SHELTON, CONN. — New Jersey-based investment firm Devli Real Estate has acquired a 209,773-square-foot industrial property in Shelton, located in the southern coastal part of the state. The property sits on 14.7 acres at 510 River Road and is leased to Talalay Global, a manufacturer of mattresses and other bedding products. The seller and sales price were not disclosed.

Industrial

DALLAS — Baik Brands, a cosmetics firm that is the parent company of several e-commerce brands, has signed a 104,000-square-foot industrial lease in the Stemmons Crossroads area of Dallas. Jeremy Mercer of Mercer Co. and John Roper of CBRE represented Baik Brands in the lease negotiations. Robert Adams represented the landlord, Rosebriar Properties, on an internal basis.

NEW JERSEY — PGIM Real Estate, in conjunction with global asset management firm AXA IM Alts, has provided a $350 million acquisition loan for a portfolio of 29 industrial properties totaling roughly 4.9 million square feet in Southern New Jersey. The specific names and locations of the properties were not disclosed, but the assets are located in Burlington and Gloucester counties. The borrower was an undisclosed institutional investor.

PEABODY, MASS. — JLL has arranged a $20.3 million acquisition loan for a 157,293-square-foot industrial property located in the northeastern Boston suburb of Peabody. Built in 1986, the property was fully leased at the time of the loan closing to Wakefield Moving Storage and Paradigm Precision. Building features include a clear height of 24 feet, 17 tailboard docks, one drive-in door and ample parking. Brett Paulsrud and Amy Lousararian of JLL placed the seven-year, fixed-rate loan through Metro Credit Union. The borrower was a partnership between Oliver Street Capital and Bain Capital Real Estate.

WAYNE, N.J. — NAI James E. Hanson has brokered the sale of a 117,340-square-foot industrial building in the Northern New Jersey community of Wayne. Situated on 10.5 acres and fully leased at the time of sale, the property features a clear height of 26 feet. Scott Perkins, Chris Todd and William Ericksen of NAI Hanson represented the buyer, Chicago-based CenterPoint Properties, in the transaction. The seller was an entity doing business as 100 Demarest Drive LLC.

WESTFIELD CENTER, OHIO — Stonemont Financial Group has unveiled plans to build a 450,000-square-foot speculative industrial development in Westfield Center near Cleveland. Named Westfield Commerce Park, the Class A facility marks Stonemont’s first speculative development in Northeast Ohio. Plans call for a clear height of 36 feet, cross-dock configuration, 500 car parking spaces, 130 trailer stalls, 65 dock doors and four drive-in doors. Stonemont is the developer, while Pinnacle Bank and PCCP are debt and capital partners. JLL will oversee lease-up. Completion is slated for the first quarter of 2023.

ROLLING MEADOWS, ILL. — SVN Chicago’s industrial team has arranged the sale of a 66,674-square-foot industrial building in the Chicago suburb of Rolling Meadows for nearly $3 million. The buyer will utilize the property, located at 1125 Carnegie St., as a cannabis production facility. The property features clear heights ranging from 16 to 22 feet, five interior docks, one drive-in door and 3,400 square feet of office space. John Joyce of SVN represented the buyer, 11th Level Inc., a cannabis growth company that is licensed by the State of Illinois. Mike Senner and Tom Rodeno of Colliers represented the seller, Adams Plastics.

DENVER — Starpoint Properties is developing Point Central Business Park, a two-building, 155,000-square-foot industrial complex in central Denver. Situated on 9.6 acres at 1051 E. 73rd Ave., the property will feature 155,000 square feet of Class A, LEED-certified industrial and warehouse space. Groundbreaking for the property is slated for July, with completion scheduled for summer 2023. Drew McManus, Ryan Searle and Bryan Fry of Cushman & Wakefield are handling leasing for the project. Point Central Business Park will offer two buildings: an 81,800-square-foot asset and a 73,500-square-foot building. The buildings will offer office space to suit, clerestory windows, high parking ratio, monument and building signage, a combined 25 dock doors, four drive-in doors and other modern design and functionality elements.

BUFORD, GA. — Seefried Industrial Properties and Clarion Partners plan to develop Buford North Distribution Center, a 969,620-square-foot logistics park in the Atlanta suburb of Buford. The speculative project will include three buildings located along I-985 in Hall County. All three buildings will include 185-foot concrete truck courts, 36-foot clear heights and ESFR sprinklers. Seefried and Clarion recently purchased an 80-acre site about 40 miles northeast of Atlanta near I-85. The first facility is slated to break ground in August and full completion is anticipated for the fourth quarter of 2023. The project team includes civil engineer Eberly & Associates and architect Atlas Architecture. Joseph Kriss, Tripp Ausband and Doug Smith of Seefried will oversee leasing efforts.

Hunt Midwest Breaks Ground on 258,801 SF Industrial Facility in Upstate South Carolina

by John Nelson

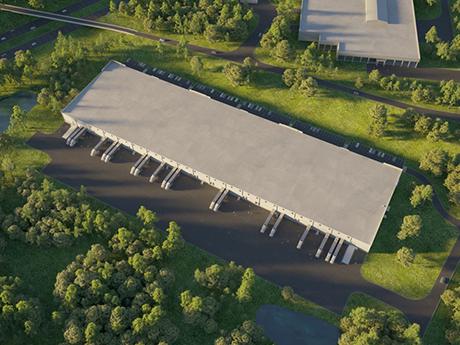

ANDERSON, S.C. — Kansas City-based Hunt Midwest has broken ground on a 258,801-square-foot industrial facility within the new Evergreen Logistics Park, an industrial campus spanning 200 acres in Upstate South Carolina. Located at 1105 Scotts Bridge Road in Anderson, the new facility will feature 36-foot clear heights, an ESFR sprinkler system, motion-sensor LED lighting, 26 dock doors, 60-foot speed bays, four drive-in doors, more than 200 parking stalls, up to 77 tractor-trailer parking spots and a 185-foot truck court. Hunt Midwest expects to deliver the building by the end of the year. At full capacity, Evergreen Logistics Park will span 2 million square feet and offer immediate access to I-85 and a major FedEx terminal. Hunt Midwest has selected Seamon Whiteside for civil engineering, LS3P for building design, CBRE for leasing and Evans General Contractors as the general contractor.