and 11 grade-level doors. Additionally, the park offers five office spaces totaling 2,000 square feet. At the time of sale, the property was fully leased to five investment-grade credit tenants. The industrial park is located at 5425 and 5365 S. Riley St. and 8875 W. Hacienda Ave. Andrew Briner and Bret Hardy of Newmark represented the sellers, with support from Rob Lujan and Jason Simon of JLL’s Industrial Las Vegas office. Terms of the deals were not disclosed.

MCCOOK, ILL. — Tru Vue, a manufacturer of glazing products for the custom picture framing, museum, photography, technical glass and acrylic markets, has renewed its 299,200-square-foot industrial lease at 9400 W. 55th St. in McCook, an industrial suburb of Chicago. Fischer and Co. and Tom Condon of Lee & Associates represented the tenant. Terry Grapenthin and Ryan Earley of Lee & Associates represented the owner, High Street Logistics Properties.

SOUTH BEND, IND. — DWG Capital Partners has acquired a 65,256-square-foot industrial facility located at 301 E. Sample St. in South Bend. The sales price was undisclosed. The single-story property is situated on four acres and features a clear height of 24 feet, a drive-in door and two dock doors. Structured as a sale-leaseback, the transaction was completed with private equity firm JAL Equity, which simultaneously acquired the longtime tenant, Mossberg & Co. The tenant is a provider of technology-based print and marketing solutions. Bryan Huber and Michael Soleimani of SAB Capital represented the seller.

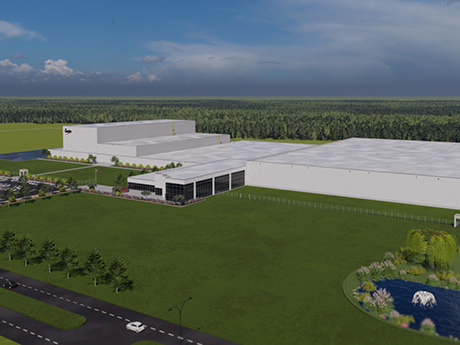

GREENVILLE, S.C. — EnerSys, an industrial technology company, has announced plans to develop a new manufacturing facility in Greenville. EnerSys expects to break ground on the $500 million project next year. Upon completion, the facility will total 500,000 square feet on 140 acres within the August Grove Business Park. Operations are slated to begin at the property in late 2027. Reading, Pa.-based EnerSys manufactures batteries, chargers and power systems for use in the telecommunications, broadband, data center, industrial utilities, warehouse, logistics, aerospace, defense and transportation industries. The new operations will focus on producing lithium-ion cells, with a projected annual production capacity of four gigawatt hours (GWh). This will mark the second facility in the state for the company, which operates in 14 other locations throughout North America. EnerSys says the new facility will create 500 jobs, presumably including both the permanent employees and temporary construction workers. — Hayden Spiess

AURORA, COLO. — MCA Realty has purchased Commerce Center I, a three-building industrial business park at 15200 E. 33rd Place, 15250 E. 33rd Place and 15201 E. Moncrieff Place in Aurora. Commerce Center I was acquired through the firm’s MCA Realty Industrial Growth Fund. An undisclosed seller sold the asset for $9.2 million. MCA Realty plans to spend approximately $1.2 million on interior and exterior renovations that will include exterior paint, renovations to the parking lot, exterior lighting upgrades, HVAC repair and replacement, upgraded signage and landscaping, new loading doors, a remote monitored security system, and renovations to interior storefronts and warehouse space. Built in 1985, the three-building, 70,301-square-foot industrial business park was fully occupied at the time of sale. T.J. Smith, Nick Rice and Matt Keyerleber of Colliers represented MCA Realty and the seller in the transaction.