AUBURN, WASH. — Fortress Investment has acquired a seven-acre industrial property in Auburn from MK Holdings for $22 million in an off-market transaction. Matt Murray and Matt McLennan of Kidder Mathews brokered the deal. Located at 904 W. Main St., the land includes a 24,000-square-foot building. Utility Trailer Sales of Washington Co. occupies the property.

Industrial

CBRE Investment Management Agrees to Acquire Logistics Portfolio in US, Europe from Hillwood for $4.9B

by John Nelson

NEW YORK CITY AND DALLAS — CBRE Investment Management has agreed to acquire a portfolio of logistics real estate assets in the United States and Europe from Hillwood Investment Properties, an industrial developer and owner based in Dallas. Under terms of the $4.9 billion acquisition agreement, affiliates of New York City-based CBRE Investment Management will purchase the 57-property, 28.4 million-square-foot portfolio from Hillwood. The transaction is subject to customary closing conditions, and CBRE Investment Management expects to close on the assets in stages. The portfolio includes 33 properties in the United States totaling 19.2 million square feet and 24 assets in Germany, Poland and the United Kingdom totaling 9.2 million square feet. “This milestone transaction reflects our ability to leverage the strong financial capacity of our parent company to secure compelling opportunities that help to drive strategic real assets solutions for our clients,” says Chuck Leitner, CEO of CBRE Investment Management. “Backed by a $35 billion AUM global logistics platform and a skilled team with deep domain expertise, we are positioned to be one of the world’s leading investors and operators of logistics assets.” The portfolio is one of several multi-market portfolio transactions in the industrial sector in the past …

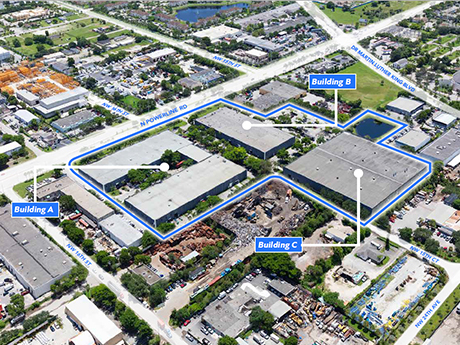

POMPANO BEACH, FLA. — Bridge Industrial has purchased Pompano Beach Commerce Park, a 336,852-square-foot industrial campus in Pompano Beach. Jose Lobon of CBRE National Partners represented the undisclosed seller in the transaction. The price was not disclosed. Located on Powerline Road, Pompano Beach Commerce Park comprises three buildings spanning 140,094 square feet, 124,894 square feet and 71,864 square feet, respectively. The facilities include features such as 24-foot clear heights and multiple points of ingress and egress along its 800 feet of linear frontage on Powerline Road. Following the acquisition, Bridge Industrial plans to launch a comprehensive capital improvement program at the property, including upgrades to the landscaping, parking lot, signage and roof. The campus is located less than two miles from Interstate 95 and just 1.4 miles from the Florida Turnpike. The property also sits 15 miles from Port Everglades and the Fort Lauderdale-Hollywood International Airport, and approximately 40 miles from the Port of Miami and Miami International Airport.

MIAMI — Cushman & Wakefield has arranged the sale of a 51,392-square-foot industrial facility located at 7480 NW 48th St. in Miami. Wayne Ramoski and Miguel Aclivar of Cushman & Wakefield represented the seller, DFJ Properties West LLC, in the transaction. RLIF East 5 LLC was the buyer. The price was $14.8 million. Sitting on more than four acres, 7480 NW 48th St. is a warehouse and showroom property that is fully leased to Ferguson Enterprises, a Newport News, Va.-based distributor of plumbing supplies, waterworks and fire and fabrication products. The facility is situated on two lots offering a variety of industrial and commercial uses in South Florida’s airport submarket. The property includes features such as 23.8-foot clear heights, more than 50 striped parking spaces and proximity to Miami International Airport. The property is currently zoned for industrial and heavy manufacturing use.

