OCALA, FLA. — Kansas City-based Hunt Midwest and locally based partner Boyd+Mox have broken ground on Ocala South Logistics Park, a 1.4 million-square-foot industrial campus in Central Florida. The Class A development will be situated on a 93-acre site within Florida Crossroads Commerce Park, about three miles from I-75. The co-developers broke ground on the first of four buildings, a rear-load warehouse spanning 251,511 square feet. The speculative building is set to deliver before the end of the year and will feature 32-foot clear heights, 68 dock-high doors, 60-foot-deep speed bays and two drive-in doors. The project represents Hunt Midwest’s first industrial development in Florida and its first venture with Boyd+Mox. The design-build team for Ocala South Logistics Park includes civil engineer Kimley Horn, architect LS3P and general contractor Evans General Contractors. Rian Smith, Kris Courier and Josh Tarkow of CBRE are leasing the park on behalf of the owners.

Industrial

SURPRISE, ARIZ. — Rockefeller Group has purchased a 25-acre parcel in Surprise with plans to develop Surprise Pointe Commerce Center, a 415,000-square-foot speculative distribution center. Located approximately 20 miles northwest of Phoenix, the project is designed to accommodate one to four tenants. Plans call for 36-foot clear height, 83 dock doors, a 185-foot truck yard, 103 truck trailer parking stalls, 466 auto parking stalls and custom-designed office space. Cooper Fratt of CBRE and Kirk Kuller of Cushman & Wakefield represented Rockefeller Group and will handle the marketing and leasing of the project. Ware Malcomb will design the project and Layton Construction will be the general contractor. Rockefeller Group’s civil engineer is Hunter Engineering.

WATSEKA, ILL. — Franklin Street has arranged the sale of a 104-unit self-storage facility totaling 12,600 net rentable square feet in Watseka, about 60 miles east of Champaign. The sales price was undisclosed. The value-add property is located at 1090 E. Walnut St. Frank DeSalvo and David Perlleshi of Franklin Street represented the seller, Houston-based Pebble Ridge Capital. Wisconsin-based Just Simple Storage acquired the asset. The transaction marks the entrance into the Illinois market for Just Simple Storage, which currently operates facilities in Michigan and Wisconsin.

ST. CHARLES, ILL. — DarwinPW Realty/CORFAC International has negotiated the sale of a 50,000-square-foot industrial building in St. Charles, about 40 miles west of Chicago. The sales price was undisclosed. The Class B property, located at 2500 Production Drive, features a clear height of 21 feet, seven docks, one drive-in door, 1,500 square feet of office space and 55 parking spaces. Marc Hale of DarwinPW Realty represented the buyer, an HVAC manufacturing company that is relocating from Elk Grove Village. Brian Lindgren of SVN Landmark represented the seller, Hill & Smith.

PLANO, TEXAS — Lee & Associates has negotiated a 79,720-square-foot industrial lease in the northern Dallas suburb of Plano. According to LoopNet Inc., the property at 3605 E. Plano Parkway was built in 1999, totals 100,320 square feet and features 24-foot clear heights, 32 exterior dock doors and 445 parking spaces. George Tanghongs of Lee & Associates represented the landlord, an affiliate of Pennsylvania-based Equus Capital Partners, in the lease negotiations. Brett Lewis, also with Lee & Associates, represented the tenant, LiteOn, a Taiwanese provider of consumer electronics.

SECAUCUS, N.J. — Newmark has negotiated a 46,000-square-foot industrial lease at 60 Metro Way in the Northern New Jersey community of Secaucus. The facility features 8,000 square feet of office, space seven loading docks and one drive-in door. David Simson and Dan Reider of Newark represented the tenant, Creative Technology Inc., which supplies technical equipment for sports and entertainment events, in the lease negotiations. Locally based investment firm Hartz Mountain Industries owns the building.

BAYTOWN, TEXAS — A partnership between two locally based firms, Pontikes Development and McNair Interests, has broken ground on a pair of rail-served industrial facilities totaling 630,128 square feet in the eastern Houston suburb of Baytown. Building 3 at Port 10 Logistics Center will span 450,873 square feet and is expected to be complete in the third quarter. Building 5 will total 179,255 square feet and is scheduled for a fourth-quarter delivery. JLL is leasing both projects. A fourth building totaling 452,266 square feet has also been proposed at Port 10 Logistics Park.

PLANO, TEXAS — Horizon Oxygen & Medical Equipment has signed a 7,855-square-foot industrial lease in Plano. According to LoopNet Inc., the building at 600 Development Drive was built in 2001 and totals 23,334 square feet. Jared Laake of Bradford Commercial Real Estate Services represented the landlord, Dallas-based Kennington Commercial, in the lease negotiations. Schaefer Amos of Lee & Associates represented the tenant.

KNIGHTDALE, N.C. — Beacon Partners has broken ground on Knightdale Gateway, a 511,000-square-foot industrial park about 15 miles east of Raleigh in Wake County. Slated for completion in the second quarter of 2024, the project will feature two Class A buildings with 36-foot clear heights. The assets will include a 221,363-square-foot building anchored by the new 195,056-square-foot headquarters facility for Kitchen Cabinet Distributors (KCD) and a 289,632-square-foot building with frontage along U.S. Highway 64. Al Williams and Michael Morgan of JLL represented KCD in the lease transaction, and Tim Robertson with Beacon Partners represented the landlord internally. Williams, along with JLL colleague Matt Winters, will handle the leasing assignment for the remaining space at Knightdale Gateway. The design-build team includes general contractor Choate Construction, Merriman Schmitt Architects and Advanced Civil Design. Fifth Third Bank is providing an undisclosed amount of construction financing to Beacon Partners for the project.

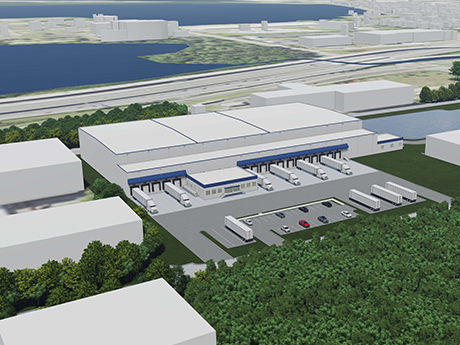

Joint Venture to Develop 108,554 SF Cold Storage Facility in Tampa’s Ybor City Neighborhood

by John Nelson

TAMPA, FLA. — Sansone Group, Mandich Group and BentallGreenOak have formed a joint venture to develop and operate a new 108,554-square-foot cold storage facility in Tampa’s Ybor City neighborhood. The rail-served facility will be situated less than three miles from Port Tampa and the CSX Intermodal Tampa Terminal, as well as 12 miles from Tampa International Airport. Tippmann Construction is the general contractor for the project, and locally based Stifel Bank provided an undisclosed amount of construction financing to the developers. Scott Delphey and Matthew Delphey of Food Properties Group, along with Lisa Ross and Trey Carswell of Cushman & Wakefield, will lease the facility on behalf of the ownership group.