STREETSBORO, OHIO — NAI Pleasant Valley has arranged the $8.4 million sale of a 130,257-square-foot industrial building in Streetsboro, a southern suburb of Cleveland. The property sits on 8.5 acres at 675 Mondial Parkway. David Hexter and Jeffrey Calig of NAI Pleasant Valley represented the undisclosed seller. Exeter 675 Mondial LLC was the buyer. The transaction marks the first acquisition in the Northeast Ohio market for the buyer.

Industrial

Wharton Industrial, Madison Ventures Receive $224.1M Construction Loan for Industrial Park in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Wharton Industrial and Madison Ventures Plus have received $224.1 million in acquisition and construction financing for The HUB @ 202, a master-planned, 1.5-million-square-foot industrial park in Mesa. John Alascio, Dave Karson, Chris Moyer, Will Strong, Kirk Kuller, TJ Sullivan, Chuck Kohaut and Zachary Smolev of Cushman & Wakefield Capital Markets arranged the financing. Situated on 101 acres, The HUB @ 202 will feature 11 Class A buildings with 28-foot to 36-foot clear heights, ample truck and car parking, grade- and dock-high loading doors and functional divisibility with a variety of bay sizes. Construction is slated to begin in second-quarter 2022.

GREENVILLE, S.C. — Charlotte-based Keith Corp. has broken ground on Upstate Trade Center, a 907,444-square-foot speculative industrial development in Greenville. Slated to be completed in January 2023, the project will be made up of two Class A industrial facilities. Building One will span 640,667 square feet with a cross-dock layout and 36-foot clear heights. Building Two will include 266,777 square feet with a rear-loading layout and 32-foot clear heights. Additionally, the two buildings will be constructed with concrete tilt walls and structural steel framing, as well as ESFR sprinklers, energy-efficient LED lighting and TPO membrane roofs. The project’s location is adjacent to U.S. Highway 25 and Donaldson Center Airport, as well as Interstate 85. Frampton Construction is Upstate Trade Center’s general contractor, Merriman-Schmitt Architects is providing design services and Thomas + Hutton will serve as the project’s civil engineer.

SUMMERVILLE, S.C. — Trinity Capital Advisors, in partnership with Iconic Equities, plans to develop Jedburg Tradeport, two Class A industrial buildings totaling nearly 780,000 square feet in Summerville. Construction on the two facilities will begin this summer and are slated for completion in spring 2023. Lee Allen and Kevin Coats of JLL are leading the leasing efforts for the industrial facilities. Located on 115 acres at 239 Jedburg Road, the Jedburg Tradeport project is located off Interstate 26 and will include a 621,000-square-foot cross-dock building and 158,000-square-foot rear-load building.

KANSAS CITY, MO. — Newmark Zimmer has negotiated the sale of 4001 N. Norfleet Road in Kansas City for an undisclosed price. The 700,000-square-foot distribution center was built in 2007 as a build-to-suit for Musician’s Friend, which continues to occupy the property today. The facility sits on 68 acres near I-435. Mark Long, John Hassler, Jim Linn and Bret Hardy of Newmark Zimmer brokered the transaction. Buyer and seller information was not provided.

BAYTOWN, TEXAS — Reich Brothers, an investment firm based in White Plains, New York, has purchased the former DHL Intermodal Campus, a 1.2 million-square-foot industrial property located in the eastern Houston suburb of Baytown. The rail- and barge-served campus consists of four buildings spanning between 200,000 and 400,000 square feet on a 67-acre site. Building features include 28- to 40-foot clear heights, more than 100 dock-high doors, ample car and trailer parking and renovated office space. The seller and sales price were not disclosed. The new ownership plans to invest in site improvements at the property to further enhance its functionality for distribution, rail and port-related logistics and manufacturing uses.

DALLAS — CapRock Partners, an investment, development and asset management firm based in Southern California, has expanded into Texas with the opening of a new office in Dallas. The firm will primarily pursue value-add investment opportunities, as well as large-scale logistics developments. Jon Pharris, CapRock’s co-founder and president, will lead the new Texas office. The company, which recently closed a venture to fund some $2 billion in industrial development in California, Nevada and Arizona, sees the expansion into Dallas as a natural move. Specifically, the company cited the metroplex’s temperate weather, affordable lifestyle, highly skilled workforce, established infrastructure, low regulations and business-friendly climate as the key incentives behind its decision.

PEARLAND, TEXAS — Partners Capital, the investment management platform and development arm of Partners Real Estate Co., has purchased Silverlake Business Park, a five-building, 90,000-square-foot office and industrial complex located in the southern Houston suburb of Pearland. Wes Cole of Cantera Real Estate Group represented Partners Capital in the off-market transaction in conjunction with internal agents Andrew Pappas and Adam Hawkins. The seller and developer, WC Properties Ltd., was self-represented. Veritex Bank provided acquisition financing for the transaction.

EAST RUTHERFORD, N.J. — Locally based investment firm Devli Real Estate has purchased a 175,000-square-foot industrial facility in East Rutherford, located in Northern New Jersey. The facility sits on a six-acre site within The Meadowlands submarket. Devli Real Estate will lease back the space to the undisclosed seller/tenant on a short-term basis. Yanni Marmarou of B6 Real Estate brokered the transaction. Michael Klein and Max Custer of JLL arranged acquisition financing through First Bank on behalf of Devli Real Estate.

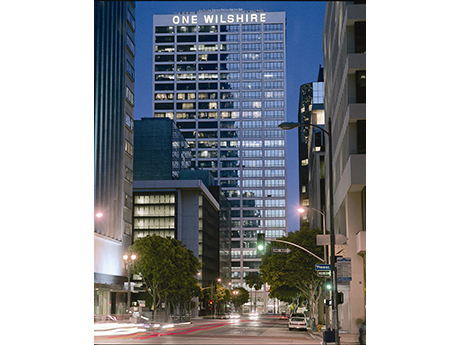

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …