IRVING, TEXAS — Bradford Commercial Real Estate Services has negotiated a 13,000-square-foot industrial flex lease at Las Colinas Distribution Center 5 in Irving. The lease term is six years. Brian Pafford of Bradford represented the landlord, an entity doing business as Las Colinas AAA Investment LLC, in the lease negotiations. Chris Shilling of Minerva Realty Group represented the tenant, automotive maintenance and service provider Repairify.

Industrial

CLAYMONT, DEL. — Chicago-based REIT First Industrial Realty Trust (NYSE: FR) is underway on construction of a 358,000-square-foot facility in the greater Philadelphia area. The site is located within the 425-acre First State Crossing mixed-use development. The rear-load facility will offer a clear height of 40 feet, 68 dock positions and 241 trailer parking stalls. Completion is slated for October. Blue Rock is the general contractor for the project, and Joseph V. Belluccia is the architect. CBRE is the leasing agent. Delivery is slated for the first quarter of next year.

AUBURN HILLS, MICH. — Northmarq has brokered the $8.6 million sale of a 77,100-square-foot industrial property in Auburn Hills. The single-tenant facility is fully leased to the Morrell Group, including its division Stegner Controls, which is a motion controls manufacturer that services dozens of industries including the automotive industry. The property at 3333 Bald Mountain Road was built in 1998 and renovated in 2021. It features 57,825 square feet of warehouse space and 19,275 square feet of office space. BJ Feller and Josh Dicker of Northmarq represented the seller, a Michigan-based developer. The buyer was a California-based private investor.

SIHI, Graycor Construction Break Ground on 516,320 SF Camelback 303 Industrial Park in Goodyear, Arizona

by Jeff Shaw

GOODYEAR, ARIZ. — Sunbelt Investment Holdings and Graycor Construction Company have begun construction on Phase I of Camelback 303, a Class A industrial park in Goodyear. The first phase consists of a 516,320-square-foot building within the Loop 303 Corridor. It is designed for use by a single tenant, or it can be divisible to three tenants. The Camelback 303 project aims to provide warehouse, distribution and manufacturing space. At completion, Camelback 303 is slated for up to 16 buildings ranging from 32,400 square feet to 1.2 million square feet. The development is part of the even larger PV|303 master-planned business park, which totals 1,600 acres and offers 20 million square feet of industrial, office and retail space. Construction on Camelback 303 Phase I is underway now, with completion scheduled for first-quarter 2024. The architect for Camelback 303 is Butler Design Group. Graycor Construction serves as the general contractor. Andy Markham, Mike Haenel and Phil Haenel of Cushman and Wakefield are the project’s exclusive leasing brokers.

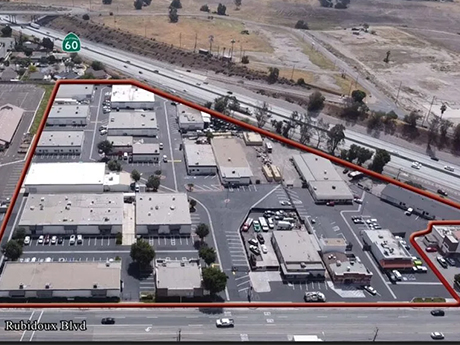

Lee & Associates-Ontario Negotiates $19.5M Sale of Riverside Business Park in Jurupa Valley, California

by Jeff Shaw

JURUPA VALLEY, CALIF. — Lee & Associates-Ontario has facilitated the sale of Riverside Business Park, a fully occupied, multi-tenant business park in Jurupa Valley. Intersection Equities LLC acquired the asset, consisting of 37 units across 22 buildings, for $19.5 million. The park features ground-level and dock-high door loading, private yards, and clear heights of up to 16 feet. The sellers were Bravo Whiskey Properties LLC and Transition Properties LLC. The selling agent, Barret Woods of Lee & Associates-Ontario, represented himself as a principal in the transaction. Brad Yates and Stefan Pastor of Stream Realty represented the buyer.

ORLANDO, FLA. — CBRE has brokered the $23.1 million sale of Windermere Storage, an 89,145-square-foot self-storage facility located at 8550 Old Winter Garden Road in Orlando. CBRE’s Self Storage Advisory Group represented the seller, locally based Schrimsher Properties, in the transaction. Wentworth Properties was the buyer. Built in the second quarter of this year, Windermere Storage features a two-story building comprising 609 climate-controlled units ranging in size from 25 to 450 square feet, as well as a 2,000-square-foot office building and 351 parking spaces.

LEXINGTON, MICH. — Dominion Real Estate Advisors LLC has brokered the sale of a 51,329-square-foot industrial building in Lexington, a city in eastern Michigan along Lake Huron. The sales price was undisclosed. The property is located at 5160 Lakeshore Drive. Rem Murray of Dominion represented the undisclosed seller. David Wax of Burger & Co. represented the buyer, an entity doing business as KCRE LLC.

MULBERRY, ARK. — Compass Cold Storage has announced the completion and opening of the 142,160-square-foot first phase of its new cold storage facility located in Mulberry. Featuring 18,500 pallet positions, the cold storage facility can maintain temperatures ranging from negative 20 to 40 degrees Fahrenheit. Completion of the second phase of the project, which will include additional freezer and dock space and bring the project cost to roughly $50 million, is scheduled for later this summer. A third phase is in the planning stage. Doug Bowen and Darren Winstead are the owners and operators of Compass Cold. Melbourne, Fla.-based Ti Cold is the developer on the project.

FORT WORTH, TEXAS — Chubby Gorilla, a provider of liquid packaging services, has signed a 54,915-square-foot industrial lease at Champions Business Park in Fort Worth. Reid Bassinger and Nathan Denton of Lee & Associates represented the landlord, Hopewell Development, in the lease negotiations. Sam Pruitt and Luke Harp of Site Selection Group represented the tenant.

HOUSTON — Locally based brokerage firm Finial Group has negotiated a 9,750-square-foot industrial lease renewal at 13014 Brittmoore Park Drive in Houston. According to LoopNet Inc., the single-tenant property was built in 2006. John Buckley and Doc Perrier of Finial Group represented the undisclosed landlord in the lease negotiations. The tenant was automotive parts and services provider Serious HP.