JACKSONVILLE, FLA. — Savlan Capital has purchased a seven-building office and flex portfolio in Jacksonville for $52 million. An undisclosed financial institution sold the properties, which span 765,190 square feet and are situated within the Lakeside and Flagler Center business parks. Robbie McEwan and Hunter Smith of JLL represented the buyer and seller in the transaction. The portfolio was 57.2 percent leased at the time of sale to tenants including HTS Logistics (corporate headquarters), Kimley-Horn, EY, Pulte Home Co., Siemens Mobility, United Healthcare Service and Total Quality Logistics.

Industrial

Lincoln Property Co., Brasa Capital Acquire Spectrum Tech Center in San Diego for $26.2M

by Amy Works

SAN DIEGO — Lincoln Property Co. and Brasa Capital Management have purchased Spectrum Tech Center, an industrial and flex property in the Kearny Mesa submarket of San Diego, for $26.2 million. The new owners will rebrand the asset as Spectrum Logistics Center and plan renovations designed to align the site with current market demand for industrial space. The existing industrial building will be renovated and the existing vacant office building will be demolished and replaced with a 3.7-acre industrial outdoor storage (IOS) yard. The owners will begin demolition and construction activity on the site immediately, with delivery planned for late summer 2026. Located at 4820 Overland Ave. and 9112 Spectrum Center Blvd., Spectrum Tech Center currently comprises two buildings totaling 161,981 square feet on two parcels totaling 8.8 acres. The asset includes a two-story, 59,460-square-foot corporate headquarters building and a 102,521-square-foot technical R&D, manufacturing and distribution space.

Marcus & Millichap Negotiates Sale of 10,060 SF Net-Leased Warehouse in Prescott, Arizona

by Amy Works

PRESCOTT, ARIZ. — Marcus & Millichap has negotiated the sale of a warehouse and industrial outdoor storage property located at 6400 Lear Lane in Prescott. An individual/personal trust acquired the asset from Arizona Industrial Development for $4.4 million. Constructed in 2025, the asset comprises a 10,060-square-foot warehouse on a 2.9-acre site. The property is leased to a national credit tenant on a new 10-year, absolute net lease with a corporate guarantee. Paul Berkner of Marcus & Millichap represented the buyer, while Sev Keshishian of Marcus & Millichap procured the buyer in the deal.

DAYTON, MINN. — Daedex, a national custom data center cooling equipment manufacturer and subsidiary of MAS HVAC, has signed a long-term lease for the remaining 503,440 square feet at The Cubes at French Lake, a 1 million-square-foot development in Dayton. Located at 11500 Lawndale Ave., The Cubes at French Lake is the largest speculative industrial project ever developed in Minnesota, according to owner CRG. The project is now fully leased. Daedex joins States Manufacturing Corp., which previously leased the other half of the building. Completed in 2024, the property features a clear height of 40 feet, 169 dock doors, four drive-in doors, 60-foot speed bays and ample parking. The two leases at The Cubes at French Lake are the largest signed in metro Twin Cities in the past three years, according to CBRE. Dan Swartz, James DePietro and Austin Lovin of CBRE represented CRG in the lease, while Brent Masica and Danny McNamara of Cushman & Wakefield represented the tenant. CRG integrated partner Lamar Johnson Collaborative designed The Cubes at French Lake, while parent company Clayco served as general contractor.

MARYLAND HEIGHTS, MO. — Contegra Construction has completed the first of three planned distribution centers at the $117 million River Valley Logistics Center in Maryland Heights, a northwest suburb of St. Louis. NorthPoint Development is the developer. The first building totals 357,056 square feet. Two more distribution centers totaling nearly 800,000 square feet are also planned for the 94-acre development. The first building can accommodate a single user or multiple tenants and features a clear height of 36 feet, high bay windows, 40 dock doors, LED lighting and parking for 259 cars and 98 trailers. Sansone Group is handling leasing.

