HOUSTON — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged a $17.6 million acquisition loan for a portfolio of four industrial properties in Houston. The portfolio includes a fifth property in Cedar Rapids, Iowa, and the quintet of assets totals 229,775 square feet. Frank Montalto and Dean Giannakopoulos of IPA originated the five-year loan, which was structured with a 65 percent loan-to-value ratio and a 25-year amortization schedule. The names of the borrower and direct lender, a local bank, were not disclosed.

Industrial

HOUSTON — Electrical distribution firm Lightning Inc. has signed a 61,920-square-foot industrial lease renewal in East Houston. According to LoopNet Inc., the building at 2425 Broad St. was built in 1957 and totals 166,440 square feet. Michael Keegan and Andrew Laycock of Partners represented the landlord, an entity doing business as SL5 Urban Industrial GP LLC, in the lease negotiations. Grant Hortenstine and Drew Morris of Savills represented the tenant.

BentallGreenOak Buys 119,591 SF R&D/Life Sciences Flex Building in Carlsbad, California

by Amy Works

CARLSBAD, CALIF. — BentallGreenOak has acquired a R&D/life sciences flex building at 2210 Faraday Ave. within the Faraday Research Center in Carlsbad. Hill Cos. sold the freestanding asset for $35.7 million. The property consists of a single-story, 119,591-square-foot building with second-floor mezzanine space, 24-foot clear heights, dock and grade-level loading, heavy power and ample parking. Originally built in 1997, the property underwent significant renovates in 2005 and features existing life sciences and R&D buildout. Aric Starck and Drew Dodds of Cushman & Wakefield’s capital markets team in San Diego represented the seller in the deal. Don Trapani provided leasing advisory for the property.

WALTERBORO, S.C. — Pomega Energy Storage Technologies, a subsidiary of Kontrolmatik Technologies, has broken ground on its first U.S. lithium-ion battery manufacturing plant in South Carolina. The company will invest $300 million in upfront capital expenditures in the new facility in Walterboro, a suburb of Charleston in Colleton County. Pomega Energy Storage expects to begin production at the 500,000-square-foot facility in mid-2024, create about 575 new jobs and have an initial production capacity of 3 gigawatt-hours (GWh) — with plans to later increase capacity to 6 GWh with future development on the site. In addition to manufacturing the battery cells at the South Carolina plant, Pomega Energy Storage will also manufacture and assemble turnkey battery energy storage systems, including modules, cabinets and final containerized energy storage solutions. JLL led the site selection process for Pomega Energy Storage, which considered more than 200 locations before selecting the Colleton County site.

MIAMI — JLL has arranged a $193 million permanent loan for the refinancing of a nine-property industrial portfolio totaling 1.7 million square feet. The properties are located on infill sites in South Florida, Texas, North Carolina, Alabama and Maryland. Chris Drew, Melissa Rose and Christopher Gathman of JLL arranged the five-year, fixed-rate, non-recourse loan through TIAA Bank on behalf of the borrower, Adler Real Estate Partners. The assets were constructed between 1981 and 2001 and were leased to 145 separate tenants at the time of financing. The properties included: • Riverchase Center in Hoover, Ala. • 1001 Broken Sound Parkway in Boca Raton, Fla. • Prospect Park I & II in Fort Lauderdale, Fla. • Delray North Business Center in Delray Beach, Fla. • Rivers Business Park I & II in Columbia, Md. • South Point Business Park in Charlotte, N.C. • Parkwest I & II in Raleigh, N.C. • Addison Tech Center in Addison, Texas • Kramer 1-5 at Braker Center in Austin, Texas

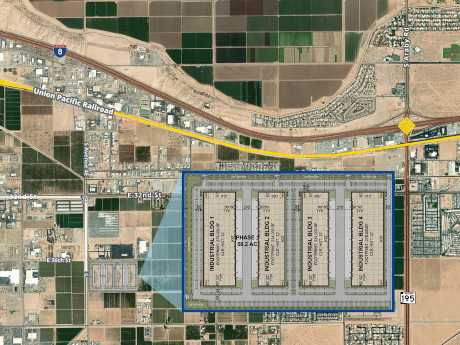

YUMA, ARIZ. — Panattoni Development has unveiled plans to develop a 1 million-square-foot industrial park at 36th Street and South Avenue 4E in Yuma. The initial phase of Panattoni’s Yuma Industrial Park is slated to include four buildings ranging from 234,000 square feet to 279,000 square feet each. The buildings will feature two grade-level doors, 49 rear-load, dock-high doors and 32-foot clear heights.

BRISTOL, WIS. — Peak Construction Corp. is underway on Building 4 within Bristol Business Park in Bristol, a city in Southeast Wisconsin. Janko Group is the developer. Peak completed construction of Buildings 2 and 3 in 2022. The industrial business park totals 225 acres and is fully entitled for up to 3 million square feet of development. So far, 2.4 million square feet is completed or under construction, of which 1.7 million square feet is leased. Constructed on a speculative basis, Building 4 will total 157,043 square feet and feature a clear height of 32 feet, 24 docks, two drive-in doors, 212 car parking spaces and a build-to-suit office space. Kelly P. Harris is the architect, Manhard Consulting is the civil engineer and Cushman & Wakefield is the leasing agent. Completion is slated for the third quarter of this year.

AUSTIN, TEXAS — North Texas-based developer Jackson-Shaw has acquired 67 acres at the northeast corner of State Highway 130 and Elroy Road in southeast Austin for the development of a 602,400-square-foot, four-building industrial project. Plumbing and HVAC supplies distributor Ferguson Enterprises has already preleased the entirety of the 207,180-square-foot Building 3. Method Architecture is designing the project, and Burton Construction is serving as the general contractor. AQUILA Commercial has been tapped as the leasing agent. Construction is scheduled to begin in March.

NORTHLAKE, TEXAS — Lee & Associates has negotiated a 506,410-square-foot industrial lease at 4500 Northport Drive in Northlake, located north of the metroplex in Denton County. According to commercialcafé.com, the property was built on 25.4 acres in 2008 and includes 131 parking spaces. Trey Fricke and Reid Bassinger of Lee & Associates represented the landlord, Link Industrial Properties, in the negotiations for the full-building lease. Nathan Lawrence and Krista Raymond of KBC Advisors represented the tenant, Exel Logistics.

HOUSTON — Fort Worth-based investment firm Fort Capital has acquired a portfolio of 10 light industrial buildings totaling 239,591 square feet located in various submarkets throughout Houston. The buildings were all constructed between 1980 and 1984 and had a collective occupancy rate of 86 percent at the time of sale. The seller and sales price were not disclosed.