Before we look at the current happenings in the Birmingham industrial market, it is worth glancing into the rearview mirror of the last 24 months or so. 2021 and 2022 saw the delivery of 10 notable industrial build-to-suit projects. Some were announced in 2020 before pricing surges. The last delivery of these projects was completed in fourth-quarter 2022, an automotive project on the west side for Lear Automotive Seating oriented toward Mercedes-Benz. This unprecedented streak of projects totaled 3.3 million square feet. In addition to Lear, tenants included: Lowes, Mercedes-Benz, Motion Industries, TSF Sportswear, Samuel, Son & Co., Amazon (two) and FedEx Ground. Interestingly, two of these facilities are now available for sublease and were never occupied by the tenant. And as of this writing, there is not a single industrial build-to-suit announced or under construction. What did follow the noted build-to-suit wave were six speculative (or partial speculative) projects. The first one delivered — the first phase of Crossroads Commerce Center in the Central submarket — spanned 186,000 square feet, and the twin second phase was recently completed. The two phases are now 75 percent occupied, demonstrating market demand shown in other Southeastern markets in mid-2022 and prior. In …

Industrial

SALT LAKE CITY AND BUFFALO, N.Y. — Extra Space Storage Inc. (NYSE: EXR), a Salt Lake City-based REIT, has entered into a definitive agreement to acquire Buffalo-based REIT Life Storage (NYSE: LSI) in an all-stock transaction. According to multiple news outlets including The Wall Street Journal and Reuters, the deal is valued at $12.7 billion. The combined portfolio will yield the largest self-storage operation in the country, with over 3,500 locations spanning over 264 million square feet that serve more than 2 million customers. In announcing the deal, executives of both REITs noted that combining their respective platforms creates opportunities to maximize value for shareholders via additional scaling of third-party management services and access to elevated levels of joint-venture equity and bridge-loan debt for future developments and acquisitions. Under the terms of the agreement, Life Storage shareholders will receive roughly nine-tenths of a share of Extra Space common stock for each share of Life Storage stock that they own. At closing, Extra Space and Life Storage shareholders are expected to own approximately 65 percent and 35 percent of the combined company, respectively. The boards of directors of both companies have unanimously approved the transaction, and the deal is expected to …

JACKSONVILLE, FLA. — Merritt Properties has acquired 16 acres for the expansion of the company’s Imeson Landing Business Park in Jacksonville. Three additional flex/light buildings comprising 114,500 square feet will be built at the site, with construction scheduled to begin in 2024. Upon completion, the development, which is located at the corner of Imeson Park Boulevard and Zoo Parkway, will total 380,700 square feet across eight buildings. Merritt was self-represented by Bobby Lanigan and Pat Franklin, and Luke Pope of JLL represented the land seller in the transaction. Preleasing is currently underway. Nine tenants have signed leases ranging in size from 3,000 to 29,000 square feet at the development thus far.

Northmarq Brokers $9.5M Sale-Leaseback of Industrial Property in Rockingham, North Carolina

by John Nelson

ROCKINGHAM, N.C. — Northmarq has brokered the $9.5 million sale-leaseback of a single-tenant industrial property located at 235 River Road in Rockingham. The seller, Mount Vernon Mills Inc., fully occupies the 270,252-square-foot facility on a corporate guaranteed, triple-net-lease basis. Built in 1973, the property is situated on 27.7 acres and offers room for expansion. Robert Poirier of Northmarq represented both the seller and buyer, an Arizona-based institutional investor.

LAREDO, TEXAS — Marcus & Millichap has brokered the sale of Budget Self Storage, a 199-unit facility located in the Rio Grande Valley city of Laredo. The facility was built in 1970 and totals 25,600 net rentable square feet. Jon Danklefs of Marcus & Millichap represented the seller and procured the buyer in the transaction. Both parties were limited liability companies that requested anonymity.

SAN ANTONIO — Partners Real Estate has negotiated a 30,493-square-foot industrial lease at 4441 Centergate St. in San Antonio. According to LoopNet Inc., the property was built in 1979 and totals 67,391 square feet. Kyle Kennan of Partners represented the tenant, HVAC contractor Texas Chiller Systems, in the lease negotiations. Colin McLellan with Llano Realty represented the landlord, an entity doing business as EDG Centergate LLC.

ZION, ILL. — O2C Brands, a Chicago-based designer and manufacturer of consumer products, has signed a 75,036-square-foot industrial lease in Zion, a city in Northeast Illinois. O2C’s products are sold in brick-and-mortar, e-commerce, healthcare, international and promotional channels under five different brands: O2COOL, Treva, LunchBots, Ecovessel and Ukonserve. O2C Brands retained Entre Commercial Realty in early 2022 for site selection services to support its growing business and distribution requirements. Dan Benassi and Sam Deihs of Entre represented the tenant in its lease at 451 Trumpet Road in Zion. The facility, constructed in 2009, features a clear height of 30 feet, eight exterior truck docks and an office buildout. Pat Hake, Ned Frank and Chris Volkert of Colliers represented the landlord, LINK Logistics.

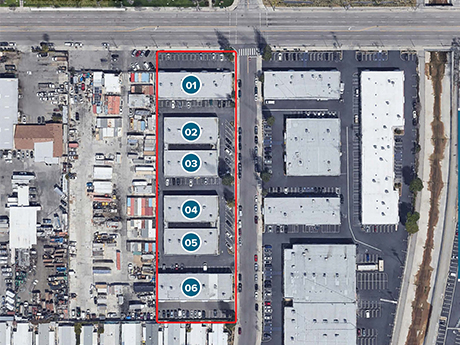

PORTLAND, ORE. — BKM Capital Partners has purchased Airport Business Center in Portland for $37.3 million. The 11-building light industrial portfolio is located at 6756 NE Alderwood Road and 6620-7040 NE 79th Court in Portland’s Columbia industrial corridor. The 228,518-square-foot business park contains 41 units with an average size of 5,600 square feet. The spaces were 92 percent occupied at the time of the sale. BKM acquired the asset through a joint venture partnership with TerraCore Capital.

LOS ANGELES — Selective Eton Nordhoff LLC has acquired a 48,550-square-foot industrial property in the Chatsworth and Canoga Park communities of Los Angeles. Though the purchase price was not disclosed, the asset was listed at nearly $10.5 million and sold for above asking price. The multi-tenant industrial property was built in 1977. It has largely remained the same since that time, save for cosmetic updates over the years. Arthur Pfefferman of Coldwell Commercial Quality Properties represented both the buyer and the seller.

CARLSBAD, CALIF. — PSRS has arranged $5.9 million in financing for the acquisition of a 32,000-square-foot industrial property in Carlsbad. The deal closed in 35 days to meet the borrower’s 1031 exchange deadline. The non-recourse loan features a five-year term with a 5.55 percent interest rate and a 30-year amortization. Ryan Frankman and Ari Zeen of PSRS arranged the financing through an insurance company.