BURLINGAME, CALIF. — Levin Johnston has arranged the $14.5 million sale of an industrial portfolio in the Bay Area city of Burlingame. The 1.6-acre site consists of eight separate industrial suites in two adjacent buildings. The transaction comprised two adjacent properties with 31,415 square feet of leasable space. Both properties are zoned for warehouse use with flex office space. The properties include on-site external parking, 14-foot ceiling heights and multiple drive-in bays for warehouse access. They are located at 890 Mahler Road and 1550 Gilbreth Road. The Levin Johnston team of Adam Levin, Robert Johnston and Jessica Tomasetti represented both the buyer and seller of the properties.

Industrial

National Transportation Company Signs 125,480 SF Lease at Logistics Center in Ontario, California

by Jeff Shaw

ONTARIO, CALIF. — CRST The Transportation Solution Inc. has signed a long-term lease for a 125,480-square-foot warehouse in the Inland Empire city of Ontario. The company plans to establish a truck maintenance and logistics center in the facility, which Realterm owns. Stream Realty Partners represented the tenant in the transaction, while Colliers International represented the landlord.

INDIANAPOLIS — Colliers has negotiated two new leases at 96th Street Commerce Park, a new industrial business park located on the site of the former HH Gregg headquarters in Indianapolis. Virginia Tile, a wholesale building materials supply vendor, leased 51,837 square feet to open a new showroom and finishing facility. Springfield Electric, an electrical supplies vendor, leased 28,817 square feet for its first location in the Indianapolis market. Jimmy Cohoat and Brian Zurawski of Colliers represented the landlord, Citimark.

CLAWSON, MICH. — Dominion Real Estate Advisors has arranged the sale of a 9,673-square-foot auto repair shop in Clawson, a northern suburb of Detroit. The sales price was undisclosed. The property is located at 650 N. Rochester Road. Barry Landau of Dominion represented the seller, Kimberly Tire & Wheel, and the buyer, XCEL Collision LLC.

EULESS, TEXAS — Automotive repair services provider Dents Dun Rite Inc. has signed a 5,280-square-foot industrial lease in Euless, located in the northern-central part of the metroplex. Jason Finch and Michael Spain of Bradford Commercial Real Estate Services represented the landlord, an entity doing business as Euless Industrial LLC, in the lease negotiations. The representative of the tenant was not disclosed.

HUNTINGTON STATION, N.Y. — A partnership between Dallas-based investment firm Realty Capital Partners and self-storage developer DXD Capital is underway on construction of a 664-unit facility in the Long Island community of Huntington Station. The facility will total 62,125 net rentable square feet of space that will be entirely climate-controlled. Construction began in June and is expected to be complete in August 2024. Extra Space Storage will operate the facility, which will be the first new self-storage project to be built in Huntington Station in nearly three years, according to the development team.

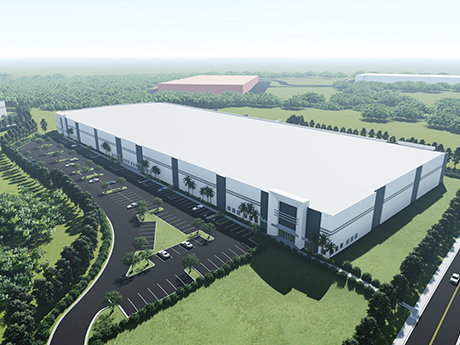

Woodmont, Butters, PCCP Break Ground on 303,364 SF Industrial Project in South Florida

by John Nelson

JUPITER, FLA. — Woodmont Industrial Partners, Butters Construction & Development and PCCP LLC have broken ground on the first building of a 303,364-square-foot industrial project in Palm Beach County. Situated within Palm Beach Park of Commerce in Jupiter, the building, the first of eight, will feature 40-foot clear heights, 60-foot speed bays, 43 dock high doors, two drive-in doors, roughly 196-foot truck courts and 26 trailer parking spaces. Construction of the project is expected to be complete in the second quarter of 2024. The joint venture acquired the property, located at 15430 Corporate Road N, in December 2021.

PEABODY, MASS. — Marcus & Millichap has brokered the sale of Andover Street Self Storage, a 1,100-unit facility located on the northern outskirts of Boston in Peabody. The facility spans 76,396 net rentable square feet. Nathan Coe, Brett Hatcher and Gabriel Coe of Marcus & Millichap represented the seller, a limited liability company, in the transaction. The buyer was not disclosed. Thomas Shihadeh of Marcus & Millichap assisted in closing the deal as the broker of record.

WHITESTOWN, IND. — Rockwell Automation Inc. (NYSE: ROK) has signed a 369,449-square-foot industrial lease renewal at Anson8A within the AllPoints at Anson industrial park in Whitestown, a northern suburb of Indianapolis. The property is situated near the I-65 logistics corridor. Jimmy Cohoat and Jason Speckman of Colliers represented the landlord, CBRE Investment Management.

COUNCIL BLUFFS, IOWA — Meristem Crop Performance Group LLC has inked a 42,810-square-foot industrial lease at 2101 S. 35th St. in Council Bluffs. The property is situated near I-29. Meristem is looking to expand its operations into metro Omaha. Kevin Stratman and Sydney Weller of Investors Realty represented the landlord, V & R Joint Venture.