CAMBRIDGE, MASS. — Breakthrough Properties, a joint venture between Tishman Speyer and Bellco Capital, has started construction of One Canal by Breakthrough, a life sciences development in Cambridge, roughly two miles from downtown Boston. The property, situated along the city’s First Street corridor facing Canal Park and the Charles River in the East Cambridge neighborhood, is located adjacent to CambridgeSide — an enclosed regional mall that is being redeveloped to include 650,000 square feet of office, life sciences and residential space — and the 4.5 million-square-foot Cambridge Crossing innovation hub. Breakthrough acquired the four-story building last year, and is updating it to feature 105,000 square feet of high-quality research and development space. The property will feature a ground-floor lounge, private outdoor gathering spaces, concierge, fitness center, on-site retail and adjacent parking. A timeline for the redevelopment — which is targeting Fitwel, WELL and LEED Gold certifications — was not announced. A flurry of life sciences development is underway in the Boston metropolitan area. Recently announced projects include Phase I of Assembly Innovation Park, a life sciences tower spanning 485,000 square feet in the Boston suburb of Somerville; and Allston LabWorks, a 580,905-square-foot life sciences, retail and multifamily project in the Allston neighborhood of …

Life Sciences

Breakthrough Properties Begins Construction of One Canal Life Sciences Property in East Cambridge, Massachusetts

by Jeff Shaw

CAMBRIDGE, MASS. — Breakthrough Properties, a joint venture between Tishman Speyer and Bellco Capital, has begun construction of One Canal by Breakthrough, a life sciences development project in Cambridge, about two miles from downtown Boston. The property is located on the city’s First Street Corridor overlooking Canal Park and the Charles River in the East Cambridge neighborhood and is adjacent to CambridgeSide – a gated regional mall that is being redeveloped and includes 650,000 square feet of office, life sciences and residential space — and the 4.5-million-square-foot Cambridge Crossing innovation hub. Breakthrough acquired the four-story building last year and is modernizing it to provide 105,000 square feet of high-quality research and development space. The property will feature a ground floor lounge, private outdoor meeting spaces, concierge, fitness center, on-site shops and adjacent parking. A timeline for the redevelopment — which aims for Fitwel, WELL and LEED Gold certifications — has not been announced. A flurry of life sciences developments are underway in the Boston metro area. Recently announced projects include Phase I of Assembly Innovation Park, a 485,000-square-foot life sciences tower in the Boston suburb of Somerville; and Allston LabWorks, a 580,905-square-foot life sciences, retail, and multi-family development in Boston’s …

PHILADELPHIA — SmartLabs, a Boston-based life sciences operator, will open a new facility within Drexel University’s campus in Philadelphia. The square footage was not disclosed, but the space will span two stories within a 508,000-square-foot facility that is being developed by a partnership between Gattuso Development Partners and New York-based Vigilant Holdings. The facility, which is scheduled to open in 2025 and will include research and development, office and manufacturing space, will be SmartLabs’ seventh in the country.

PHILADELPHIA — SmartLabs, a Boston-based life sciences operator, will open a new facility within Drexel University’s campus in Philadelphia. The square footage was not disclosed, but the space will span two stories within a 508,000-square-foot facility that is being developed by a partnership between Gattuso Development Partners and New York-based Vigilant Holdings. The facility, which is scheduled to open in 2025 and will include research and development, office and manufacturing space, will be SmartLabs’ seventh in the country.

Newmark Arranges $514M Construction Loan for BioMed Realty’s Life Sciences Tower in Somerville, Massachusetts

by John Nelson

SOMERVILLE, MASS. — Newmark has arranged $514 million in construction financing for Phase I of Assembly Innovation Park, a life sciences tower spanning 485,000 square feet in the Boston suburb of Somerville. BioMed Realty, a San Diego-based subsidiary of Blackstone that focuses on life sciences real estate, is developing the 12-story tower and accompanying parking garage. The tower will be situated at the intersection of Middlesex Avenue and Foley Street, with visibility along I-93. According to the property website, Phase I of Assembly Innovation Park will feature an even split between office and laboratory space. Future phases of the three-building campus will include a cafe, conference center and a food hall. David Douvadjian Sr., Timothy O’Donnell, Brian Butler, David Douvadjian Jr. and Conor Reenstierna of Newmark’s Boston office arranged the financing on behalf of BioMed Realty. The direct lender was not disclosed. Harrison Zucco of Cushman & Wakefield provided supporting financial analysis for the deal. Phase I of Assembly Innovation Park will incorporate tech-enabled sustainable features, including a high-performance curtain wall, high-efficiency chilled water and exhaust air systems and a rooftop photovoltaic array. BioMed Realty is aiming to achieve LEED Gold and WELL certifications at the property. The San Diego-based …

