COLUMBUS, OHIO — Saltbox, a flexible warehousing and small-business logistics provider, has opened a new fulfillment hub in Columbus. The 80,000-square-foot building is the sixth Saltbox location nationwide and the first in Ohio. The property is situated near John Glenn Columbus International Airport, major railroads and I-270. Saltbox says the location enables its members to reach 67 percent of the U.S. population via two-day shipping. More than 70 percent of Saltbox’s 300 members are e-commerce companies that sell physical goods directly to consumers. Saltbox plans to open more locations across the U.S. this year. Saltbox members have access to the company’s warehouses and fulfillment services to assist in their e-commerce businesses.

Industrial

PREMIER Design + Build Group Breaks Ground on 51,950 SF Spec Industrial Facility in Suburban Chicago

VERNON HILLS, ILL. — PREMIER Design + Build Group has broken ground on a 51,950-square-foot speculative industrial facility in the northwest Chicago suburb of Vernon Hills. The building will feature a clear height of 32 feet, eight dock positions, two drive-in doors and 86 parking spaces. Completion is slated for November. JRW Property Holdings LLC is the developer, Cornerstone is the architect, Swift Structural is the structural engineer and Connelly Electric is the electrical engineer. Cushman & Wakefield will market the project for lease.

ELK GROVE VILLAGE, ILL. — Repro Graphics has renewed its lease at 1900 Arthur Ave. in the Chicago suburb of Elk Grove Village. The freestanding facility spans 51,380 square feet. Andrew Maletich, Matt Garland and Dustin Albers of Cawley Chicago represented the tenant in the five-year lease. The landlord was not disclosed.

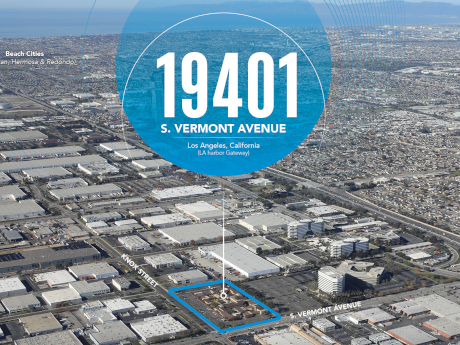

Harbor Gateway Sells Office-to-Industrial Conversion Property in Los Angeles for $39.8M

by Amy Works

LOS ANGELES — Harbor Gateway LLC has completed the disposition of a 5.4-acre industrial redevelopment property located at 19401 S. Vermont Ave. in Los Angeles’ South Bay market. Atlas Capital acquired the asset for $39.8 million. The property currently comprises 12 office buildings totaling 94,113 square feet. The location offers close proximity to two of the busiest seaports in North America and Los Angeles International Airport, as well as immediate access to the 105, 110, 710, 405 and 91 freeways. Kevin Shannon, Scott Schumacher, Ken White, Bret Hardy, Jim Linn, Andrew Briner, John McMillan and Danny Williams of Newmark represented the seller.

VERNON, CALIF. — Prime Data Centers has released plans for a three-story, 261,000-square-foot data center in Vernon. Additionally, the company will construct an electrical substation to serve the new site. The completed facility will deliver up to 33 megawatts of power to its tenants. The new carrier-neutral facility offers opportunities for tenants to obtain wholesale dark fiber in volume to all five of the central interconnection hubs in downtown Los Angeles: One Wilshire, 600 W. Seventh Street, 530 W. Sixth Street, 900 N. Alameda and 818 W. Seventh Street. The new facility will offer dedicated office, storage and staging options, as well as secure onsite parking. Completion is slated for as early as fourth-quarter 2023. Darren Eades of JLL handled the land parcel acquisition. Terms of the deal were not released.

LOS ANGELES — Rexford Industrial Realty has purchased four industrial assets for an aggregate acquisition price of $163.8 million in off-market transactions. The purchases were funded using a combination of cash on hand, the company’s line of credit and units in the company’s operating partnership (OP Units). In May and June, the company purchased: 2020 South Central Ave. in Compton, Calif., for $10.8 million, or $110 per land square foot. The 2.3-acre, industrial-zoned land site contains a fully occupied, 30,233-square-foot, single-tenant building. Upon lease expiration, Rexford plans to redevelop the site by constructing a 45,000-square-foot, Class A industrial building. 14200-14220 Arminta St. in Panorama City, Calif., for $90.2 million, or $451 per square foot. Situated on 8.5 acres, the 200,000-square-foot, Class A building is leased long-term to a credit tenant. The acquisition was completed using $24.5 million of cash and 954,000 OP Units at a value of $68.84 common stock. Michael Bogle of CBRE represented both Rexford and the seller, Powell Plaza Associates, in the transaction. 1172 Holt Blvd. in Ontario, Calif., for $17.8 million, or $404 per square foot. Built in 2021 on 2.1 acres, the 44,000-square-foot, Class A building is adjacent to the Rexford’s recently purchased 1154 Holt …

HOBOKEN, N.J. — Faropoint, an investment firm based in Northern New Jersey, has acquired six warehouses totaling approximately 550,000 square feet that are located throughout the Dallas-Fort Worth metroplex. The aggregate sales price was $59 million. The properties range in size from 40,116 to 245,300 square feet and were all fully leased at the time of sale. Cushman & Wakefield, Citadel Partners, Finial Group, Mercer Co. and Stream Realty Partners represented the various sellers of the properties, all of which were private investment groups that requested anonymity.

EL PASO, TEXAS — Logistics firm Avanza Loop Inc. has signed a 128,754-square-foot industrial lease at 12431 Mercantile Ave. in El Paso. The space is located within Building 1 of El Paso Logistics Park, a 59-acre development by Kansas City-based VanTrust Real Estate. PSRBB Industrial Group designed Phase I of the project, which was completed in September 2021, and Jordan Foster Construction served as the general contractor. Bill Caparis and Arturo De la Mora of CBRE represented the landlord in the lease negotiations. De la Mora also represented the tenant.

GEORGETOWN, TEXAS — NAI Partners has negotiated a 20,800-square-foot industrial lease at 4045 Airport Road in Georgetown, a northern suburb of Austin. According to LoopNet Inc., the property is currently under construction and will span 58,312 square feet upon completion. Troy Martin of NAI Partners represented the tenant, Liber & Co., which supplies non-alcoholic syrups for the beverage industry, in the lease negotiations. Local brokers Ken Mongold and Michael Johnson represented the landlord, Headwater Capital.

RANDOLPH, STOUGHTON AND FOXBOROUGH, MASS. — Newmark has brokered the sale of a portfolio of five industrial facilities totaling 295,602 square feet that are situated on the southern outskirts of Boston. Three of the facilities are located in Randolph, one is in Stoughton and one is located in Foxborough. At the time of sale, the portfolio was 75 percent leased to nine tenants. Robert Griffin, Edward Maher, Matthew Pullen, Tony Coskren, Brian Pinch, Samantha Hallowell and Allie Percoco of Newmark represented the seller, a partnership between Wheelock Street Capital and The Seyon Group, in the transaction. The team also procured the buyer, Ares Management.