MARYLAND HEIGHTS, MO. — McCarthy Building Cos. Inc. has broken ground on a 17-acre equipment and warehouse distribution facility in the St. Louis suburb of Maryland Heights. The McCarthy Equipment Operations Hub will span nearly 740,520 square feet and is designed to support the general contractor’s self-perform capabilities. Located in the new 141 Logistics Center, the project will include a 9.5-acre equipment yard and a 66,400-square-foot building that will include a 32,000-square-foot warehouse, 10,000-square-foot equipment maintenance shop and two-story, 24,400-square-foot office space. Completion is scheduled for 2026. The facility is also designed to support workforce development and training. St. Louis-based McCarthy says it has outgrown its current leased property in Ladue, Mo., which has been in use since the mid-1960s.

Industrial

EAU CLAIRE, WIS. — Cushman & Wakefield has brokered the sale of a 702,371-square-foot manufacturing facility in Eau Claire, a city in western Wisconsin. Jordan Dick, Todd Hanson and Jason Sell of Cushman & Wakefield represented the seller, Hutchinson Technology, which previously operated the property for its production of disk drive products. TTM Technologies was the buyer. The facility at 2435 Alpine Road features infrastructure that positions it to support advanced technology printed circuit board manufacturing.

JLL Brokers Sale of 250,541 SF Industrial Facility in Durham Leased to LifeScience Logistics

by Abby Cox

DURHAM, N.C. — JLL Capital Markets has brokered the sale of LifeScience Logistics at Durham 85, a 250,541-square-foot industrial facility situated at 2360 Ferrell Road within Durham 85 Industrial Park. The facility, which is located 10 miles from Research Triangle Park, is fully leased by LifeScience Logistics LLC, a supply chain service provider in the healthcare and pharmaceutical industries. The facility features 32-foot clear heights, ESFR fire suppression and energy-efficient LED lighting throughout the property. Dave Andrews, Pete Pittroff, Michael Scarnato and Mike Lewis of JLL represented the seller, a joint venture between Scannell Properties and Manulife Investment Management, in the transaction. Mississippi-based EastGroup Properties purchased the facility for an undisclosed price.

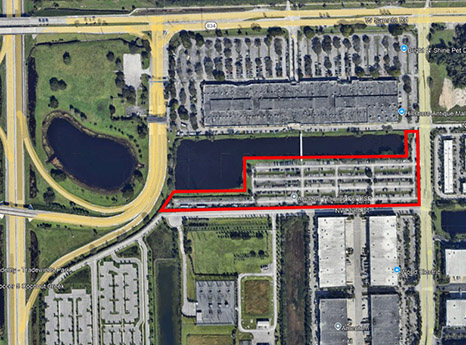

Foundry, Crow Holdings Acquire 10-Acre Site in Pompano Beach, Plan 182,000 SF Industrial Campus

by Abby Cox

POMPANO BEACH, FLA. — A partnership between Foundry Commercial’s Development & Investments platform and Crow Holdings Capital has acquired Festival South, a 10-acre former parking lot site located in Pompano Beach. The site will be redeveloped into a two-building industrial campus that totals 182,000 square feet. The new campus, which will be situated at the corner of NW 33rd Street and NW 27th Avenue near Fort Lauderdale-Hollywood International Airport, marks Foundry’s 21st development in the South Florida market. Further details about Festival South were not released.

BETHLEHEM, PA. — Filter King LLC, a provider of customized HVAC parts, has opened a 61,600-square-foot manufacturing and distribution facility in the Lehigh Valley city of Bethlehem. Regional developer J.G. Petrucci Co. owns the building, and The Lehigh Valley Economic Development Corp. assisted Filter King in its site selection process. Filter King, which now has an operational footprint of 200,000 square feet across three states, says the opening of the Bethlehem facility could result in the creation of as many as 120 new jobs.

HOUSTON — Philadelphia-based investment firm Alterra IOS has acquired an industrial outdoor storage facility in northeast Houston. The 2.9-acre facility at 7470 Miller Road 2 features 20,980 square feet of warehouse space and was originally built in 2002, according to LoopNet Inc. Jack Zalta of KSR NY brokered the deal. The seller and sales price were not disclosed.

NEWARK, DEL. — Chicago-based Logistics Property Co. will develop Crossroads 95 Logistics Center, a 442,350-square-foot industrial project in Newark. The 43-acre site offers proximity to the Delaware Memorial Bridge and the Port of Wilmington, as well as 1,000 feet of frontage along I-95, and the building will feature a clear height of 36 feet and ample car and trailer parking. Construction is scheduled to begin in the coming weeks and to be complete in the third quarter of 2026. John Plower, Ryan Cottone, Zach Maguire and Jordan Schwartz of JLL brokered the sale of the land.

CONCORD AND HAYWARD, CALIF. — BKM Capital Partners and Kayne Anderson Real Estate, the real estate investment arm of Kayne Anderson, have acquired a three-property industrial portfolio in the San Francisco Bay Area. Details of the transaction were not released. CBRE National Partners handled the transaction. Totaling approximately 505,000 square feet across 16 buildings and 94 units, the portfolio consists of institutional quality, light industrial space situated on 34 acres of infill land with access to regional transportation. At the time of sale, the portfolio was 89 percent leased to more than 70 tenants, with unit sizes averaging just over 5,300 square feet. The portfolio includes the 10-building, 245,930-square-foot Concord Industrial Park in Concord as well as the three-building, 176,056-square-foot Huntwood Business Center and the three-building, 82,562-square-foot Hesperian Business Park in Hayward. The Concord asset will be renamed Mount Diablo Industrial Park as part of BKM’s broader repositioning plan.

AVENEL, N.J. — Chicago-based investment firm CenterPoint Properties has acquired two industrial buildings totaling 387,526 square feet in the Northern New Jersey community of Avenel. The building at 191 Blair Road is a 198,854-square-foot, cross-dock facility with a clear height of 36 feet. The building at 215 Blair Road is a 188,672-square-foot, single-load warehouse with clear heights of 22 to 30 feet and several acres of overflow parking space. Gary Gabriel, Kyle Schmidt and Ryan Larkin of Cushman & Wakefield brokered the sales of the buildings, both of which were fully leased at closing.

Dermody Acquires Fully Entitled Site for LogistiCenter at Frederickson in Tacoma, Washington

by Amy Works

TACOMA, WASH. — Dermody has purchased 40.8 acres of land at 17027-17028 Canyon Parkway East In Tacoma for an undisclosed price. The fully entitled site will become LogistiCenter at Frederickson, a two-building industrial park. Slated for delivery in second-quarter 2026, Building A will offer 443,420 square feet and Building B will feature 91,728 square feet. Additionally, the property will feature a trailer lot. Andrew Hitchcock, Andrew Stark and Zac Snedeker of CBRE are handling leasing for the project. Brett Hartzell of CBRE’s National Partners assisted with the acquisition.