PLAINFIELD, IND. — Kuehne+Nagel, a Switzerland-based global transport and logistics company, has signed two industrial lease renewals totaling 115,395 square feet in Plainfield, a suburb of Indianapolis. Chicago-based HSA Commercial Real Estate owns the properties, which are located within Gateway Business Park near the Indianapolis International Airport. Kuehne+Nagel renewed its 59,895-square-foot lease at Gateway Industrial III as well as its 55,500-square-foot lease at Gateway Industrial IV. HSA has developed and leased up six buildings at Gateway Business Park totaling roughly 900,000 square feet. A seventh building is slated for completion later this month. Mark Writt of CBRE represented Kuehne+Nagel in both leases. Terry Busch and Jared Scaringe of CBRE represented ownership.

Industrial

NEW YORK CITY AND AUSTIN, TEXAS — CBRE Investment Management and facility operator William Warren Group have acquired a 64-property self-storage portfolio for $588 million. Austin-based World Class Holdings was the seller. The self-storage portfolio includes over 4.1 million rentable square feet across 10 states including Texas, Ohio, Illinois, Colorado, Missouri, Mississippi, Tennessee, Indiana, New York and Nevada. The properties include a total of 28,601 units. The self-storage properties will now operate under the StorQuest brand. The facilities were previously operated by Great Value Storage. The assets are primarily single-story drive-up units. The portfolio was 82 percent leased at the time of sale. “We expect these assets to add significant value to our investment stack given the high demand for self-storage facilities across multiple markets and end-users amid the pandemic,” says Justin Shanahan, deputy portfolio manager for CBRE Investment Management. “This specific portfolio offered a unique opportunity to acquire a diverse collection of facilities in various states that have strong population demographics. We believe that the portfolio is well-positioned to continue its robust leasing momentum and yield long-term profitability.” With this transaction, CBRE Investment Management, a New York City-based global real estate assets investment management firm and affiliate of Dallas-based …

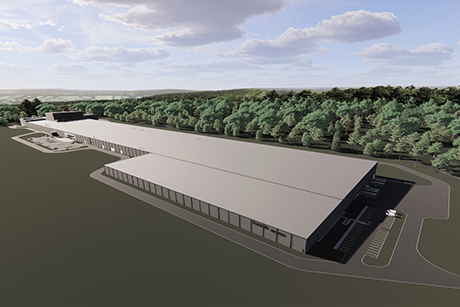

NAMPA, IDAHO — Trammell Crow Co. has broken ground on Kings Road Commerce Center, a speculative, Class A manufacturing and logistics space in Nampa. Slated for completion in fourth-quarter 2022, Kings Road Commerce Center will feature three buildings offering a total of 362,000 square feet of space. The rear-load buildings will range in size from 99,664 square feet to 150,735 square feet and will accommodate tenants of 25,000 square feet up to 150,000 square feet. The facility will feature 30- to 32-foot clear heights, 60-foot speed bays, 50-foot column spacing, 35 trailer stalls and 557 auto stalls. The project team includes Ware Malcomb as architect, Kimley Horn as civil engineer and ESI Construction as general contractor. Jake Miller and Harrison Sawyer of CBRE will handle leasing at the development.

SALT LAKE CITY — Phoenix-based ViaWest Group has acquired an 18-acre industrial development site at 3255 W. 500 South in Salt Lake City. Terms of the transaction were not released. The site contains an existing 37,000-square-foot industrial building, which was built in 2016. Phillip Eilers of Cushman & Wakefield represented the ViaWest Group and James Merrill of cRc Nationwide represented the undisclosed seller in the deal. ViaWest plans to split the existing lot, creating a separate 11-acre parcel on which it will construct a new 171,600-square-foot Class A speculative industrial building to accompany the existing building on the property.