SAN DIEGO — JLL Capital Markets has arranged a $165 million refinancing for Genesis Science Center, a life sciences R&D campus located at 5510, 5550, 5580 and 5590 Morehouse Drive in San Diego. The four-building property features 252,000 square feet of space. The fully occupied asset offers a variety of amenities, including an outdoor eatery, fitness center and a conference center that can accommodate at least 100 people. Tim Wright, Todd Sugimoto and Daniel Pinkus of JLL Capital Markets arranged the three-year loan for the borrowers, Phase 3 Real Estate Partners and Bain Capital Real Estate, through a national bank.

BOSTON — JLL has arranged a $585 million construction loan for Allston LabWorks, a 580,905-square-foot life sciences, retail and multifamily project in the Allston neighborhood of Boston. The borrower and developer is a joint venture between Boston-based King Street Properties, Brookfield and Mugar Enterprises. Allston LabWorks will feature 534,000 square feet of lab space, 20,000 square feet of retail space and 35 multifamily units, about 25 percent of which will be reserved as affordable housing. The development will also house a 5,000-square-foot outdoor event area and a 668-space parking garage. The site, which spans 4.3 acres at 305 Western Ave., is situated adjacent to Harvard University’s 350-acre Allston campus, which is home to the newly opened John A. Paulson School of Engineering & Applied Sciences. The area is also near the campuses of Boston University and Boston College, with multiple MBTA Green Line stops nearby. Greg LaBine and Amy Lousararian of JLL arranged the four-year, floating-rate loan through an undisclosed institutional debt fund. Construction of the project is underway, but a timeline for completion was not disclosed. “The fact that we were able to move quickly on this loan in today’s market conditions speaks to the level of interest and …

FREMONT, CALIF. — Diversified Healthcare Trust (Nasdaq: DHC) has acquired a life sciences building, located at 47071 Bayside Parkway in Fremont, for $82 million. The name of the seller was not released. The recently renovated facility features 89,000 rentable square feet of lab and corporate headquarters space. The property is 100 percent leased to Alamar Bioscience through January 2034. With this acquisition, DHC now owns four life sciences assets totaling approximately 327,000 square feet in the Bay Area, in addition to its joint venture investment in two properties located in the same market.

MINNETONKA, MINN. — The Abbott Laboratories life sciences campus in Minnetonka has traded hands for $53 million. The four-building campus totals 280,289 square feet and contains lab, manufacturing, office and warehouse space. Across the buildings there are 26 dock doors, seven drive-in doors and 640 parking spaces. Colin Ryan, David Berglund and Erin Fitzgerald of JLL and Judd Welliver and Bentley Smith of CBRE co-marketed the property on behalf of the seller, a joint venture between Eagle Ridge Partners and Syndicated Equities. Virtus Real Estate Capital was the buyer.

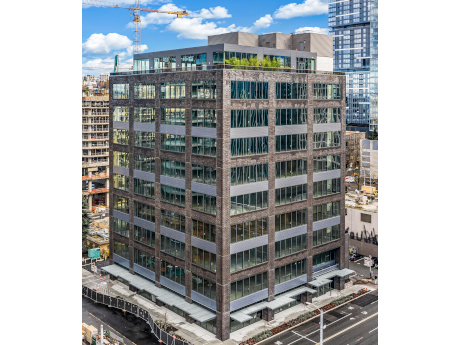

SEATTLE — Oxford Properties Group has completed the conversion of the 136,000-square-foot Boren Lofts office building into Boren Labs, a life sciences facility in downtown Seattle. Located at 1930 Boren Ave. in the South Lake Union neighborhood, the building features 15,000-square-foot floor plates, pre-built lab suites and move-in-ready research and development suites. The 10-story building features nine levels of labs and support office space, ground-level retail and a newly built amenity floor, which features a shared rooftop deck and conferencing center, fostering collaboration between occupants. The converted building features 15-foot floor-to-floor heights, fully upgraded MEP systems and ample subsurface parking. Each floor also features natural light and a private deck with outdoor access. Current tenants include Icosavax, Tune Therapeutics and GentiBio.