MICHIGAN, NEBRASKA AND GEORGIA — In a sale-leaseback transaction, MAG Capital Partners LLC has acquired three industrial properties in three states for an undisclosed price. Applegate Greenfiber, a manufacturer of insulation products for commercial and residential use, occupies the properties. The first building spans 30,000 square feet and is located at 1000 Highview Drive in Webberville, Mich. The second totals 104,930 square feet at 3421 Old Highway 8 in Norfolk, Neb. Lastly, the portfolio includes a 110,000-square-foot property at 1241 Meadowbrook Drive in Eastanollee, Ga. Earlier this year, Industrial Opportunity Partners, a Chicago-based industrial investment firm, acquired both Applegate Holdings LLC and the assets of Greenfiber Holdings LLC to form Applegate Greenfiber Holdings LLC, which is based in Charlotte, N.C. Daniel Macks of STREAM Capital Partners represented the seller. Led by Dax Mitchell and Andrew Gi, MAG Capital Partners is based in Fort Worth, Texas.

Industrial

LUBBOCK, TEXAS — Fort Worth-based investment firm MAG Capital Partners has purchased a quartet of industrial buildings totaling 66,680 square feet in Lubbock in a sale-leaseback. The undisclosed seller had concurrently purchased the operations of the occupant, Lubbock Electric Co., which will remain onsite. Scott Briggs and David Read of Northmarq brokered the deal.

ELK GROVE VILLAGE, ILL. — Brown Commercial Group has negotiated the sale-leaseback of a 22,550-square-foot industrial building in the Chicago suburb of Elk Grove Village. The sales price was undisclosed. Located on Martin Lane and constructed in 1974, the property features two dock doors and four drive-in doors. Mason Hezner of Brown represented the seller, Etymotic Research, a manufacturer of earphone and hearing enhancement products. ProSource Wholesale, a flooring distributor, was the buyer. ProSource plans to use the building as a showroom and warehouse for its products. Etymotic Research will lease back a small portion of the building from the new owner.

SALT LAKE CITY — Pacific Industrial has completed the construction of Pacific Summit Logistics Center, an industrial facility at 885 N. John Cannon Drive in Salt Lake City. The development and investment firm has already sold the asset on a forward basis to Principal Global Investors, a global real estate investments platform based in Des Moines, Iowa, for an undisclosed price. Situated on 48 acres, the 824,320-square-foot facility features 40-foot clear heights, nearly 200 trailer parking stalls, a private perimeter vehicle access road and a modern entry. At the time of sale, the building was 50 percent preleased to Quality Distribution, a third-party logistics provider headquartered in Utah. Jeff Chiate, Rick Ellison, Mike Adey, Brad Brandenburg and Matthew Leupold of Cushman & Wakefield’s National Industrial Advisory Group together with Tom Freeman and Travis Healey of Cushman & Wakefield’s Salt Lake City office represented the seller. Freeman and Healey were retained by Principal Global Investors to handle leasing of the project. According to Cushman & Wakefield, the transaction is one of the largest ever single-building industrial property sales in Salt Lake City.

J.P. Morgan Divests of 340,960 SF Industrial Portfolio Near Denver International Airport

by Amy Works

DENVER — Institutional investors advised by J.P. Morgan Global Alternatives have sold Airport Central Portfolio, a two-building industrial property near Denver International Airport in Denver. Boston-based TA Realty acquired the asset for an undisclosed price. Jeremy Ballenger, Tyler Carner, Jim Bolt and Jessica Ostermick of CBRE National Partners in Denver represented the seller in the deal. Situated on 15 acres at 11777 E. 55th Ave. and 11475 E. 53rd Ave., the 340,960-square-foot asset includes two multi-tenant distribution buildings. The buildings are 93 percent leased to seven diversified tenants. Current unit sizes range from 19,000 square feet to 86,200 square feet with the ability to divide and combine units in the future as tenant demand dictates. The buildings feature clear heights ranging from 24 feet to 26 feet with dock-high and drive-in loading, ESFR/wet sprinklers and rail service by Union Pacific.

Serfer Land Ventures Sells 48-Acre SiteOne Landscape Supply Industrial Campus in Windsor, Colorado

by Amy Works

WINDSOR, COLO. — Serfer Land Ventures has completed the disposition of a 48-acre industrial campus located at 6166 Weld County Road 74/Harmony Road in Windsor. IA Windsor LLC bought the asset for $9.8 million. SiteOne Landscape Supply fully occupies the site. In 2019, SiteOne constructed a 12,821-square-foot showroom and 14,922-square-foot warehouse on the site. Jared Goodman, Aki Palmer, Cole VanMeveren, Tyler Murray and Nate Heckel of Cushman & Wakefield represented the buyer and seller in the deal.

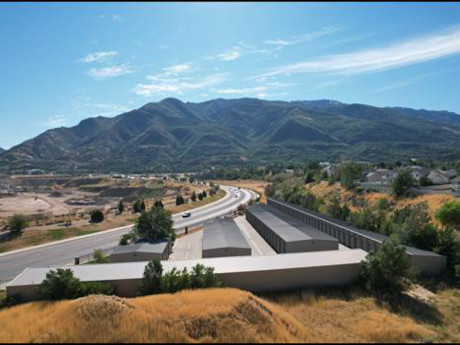

OGDEN, UTAH — Marcus & Millichap has brokered the sale of South Weber Storage, a self-storage facility in Ogden. Terms of the transaction were not released. Jordan Farrer and Adam Schlosser of Marcus & Millichap’s LeClaire-Schlosser Group represented the seller, a local partnership, and procured the undisclosed buyer. Totaling 26,060 square feet, South Weber Storage consists of five single-story buildings offering a total of 136 non-climate-controlled drive-up units. The facility features brick front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and asphalt driveways.

BRISTOL, CONN. — Newmark has arranged the $79.2 million sale of Bristol Logistics Center, a 1.1 million-square-foot industrial property in Connecticut. The rail-served site spans 179 acres and formerly housed a General Motors manufacturing plant. Treetop Development acquired the property from an entity doing business as Bristol Center LLC. Jeff Fishman, Cory Gubner and Alex Haendler of Newmark brokered the deal. At the time of sale, Bristol Logistics Center was 93 percent leased to three tenants: Firestone, Clark Dietrich and Arett Sales.

RINCON, GA. — TerraCap Management LLC has purchased Savannah Gateway Building 1H, a 790,000-square-foot industrial building located in the Savannah suburb of Rincon. The single-story property is located within Savannah Gateway Industrial Hub and was 75 percent occupied at the time of sale. Building 1H marks the completion of a two-building acquisition — TerraCap previously purchased Building 1F in August of this year. Broe Real Estate Group sold Building 1H for an undisclosed price. Britton Burdette of JLL represented the seller in the transaction, and Colliers has been appointed to manage the property. The seller and sales price were not disclosed.

LAYTON, UTAH — A local investment and development group has completed the disposition of Storage General – Layton, an 86,105-square-foot self-storage facility located on Antelope Drive in Layton. A REIT acquired the asset for an undisclosed price. Jordan Farrer and Adam Schlosser of Marcus & Millichap represented the seller and procured the buyer in the transaction. Storage General – Layton features 11 single-story buildings offering interior, drive-up, climate-controlled and traditional self-storage units with roll-up doors. The property has cinderblock front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and driveways.