LOUISVILLE, KY. AND MARSHALL, MICH. — Automotive giant Ford Motor Co. (NYSE: F) will invest $2 billion at its Louisville Assembly Plant and $3 billion at its BlueOval Battery Park Michigan factory. Combined, the investment will create and secure approximately 4,000 jobs across both plants, as well as spur dozens of new U.S.-based suppliers, according to Ford. Ford’s investments will help the automaker deliver a suite of electric vehicles (EVs), beginning with a midsize, four-door electric pickup truck that will be assembled at its Louisville plant. Ford plans to launch domestic and international sales of the new trucks, which are expected to be priced starting at $30,000, in 2027. Jim Farley, president and CEO of Ford, says that the automaker will be the first in the country to make prismatic lithium iron phosphate (LFP) batteries, which are cobalt- and nickel-free and serve as the floor of the new EVs. Ford plans to begin manufacturing the new prismatic LFP batteries for the new electric truck at BlueOVal Battery Park Michigan next year. Located in Marshall, Mich., the factory is under construction, with the shell built out and mechanical, electrical and piping infrastructure underway. Ford says that the lithium LFP battery cell …

BOSQUE COUNTY, TEXAS — A joint venture between Energy Capital Partners (ECP), an investment firm with a focus on investing in electricity and sustainability infrastructure, and global private equity firm KKR will develop a 190-megawatt data center in Bosque County, located outside of Waco in Central Texas. The facility will be located adjacent to the Thad Hill Energy Center and will span more than 700,000 square feet. A construction timeline was not disclosed. Global data center owner-operator CyrusOne is also a partner on the project, which is being developed as part of ECP and KKR’s $50 billion strategic partnership to support AI infrastructure growth in the United States.

PASADENA, TEXAS — CBRE has arranged a $17.3 million construction loan for Constellation Red Bluff, a 240,041-square-foot industrial project in the eastern Houston suburb of Pasadena. The site is located at 2543 Genoa Red Bluff Road, and the development will offer 36-foot clear heights and parking for 158 cars and 20 trailers. Brian Linnihan, Mike Ryan, Richard Henry and Taylor Crowder of CBRE arranged the loan through Texas State Bank. The borrower is Constellation Real Estate Partners. Construction is expected to be complete in 2026.

Voit Negotiates Sale of 210,098 SF Valley View Commerce Center in Santa Fe Springs, California

by Amy Works

SANTA FE SPRINGS, CALIF. — Voit Real Estate Services has negotiated the sale of Valley View Commerce Center at 14515-14585 Valley View Ave. in Santa Fe Springs. A family wealth office sold the asset to Circle Industrial Growth Fund II for an undisclosed price. Built in 1989 on 14.2 acres, the six-building asset offers 210,098 square feet of multi-tenant industrial space. The property features grade-level loading doors and 109 units ranging from 919 square feet to 3,409 square feet. At the time of escrow, the property was 76 percent occupied. Michael Hefner, Robert Socci, Mitch Zehner and Seth Davenport of Voit represented the seller and buyer in the transaction.

Blue Ridge Beverage Co. Relocates to 80,000 SF Build-to-Suit Industrial Facility in Rustburg, Virginia

by Abby Cox

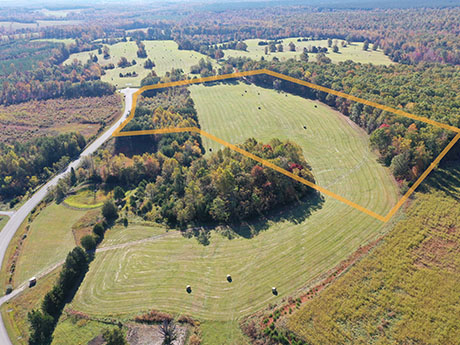

RUSTBURG, VA. — Locally based Blue Ridge Beverage Co., a full-service wholesale beverage distributor, will move its Lynchburg division of operations to Campbell County in Rustburg with the construction of an 80,000-square-foot industrial facility. The building will house the division’s operations, sales, delivery, product inventory and administrative offices on more than 14 acres at Seneca Commerce Park, a 145,000-square-foot industrial property currently under development. The company will transfer its existing workforce from Lynchburg to the new Rustburg location.