HOUSTON — General contractor Tellepsen Builders has completed a 10,000-square-foot life sciences facility in northeast Houston. Designed by Pfluger Architects, the facility is known as the San Jacinto College Center for Biotechnology by virtue of its location on that institution’s campus within the Generation Park master-planned development. The center was designed as a laboratory suite with an entry lobby fitted with lockers, a break room and workroom for San Jacinto College students and staff.

Life Sciences

ELKTON, VA. — Merck has broken ground on the Center of Excellence for Pharmaceutical Manufacturing, a $3 billion pharmaceutical manufacturing facility in Elkton. The 400,000-square-foot property will support more than 500 full-time jobs and 8,000 construction jobs, according to Merck. The facility will feature manufacturing and testing space for Merck’s active pharmaceutical ingredient and drug product divisions. In addition to the Elkton plant, Merck has announced nearly $6 billion in manufacturing investments in North Carolina, Delaware and Kansas, as well as $3.5 billion for its Rahway, N.J., headquarters.

Asensus Surgical Signs 63,000 SF Life Sciences Lease at The Stitch in Research Triangle Area

by John Nelson

MORRISVILLE, N.C. — Asensus Surgical, a leader in digital surgery and minimally invasive surgical systems, has signed a 63,000-square-foot lease at The Stitch, a life sciences and research-and-development (R&D) property in Morrisville. Located in North Carolina’s Research Triangle region, the 248,456-square-foot facility is an adaptive reuse of a former outlet mall. The Stitch is located at 1001 Airport Blvd., approximately one mile from Raleigh-Durham International Airport. Eric Forshee, John MacDonell and Ashley Ingram of JLL represented the landlord, Related Fund Management, in the lease transaction. Ryan Lawrence and Joe Judge, also with JLL, represented Asensus Surgical. The deal represents the largest R&D life science lease in the Triangle since 2022, according to JLL.

HOUSTON — A partnership between Rice Real Estate Co., the property investment arm of Rice University, and Dallas-based Lincoln Property Co. (LPC) will develop The Arc at The Ion District, a 200,000-square-foot office and life sciences property in Houston. The Ion District is a 16-acre academic, research and development and innovation hub in Midtown Houston. Amenities at the new building will include a gym, lounge, conference and meeting spaces and outdoor event plazas. Rice University has committed to occupying 30,000 square feet of office and lab space at The Arc, construction of which is expected to begin in the second quarter of next year and to be complete in early 2028.

Shriners Children’s Signs Multi-Floor Lease at Science Square Labs in Midtown Atlanta

by John Nelson

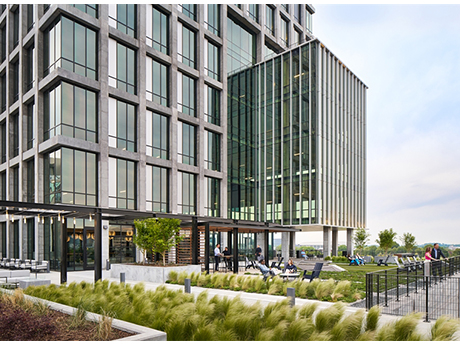

ATLANTA — Shriners Children’s, a global pediatric healthcare system, has signed a multi-floor lease for research-and-development space at Science Square Labs, a 368,213-square-foot laboratory and office tower in Midtown Atlanta. The project, owned and developed by Trammell Crow Co., is part of Georgia Tech’s 18-acre Science Square innovation district. Shriners Children’s Research Institute will feature next-generation laboratories, modern collaborative workspaces and advanced technology infrastructure. The move is expected to bring more than 470 jobs to Atlanta. With Shriners Children’s new lease, Science Square Labs is now 83 percent leased to tenants including Duracell, Georgia Tech & Emory BioMedical Engineering faculty labs, the Georgia Department of Agriculture, Portal Innovations and Osmose. Eric Ross, Jessica Doyle and Graham Little of CBRE represented Trammell Crow Co. in the lease negotiations.

