YORK, PA. — Cushman & Wakefield has arranged the back-to-back sale of a 100,232-square-foot industrial property located at 350 N. Sherman St. in York, about 100 miles west of Philadelphia. The property sits on 5.7 acres and features 14 dock doors, a clear height of 32 feet, 43 auto parking spaces and 10 trailer parking spaces. In the first deal, locally based firm Inch & Co. sold the asset to Dallas-based Dalfen Industrial for $12.7 million. That same day, Dalfen sold the property to New York-based furniture retailer Raymour & Flanigan for $16.9 million. Gerry Blinebury and Collin Potter of Cushman & Wakefield brokered the first transaction, and the firm collaborated with Newmark to facilitate the second sale.

Industrial

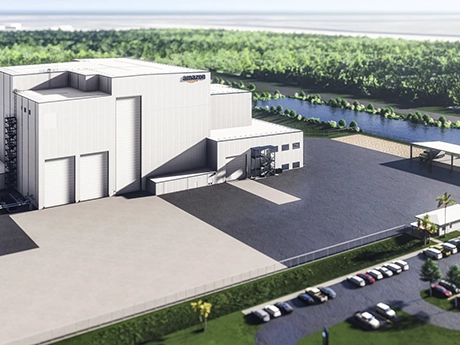

CAPE CANAVERAL, FLA. — Amazon is underway on the construction of a $120 million satellite processing facility at Space Florida’s Launch and Landing Facility within Kennedy Space Center in Cape Canaveral. Upon completion, the development will total 100,000 square feet with a 100-foot high bay clean room. The facility will be used to receive and prepare Blue Origin and United Launch Alliance (ULA) satellites as part of Amazon’s Project Kuiper, a 3,200-satellite project that will provide broadband connection to underserved communities globally. Amazon will use the facility to receive shipments, conduct final preparation ahead of launches, connect satellites to custom dispensers from space tech firm Beyond Gravity and integrate the loaded dispensers with launch vehicles. Amazon’s investment is expected to create 50 news jobs on Florida’s Space Coast. A timeline for delivery was not disclosed.

ARLINGTON, VA. — Development and construction firm Skanska has completed the construction of a 245,000-square-foot medical office building in Arlington on behalf of VHC Health. The Outpatient Pavilion facility includes physical therapy examination and treatment rooms, radiology and imaging suites, examination clinics and six operating rooms. Additionally, there is 22,000 square feet of space dedicated to women’s health services. Skanska previously delivered an adjacent parking garage, featuring capacity for more than 1,600 cars, in 2021.

Cushman & Wakefield Secures 216,317 SF Industrial Lease at Osprey Logistics Park in Coral Springs, Florida

by John Nelson

CORAL SPRINGS, FLA. — Cushman & Wakefield has arranged a 216,317-square-foot lease at Osprey Logistics Park, a 427,515-square-foot industrial development currently underway in Coral Springs. Matthew McAllister and Christ Metzger of Cushman & Wakefield’s South Florida Industrial Team represented the landlord and developer, Foundry Commercial, in the leasing negotiations. Steve Wasserman and Erin Byers of Colliers represented the tenant, CTS Engines. CTS Engines will move its headquarters to Building 2 upon completion of the project, which is scheduled for late 2023. The building features 36-foot clear heights, 235-foot building depth, a 180-foot truck court, R-19 insulated roof deck, an ESFR sprinkler system and office space.

OKLAHOMA CITY — Atlanta-based developer Seefried Industrial Properties, in partnership with Truist Securities, is underway on construction of an 842,043-square-foot, build-to-suit project in Oklahoma City. The new facility will act as a hub for depot support for the military engines of Pratt & Whitney, which are maintained at Tinker Air Force Base. The facility, which is expandable to 942,000 square feet, will feature an 86,000-square-foot office component, and future development plans include an adjacent, 100,000-square-foot training facility. In addition, the main warehouse will offer 40-foot clear heights, up to 120 dock-high doors, six grade-level doors, 515 auto parking stalls (including EV charging spots) and 103 trailer spaces. Construction is slated for a second-quarter 2024 completion.

DALLAS — Hobi International, a provider of mobile asset management services, has signed a 98,489-square-foot industrial lease renewal at 7601 Ambassador Row in northwest Dallas. According to LoopNet Inc. the property was built in 1958 and totals 185,220 square feet. Craig Jones of JLL represented the tenant in the lease negotiations. Sam Abusaad represented the landlord, Chicago-based ML Realty Partners, on an internal basis.

Bridge Industrial Acquires 13-Acre Site for Bridge Point Kent 180 Development in Washington

by Jeff Shaw

KENT, WASH. — Bridge Industrial is expanding its presence in the Pacific Northwest with the acquisition of a 13-acre site at 7730 S. 202nd St. in Kent. The site will eventually house Bridge Point Kent 180, a Class A industrial facility spanning 180,000 square feet. An aluminum smelting plant previously occupied the site, which requires significant environmental remediation due to nearly 40 years of contamination. Bridge plans to demolish the existing structure and conduct extensive cleanup before commencing construction on Bridge Point Kent 180 in the first quarter of 2024. The facility is scheduled for completion by the first quarter of 2025. Bridge Point Kent 180 will cater to a range of tenants, including ecommerce, logistics and cold storage users. The facility will feature 36-foot clear heights, multiple loading doors, trailer parking and car parking. Bridge’s continued expansion in the Seattle region reflects the strong demand for modern, sizable industrial facilities in this market, according to the company.

Lee & Associates Negotiates $10.7M Sale of Industrial Building in Chatsworth, California

by Jeff Shaw

CHATSWORTH, CALIF. — Lee & Associates has arranged the sale of a 37,000 square-foot industrial building in Chatsworth. Northwest Industrial Center sold the asset to an undisclosed buyer for $10.7 million. The property is located at 9223 Deering Ave. in the Northpark Industrial Center. Previously serving as the location for a database management company, the site’s location in the San Fernando Valley provides access to major freeways and surrounding hubs. Scott Caswell and Erica Balin of Lee & Associates – LA North/Ventura represented both the buyer and the seller.

HAMILTON, N.J. — Locally based developer Denholtz Properties has delivered 800 Horizon Center, a 40,500-square-foot industrial flex building in the Northern New Jersey community of Hamilton. The site is located less than three miles from Exit 7A on the New Jersey Turnpike at the intersection of Interstate 195 and U.S. Route 130. Building features include divisibility to 2,700-square-foot units, a clear height of 26 feet, 15 roll-up doors and roughly 110 car parking spaces. Fennelly Associates has been tapped as the leasing agent as of February 2024.

MINNEAPOLIS — A joint venture between PCCP and Capital Partners has acquired a six-building light industrial portfolio totaling 690,742 square feet in Minneapolis for an undisclosed price. The properties, built between 2001 and 2014, are 91 percent leased to 15 tenants with an average size of 38,400 square feet and a weighted average lease term of 6.3 years. The portfolio was previously under institutional ownership. Peter Mork and Jason Simek, managing partners of Capital Partners, helped design, develop and lease the portfolio throughout the early 2000s when they previously worked for CBRE.