SAN ANTONIO — Navistar (NYSE: NAV), an Illinois-based truck and bus manufacturer, has opened a nearly 1 million-square-foot facility in San Antonio. The site is located along Interstate 35 and links the company’s supply bases in Mexico and the United States. The plant includes a body shop, paint shop, general assembly shop and logistics center equipped to produce various vehicles, including electric models. Navistar is in the process of hiring as many as 600 people to operate the facility.

BAXTER, TENN. — Avison Young’s Capital Markets Group has arranged the sale-leaseback of a manufacturing facility in Baxter. The transaction totaled approximately $90 million. Timothy Hall, James Hanson and Tom Viscount of Avison Young arranged the sale-leaseback transaction. Chicago-based Oak Street Real Estate Capital will fund the construction and purchase the 965,000-square-foot facility, then lease it back to Portobello America, a tile manufacturer and distributor based in Brazil. Portobello America is building the plant and will use it to manufacture ceramic tiles and to house its U.S. headquarters. Portobello America will execute a long-term lease when construction is complete, which is expected in late 2022. The firm estimates the facility will create more than 200 local jobs and generate $150 million in annual revenue, as soon as the full capacity is reached, which is expected to occur by 2026. The 92-acre, build-to-suit project will include the main manufacturing, warehouse and office building, which will also contain the corporate headquarters and a showroom. The manufacturing plant will feature the latest green technologies to reduce the consumption of electricity, natural gas and water, according to the developer. The project site is situated on the south side of Interstate 40, about 70 miles …

LOS ANGELES — Rexford Industrial has acquired two Class A industrial buildings in central Los Angeles for a total consideration of $28 million. Located at 1501-1545 Rio Vista, the buildings feature a total of 53,651 square feet. At the time of sale, both buildings were 100 percent leased to stable credit tenants. Jerry Sackler of DAUM Commercial represented the seller, a private family real estate investment trust, and procured the buyer in the deal.

EAST WINDSOR, N.J. — Marcus & Millichap Capital Corp. (MMCC) has placed a $13.5 million construction loan for a 121,500-square-foot industrial project in East Windsor, a suburb of Trenton, that is fully preleased to an undisclosed logistics firm. The loan was structured with a 3.75 percent interest rate and a 70 percent loan-to-cost ratio. The borrower was not disclosed. Construction is slated for a third-quarter completion. Gerald Kray of MMCC arranged the financing through an undisclosed lender.

The industrial market will be forever changed by the COVID-19 pandemic. Before the pandemic, demand for industrial space was closely tied with gross domestic product (GDP), with demand rising and falling alongside the U.S. output of goods. The pandemic has accelerated an already shifting economy to an “on-demand” economy. This shift was created by technology companies fulfilling consumer demand via the immediate provisioning of goods and services, and has now led to industrial warehouse demand being more in line with consumer spending versus GDP. Consumer spending and personal income are at all-time highs, with e-commerce sales growing exponentially throughout 2020 and 2021. Companies have been leasing warehouse space at a meteoric rate, driven by the need to store goods to accommodate the demand and mitigate risk from supply chain complications that have been brought on by the pandemic. Over the past two years, millions of square feet of warehouse space in the Chicagoland area have been leased for e-commerce use to tenants such as Walmart, Wayfair, Hello Fresh, Imperfect Foods and, of course, Amazon. Additionally, as traditional brick-and-mortar retailers transition to greater online sales, they require more warehouse space for goods storage, which has led tenants such as Target, Walmart, …

KENT, WASH. — The Seattle office of Duke Realty has started the development of a speculative industrial property at 7409 S. 202nd St. in Kent. Duke Realty purchased the 12.2-acre site in February 2021. The 261,362-square-foot property will feature 40-foot clear heights, 26 dock doors, 34 trailer stalls and parking for more than 260 cars. The facility will have access to Highway 167, as well as interstates 405 and 5. Completion is slated for early 2023. Matt Wood of KBC Advisors and Jim Kidder and Nick Ramirez of Kidder Mathews will be listing agents for the development.