HOUSTON — Eli Lilly and Co. (NYSE: LLY) has unveiled plans to build a new $6.5 billion manufacturing facility at Generation Park, a 4,000-acre master-planned development in northeast Houston that is owned by McCord Development. The active pharmaceutical product (API) facility, which represents the second of four new U.S. sites that Lilly plans to announce this year, will be used to manufacture the company’s pipeline of small molecule medicines across therapeutic areas, including cardiometabolic health, oncology, immunology and neuroscience. The project is expected to be operational within five years. Lilly plans to bring 615 new, high-wage jobs to the greater Houston area, including engineers, scientists, operations personnel and lab technicians. The company also expects to generate 4,000 construction jobs as the project is built. The facility will be among those that will manufacture orforglipron, Lilly’s first oral, small molecule GLP-1 receptor agonist, which the company expects to submit to global regulatory agencies for obesity by the end of this year. “Our new Houston site will enhance Lilly’s ability to manufacture orforglipron at scale and, if approved, help fulfill the medicine’s potential as a metabolic health treatment for tens of millions of people worldwide who prefer the ease of a pill …

AUSTIN, TEXAS — Cottonwood Group, a real estate private equity firm with offices in Boston, Los Angeles and New York, has provided a $105 million construction loan for a 223,500-square-foot life sciences project in Austin. The facility, which will be a build-to-suit project for biotechnology company BillionToOne, will be located within the 425-acre EastVillage mixed-use development on the city’s northeast side. The master developer of EastVillage, Buffalo-based Reger Holdings, has partnered with San Francisco-based Tarlton Properties to develop the facility, which is expected to support the creation of about 1,000 new jobs. Newmark and CBRE co-arranged the loan. Completion is slated for early 2027.

CHICAGO — Beacon Capital Partners and Trammell Crow Co. (TCC) have inked a new lease expansion with the University of Chicago at Hyde Park Labs in Chicago. The private research university will occupy more than 155,000 square feet and is expected to move into its new space by the second quarter of 2026. The announcement was made at the grand opening of Hyde Park Labs and UChicago’s Science Incubator on Tuesday, Sept. 16. The university’s new space, including 101,199 square feet across the building’s top three floors, will support research initiatives in areas such as cancer, metastasis, biochemistry and molecular biology. UChicago’s original lease included space for faculty research and the new incubator, which is a partnership between the Polsky Center for Entrepreneurship and Innovation and Portal Innovations. Six UChicago-affiliated companies are among the incubator’s first tenants: memQ, Exactics, Signl, Cell Therapy, ZipBionexus Tech and Neuro Innovations. In partnership with the university, the ground floor of the building will also initially host IBM’s next-generation modular quantum computer, called IBM Quantum System Two. Located at 5207 S. Harper Ave., Hyde Park Labs is the South Side of Chicago’s first commercial, purpose-built advanced R&D lab building, according to TCC. Delivered earlier this …

GOOCHLAND COUNTY, VA. — Pharmaceutical giant Eli Lilly and Co. (NYSE: LLY) has announced plans for a $5 billion manufacturing facility located in Goochland County, which is situated west of Richmond. Earlier this year, Indianapolis-based Eli Lilly shared plans to build four new pharmaceutical manufacturing plants. The Virginia facility is the first of the four to be formally announced. Since 2020, the company has invested $50 billion in capital expansion commitments. When finished, the development will mark the company’s first dedicated, fully integrated active pharmaceutical ingredient (API) and drug product facility for its bioconjugate platform and monoclonal antibody portfolio, which create ingredients for the treatment of cancer and autoimmune diseases. Completion of the facility is scheduled within the next five years. According to Eli Lilly, the project will create more than 650 permanent jobs in the area, in addition to 1,800 construction jobs. The company projects that for each dollar invested in the development, up to $4 of local economic activity will be generated. Goochland County was selected as the site for the new facility out of hundreds of applications. Plans for the facility include the use of technologies including machine learning, AI and automated systems. To implement these technologies, …

CAMBRIDGE, MASS. — Los Angeles-based Thorofare Capital has provided a $50.5 million bridge loan for the refinancing of Cambridgeport Labs, a two-building life sciences development located across the Charles River from Boston. Located at 99 Erie St. and 167 Sidney St. near the Massachusetts Institute of Technology campus, the buildings total 56,351 square feet. The borrower, a partnership between Barings and Greatland Realty Partners, acquired the buildings in September 2022 and subsequently implemented a redevelopment to support lab and life sciences uses. Andrew Kim led the transaction for Thorofare.