DALLAS — Noodoe Inc., a Taiwanese provider of operating systems for electric vehicles, will open an 8,381-square-foot flex facility at 2600 Technology Drive in Plano. According to LoopNet Inc., the complex was built on 5.3 acres in 1998 and totals 82,545 square feet. Joe Santaularia of Bradford Commercial Real Estate Services represented Noodoe in the lease negotiations. Brian Pafford and Jared Laake, also with Bradford, represented the landlord.

Industrial

ELMHURST AND ADDISON, ILL. — Lee & Associates has negotiated two industrial leases totaling 67,244 square feet in DuPage County. Woodland Group, a privately owned logistics, e-commerce and supply chain management company, signed a 38,475-square-foot lease renewal at 325 W. Lake St. in Elmhurst. Kenneth Franzese and John Cassidy of Lee & Associates of Illinois represented the tenant, while Tom Maher of Hamilton Partners represented the landlord. Bauderer Packaging signed a 28,769-square-foot lease at 775 Belden Ave. in Addison. The 200,907-square-foot property is now fully occupied. Jeff Janda and Michael Plumb of Lee & Associates of Illinois represented the landlord, Link Logistics. Rick Morris of Cresa represented the tenant.

MORTON GROVE, ILL. — Entre Commercial Realty has brokered the sale-leaseback of a 66,786-square-foot industrial building in Morton Grove, a northern suburb of Chicago. Located at 5940 Oakton St., the property features four docks, four drive-in doors and a special use permit for an auto repair and body shop. Denise Chaimovitz of Entre brokered the transaction. Service King will continue leasing nearly 28,000 square feet, and the seller, Lin-Mar, will lease back roughly 39,000 square feet. Venture One Real Estate was the buyer.

SAN MARCOS, CALIF. — Stos Partners has completed the disposition of an industrial complex at 1545-1565 La Mirada Drive in San Marcos. A private investor acquired the 3.3-acre property for $12.5 million. The 61,112-square-foot building features 21 grade-level, roll-up doors; secured outdoor storage areas; multiple ingress/egress points; and minimal first-floor office space. Stos Partners implemented a value-add and capital improvement program to the asset, which it originally acquired in 2021 for $8.8 million. The renovations included a new roof, parking lot, exterior paint, drought resistant landscaping and signage. Matt Pourcho, Anthony Delorenzo and Matt Harris of CBRE, along with Chris Roth, Rusty Williams and Jake Rubendell of Lee & Associates, represented Stos Partners. Brant Aberg and Bryce Aberg of Cushman & Wakefield represented the undisclosed buyer in the transaction.

Marcus & Millichap Brokers Sale of 52,550 SF Industrial Property in Henderson, Colorado

by Amy Works

HENDERSON, COLO. — Marcus & Millichap has arranged the sale of an industrial asset located at 8777 Brighton Road in Henderson. Terms of the transaction were not released. Situated on 3.5 acres, the three-building property offers a total of 52,550 square feet of industrial space with 11 units, solar panels and a standalone office facility. Alyssa Tomback and Thimy Moraitis of Marcus & Millichap’s Denver office represented the seller and buyer, both private investors, in the deal.

Glenstar Secures $38.2M Construction Financing for Phase I of Industrial Park in Gaffney, South Carolina

by John Nelson

GAFFNEY, S.C. — Glenstar has secured $38.2 million in construction financing for the development of the first phase of an industrial park in Gaffney. CrossHarbor Capital Partners provided the financing. Upon completion, the property, which is being developed by Glenstar and capital partner Creek Lane Capital, will total 3.6 million square feet across five buildings. The first phase of the park, which has been dubbed Cherokee Commerce Center 85 (CCC-85), will comprise a 555,520-square-foot building expandable to 1.3 million square feet. The building, known as 2A, will feature 232 dock doors, four drive-in doors, 540 parking spaces and 452 trailer spaces. Completion is scheduled for fall 2024. Subsequent phases of CCC-85 will include four additional warehouses totaling 1.7 million; 252,270; 278,200; and 211,640 square feet, respectively. The project team includes general contractor The Conlan Co., architect Ware Malcomb and civil engineer SeamonWhiteside. John Montgomery, Garrett Scott, Brockton Hall and Dillon Swayngim of Colliers will manage leasing at the property on behalf of ownership.

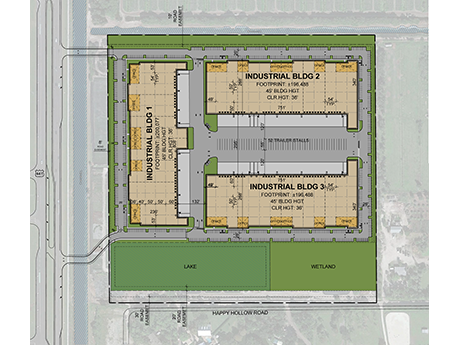

DELRAY BEACH, FLA. — BBX Logistics Properties and PCCP have formed a joint venture to develop BBX Park at Delray, a 672,533-square-foot logistics campus in Delray Beach. The joint venture has acquired 40 acres along U.S. Highway 441 for the project. Upon completion, the property will feature three buildings, with the first phase comprising a 200,000-square-foot building. Construction is scheduled to begin in the first quarter of 2024. BBX has contributed $2.9 million to the joint venture and plans to expend an additional $2.5 million in development costs.

Halstatt, Tectonic to Construct 614,220 SF Industrial Development in Salisbury, North Carolina

by John Nelson

SALISBURY, N.C. — Halstatt Real Estate Partners and Tectonic Real Estate will develop a two-building industrial property totaling 614,220 square feet in Salisbury. Upon completion, the campus will feature 60-foot speed bays in both buildings, as well as 505 parking spaces and 165 trailer spaces. A construction timeline was not disclosed.

ROUND ROCK, TEXAS — Newmark has negotiated a 44,680-square-foot industrial lease extension at Corridor Park I in Round Rock, a northern suburb of Austin. The tenant, Benchmark Electronics, is also expanding its footprint at Building 6 of the development. Sherry Gubera and Joshua LaFico of Newmark represented the tenant in the lease negotiations. JLL represented the landlord.

BRISTOL, PA. — Chicago-based investment firm Venture One Real Estate has acquired a 61,488-square-foot industrial building in Bristol, a northeastern suburb of Pennsylvania. Constructed in 1988, the single-tenant building is situated within Keystone Industrial Park and features a clear height of 20 feet, 11 exterior docks, one drive-in door and 5,331 square feet of office space. The seller was not disclosed. The building was leased on a short-term basis at the time of sale. Cushman & Wakefield will handle future leasing initiatives.