BELOIT, WIS. — Zilber Property Group has acquired a 125,000-square-foot industrial facility located at 2350 Springbrook Court in the southern Wisconsin town of Beloit. The purchase price and seller were undisclosed. WestRock, a global packaging solutions company, fully occupies the property, which features a clear height of 20 feet, 11 dock positions, 15 trailer stalls, one drive-in door and additional land for expansion. Rachel Agba represented Zilber on an internal basis.

FORT WORTH, TEXAS — Transwestern Development Co. (TDC) has started construction of Cowtown Crossing, a roughly 1 million-square-foot industrial project that will be located at the confluence of U.S. Highway 287 and Interstate 35 in Fort Worth. TDC is developing the three-building project on a speculative basis. Building 1 will total 553,384 square feet and feature 40-foot clear heights. Buildings 2 and 3 will respectively span 163,080 and 304,665 square feet and will feature 32- and 36-foot clear heights. All three buildings will have ESFR sprinkler systems. Completion is slated for late 2022.

HARRISBURG, PA. — JLL has negotiated the $24.4 million sale of a 254,449-square-foot distribution center in the West Shore area of Harrisburg. The multi-tenant facility was fully leased at the time of sale. Building features include clear heights of 24 feet, 27 dock-high doors, early suppression fast response (ESFR) sprinkler systems and ample car parking. John Plower, Ryan Cottone and Zach Maguire of JLL represented the seller, a fund managed by Penwood Real Estate Investment Management, in the deal. The buyer was New York-based investment firm Brickman.

The current state of the New Orleans industrial real estate market can best be described as “dichotomic.” On the one hand, New Orleans has the stability of a mature market featuring one of the largest and oldest ports in North America, traditionally serving heavy industry that continues to perform. On the other, you have two new proposed container port projects that could significantly alter the landscape of the industrial real estate market for the foreseeable future. Like so many other markets across the country, the New Orleans area is gaining its fair share of distribution facilities, with Amazon and the like scrambling for sites to service increased consumer and business-to-business demand. That said, the real game-changer for the distribution sector will ensue when at least one of the two announced container port projects in the New Orleans area comes on line. The Port of Plaquemines and the Port of New Orleans have both identified sites with access to rail, major roadways and water-based transport options that would fundamentally alter the opportunity for distribution emanating out of the New Orleans area. Either project would instantly create a great demand for warehousing and distribution space and further diversify the industrial asset class …

With the explosion of e-commerce over the past year and a half, it’s no surprise the industrial sector across the United States is posting significant gains. In fact, 2021’s national demand for industrial space is up by 22 percent year-over-year, and the market is showing no signs of retreating. This trend comes as a result of increased consumer demand for immediate, contactless deliveries, which has boosted demand for distribution centers that house e-commerce and logistics companies. The Louisville market, which features major attractors such as the UPS Worldport, two Ford plants, the GE Appliance Park and robust interstate connectivity, has experienced record success in 2021, with several key trends driving this sector’s growth. 1. Explosive leasing Louisville’s net absorption metrics are approaching historic highs. When COVID-19 hit, nearly all businesses took a 30-day pause to evaluate the implications the pandemic posed. The ensuing change in consumer purchasing patterns and product delivery pushed the national industrial market on a positive trajectory for both absorption and construction starts. Louisville is no exception. To date, 62 percent of industrial buildings in Louisville were leased prior to construction completion, compared to 25 percent in 2020. In addition, 85 percent of facilities delivered this year …

NEWPORT BEACH, CALIF. — CapRock Partners, a Newport Beach-based industrial real estate manager, has raised $700 million for CapRock Logistics Venture, its new development fund. The raised amount exceeds the fund’s initial $450 million target. CapRock Logitsics Venture is seeded with large-scale industrial real estate projects and will fund nearly $2 billion worth of projects in the Western United States totaling 15 million square feet. The seed portfolio includes CapRock’s Palomino Business Park, Saddle Ranch Business Park, Phase 2 and the I-15 Logistics asset. The new fund is an expansion of CapRock’s fund strategy that previously focused on value-add investments. Hodes Weill Securities served as global placement agent and financial advisor to CapRock.