BEND, ORE., AND CLARKSVILLE, TENN. — Invesco Real Estate Income Trust (INREIT) has acquired two self-storage portfolios in Bend and Clarksville for a combined purchase price of $42 million. The two-story, single-story, drive-up self-storage properties in Bend total 62,805 square feet across 674 units. The portfolio includes a 49,523-square-foot, 550-unit property that is 98.7 percent occupied, at 20230 Powers Road, as well as 345 Cleveland Ave., a 13,282-square-foot, 124-unit facility that is 100 percent occupied. Located in Clarksville, the three single-story, drive-up self-storage properties total 204,425 square feet across 1,347 units. The portfolio includes 1280 Parkway Place, a 67,350-square-foot, 505-unit facility that is 95.6 percent occupied; 4351 Guthrie Highway, an 80,275-square-foot, 471-unit facility that is 96.6 percent occupied; and 117 Old Excell Road, a 56,800-square-foot, 371-unit facility that is 97.8 occupied. The names of the sellers were not released.

Industrial

BOSTON AND NEW YORK CITY — American Tower Corp. (NYSE: AMT), a multitenant communications REIT, has agreed to sell a 29 percent stake in its data center platform to Stonepeak, an alternative asset management firm based in New York City. The deal, which comprises common and preferred equity from Stonepeak’s affiliated investment vehicles and debt commitments, is valued at $2.5 billion. The AMT data center portfolio consists of 27 data centers in 10 U.S. markets. AMT purchased Denver-based CoreSite Realty Corp. in a $10.1 billion deal that was announced last November. AMT will retain managerial and operational control, as well as day-to-day oversight of its U.S. data center business, and Stonepeak will obtain certain governance rights. The transaction is expected to close in third-quarter 2022, subject to customary closing conditions. “We are pleased to partner with Stonepeak in our U.S. data center business,” says Tom Bartlett, president and CEO of American Tower. “While this transaction supports the equity financing component for our previously completed CoreSite acquisition, it also creates a platform through which growth opportunities can be strategically evaluated and financed.” Andrew Thomas, managing director and co-head of communications at Stonepeak, says that AMT’s data center platform aligns with Stonepeak’s …

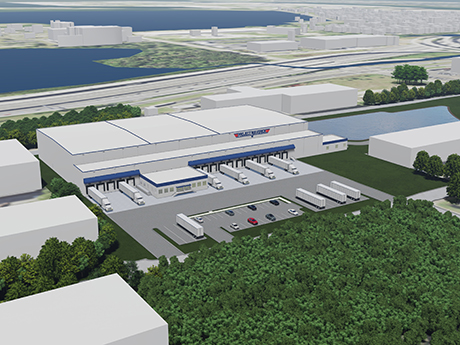

Sansone Group, Mandich to Develop 110,476 SF Spec Cold Storage Facility in Downtown Tampa

by John Nelson

TAMPA, FLA. — A partnership between St. Louis-based Sansone Group and Miami-based Mandich Group has purchased a 7.3-acre site in downtown Tampa’s Ybor City district. The developers plan to build a speculative cold storage facility at the site that will include 45-foot clear heights and span 110,476 square feet upon completion, which is set for 2024. The property, dubbed Tampa Cold Logistics, will be situated near I-4, Port Tampa and Tampa International Airport. Tippmann Group is the general contractor for the project, and Eric Swanson on Avison Young helped facilitate the deal, which is Sansone’s first partnership with Mandich Group.

DALLAS — JLL has negotiated the sale of a portfolio of 19 industrial buildings totaling 764,156 square feet. The buildings are located in various cities throughout the Dallas-Fort Worth metroplex. At the time of sale, the portfolio was 96 percent leased to 29 tenants with an average remaining lease term of 4.3 years. Stephen Bailey, Dustin Volz, Dom Espinosa, Wells Waller, Pauli Kerr and Cole Sutter of JLL represented the seller, Dallas-based investment firm MoxieBridge, in the transaction. Arden Logistics Park, the industrial investment arm of Philadelphia-based Arden Group, acquired the portfolio in partnership with global investment management firm Arcapita.

PHILADELPHIA — A fund managed by Ares Investment has purchased a 105,000-square-foot cold storage facility in Philadelphia. The property, which is currently leased to FreezPak Logistics, is located at 1801 N. 5th St., in between the Norris Square and Olde Kensington neighborhoods. Bob Yoshimura of Lee & Associates represented the seller, locally based investment and development firm BG Capital, and the buyer in the transaction. BG Capital originally purchased the facility as a part of a four-property portfolio deal in 2018.

STURTEVANT, WIS. — Ashley Capital has broken ground on two new speculative industrial buildings at Enterprise Business Park in Sturtevant, a southern suburb of Milwaukee. Buildings V and VI will each span 390,000 square feet and are slated for completion in the first quarter of 2023. Ashley is also renovating Building IV and expects to have it available for occupancy by the end of this summer. Upon full buildout, Enterprise Business Park will comprise six buildings totaling more than 2.1 million square feet. Current tenants include CNH, Fresenius, Andis and Ryder Logistics. Terence McMahon and Cody Ziegler of Cushman & Wakefield/Boerke Co., along with John Sharpe and Tom Boyle of Lee & Associates, are the leasing agents for the business park.

WEST DUNDEE, ILL. — Elgin Recycling has signed a 63,800-square-foot industrial lease at 1101 Wesemann Drive in West Dundee, a far northwest suburb of Chicago. The newly built facility is located less than two miles from Elgin Recycling’s headquarters at 46 East End Drive in Gilberts. The new property will be utilized for the company’s electronics division, which disassembles and recycles a wide variety of computer equipment. Dan Brown and Collin Tyrrell of Brown Commercial Group represented the tenant in the lease. The landlord was not disclosed.

NEW YORK CITY — Locally based brokerage firm TerraCRG has arranged the $10.2 million sale of a 68,000-square-foot warehouse in Brooklyn’s Red Hook district. The property comprises 36,400 square feet of above-grade space and 32,400 square feet of below-grade space. Ofer Cohen, Dan Marks, Daniel Lebor and Jackson O’Neill of TerraCRG represented the seller, an entity doing business as M-Kids LP, in the transaction. The buyer was J&R Acquisition LLC.

Charlotte’s Underlying Fundamentals Support Strong Industrial Development, Forward Sales

by John Nelson

In a constantly evolving and unprecedented era, Charlotte is an extremely well-positioned industrial market experiencing significant rent growth, an influx of new capital and development in new frontiers. As of first-quarter 2022, Charlotte was nearing an all-time low vacancy rate and rental rate growth reached more than 12 percent year-over-year. Needless to say, Charlotte has become a prime target for industrial investors, developers and tenants. Staggeringly low vacancy, strong tenant demand and rapid rent growth are trends the industrial real estate sector is experiencing around the county. While these trends are not necessarily unique to Charlotte, they are having a particularly large impact on how Charlotte is growing. These strong underlying leasing fundamentals accompanied by land scarcity left Charlotte under-supplied with developers on the hunt for land. A recent announcement by the Silverman Group is a great example. After closing on a 200-acre site just 30 minutes northeast of Charlotte in Rowan County, the Silverman Group announced a speculative industrial development capable of up to 1.9 million square feet and quickly signed a lease with Macy’s for an e-commerce distribution center spanning 1.4 million square feet. On the west side of Charlotte in Gaston County, NorthPoint Development has seen similar …

BAYTOWN, TEXAS — Chicago-based Dayton Street Partners will develop a 164,640-square-foot speculative industrial project near Port Houston. The facility will be situated on a 47.4-acre site within the 15,000-acre TGS Cedar Port Industrial Park in Baytown and function as a truck terminal as well as a storage and distribution center. Building features will include 24-foot clear heights, 214 dock doors and 6,000 square feet of office space. Completion is slated for the second quarter of 2023. Veritex Community Bank is providing construction financing NAI Partners will market the project for lease.