SEATTLE — CBRE has arranged joint-venture equity and $196.2 million in construction financing for Chapter Buildings I and II, two mixed-use buildings in Seattle’s University District. Seattle-based Touchstone, Atlanta-based Portman Holdings and Houston-based Lionstone Investments comprise the development team. Tom Pehl, Charles Safley, Todd Tydlaska of CBRE Capital Markets West Coast, along with James Scott and Brian Myers of CBRE Capital Advisors, arranged the equity. Brad Zampa, Mike Walker and Megan Woodring of CBRE Debt & Structured Finance arranged the financing. Construction of Building I commenced earlier in 2022 and construction of Building II will begin in late 2022, with expected delivery in 2024. Totaling more than 400,000 square feet, the Chapter Buildings will consist of two assets. Chapter Building I, located at 4530 12th Ave. NE, will rise 12 stories featuring 240,000 square feet of office space and 9,000 square feet of ground-floor retail. The 10-story Chapter Building II will feature 154,000 square feet of life sciences and research & development space above 4,000 square feet of retail space. Greg Inglin, David Abbott and Laura Ford of CBRE are marketing the buildings for lease.

Life Sciences

BOSTON — Dallas-based Lincoln Property Co. has received approval from The Boston Planning & Development Agency for the development of a 650,000-square-foot life sciences project in the city’s Seaport District. The facility, which will be known as Seaport Circle, will sit on 1.9 acres and will feature traditional lab and office space, as well as 5,000 square feet of retail space and a 15,000-square-foot training center. The development team expects that the project will create approximately 2,500 permanent jobs, 1,159 construction jobs and train approximately 2,000 students per year for careers in the life sciences industry. Construction is scheduled to begin in early 2023.

LEXINGTON, MASS. — A joint venture between Dallas-based developer Trammell Crow Co. and Invesco Real Estate will develop a 310,000-square-foot life sciences project in the northwestern Boston suburb of Lexington. The six-story facility will be known as 440 Bedford and will feature a covered parking garage, bicycle storage area, cafeteria, fitness center and various outdoor spaces, including proximity to the Minuteman bicycle trail. Completion is slated for the middle of 2024.

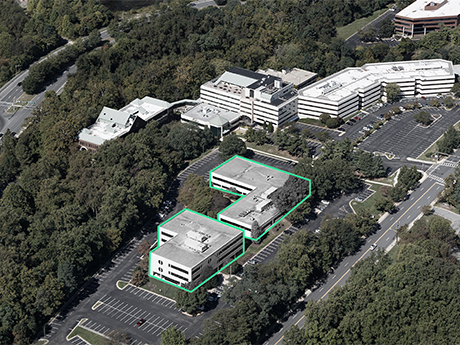

ROCKVILLE, MD. — CBRE has negotiated the $25.5 million sale of Research Square, a two-building office complex located at 1500 and 1550 Research Blvd. in Rockville, a suburb of Washington, D.C. The seller is Westat, an employee-owned research company based in Rockville. Tommy Cleaver, Dan Grimes and Stuart Kenny of CBRE represented Westat in the transaction. The buyer was not disclosed. CBRE says that the properties, which were fully vacated at the time of sale, represent a “premier life sciences conversion opportunity” as the Washington-Baltimore Corridor ranked No. 2 in CBRE’s Life Sciences Research Talent 2022 report.

BURLINGTON, NATICK AND BRAINTREE, MASS. — Hudson Bay Co., a holding and investment firm focused on retail properties, and its affiliate Streetworks Development will undertake a trio of life sciences conversion projects throughout the Boston area. Specifically, the development team plans to convert a portfolio of three 120,000-square-foot retail properties located in Burlington, Natick and Braintree into facilities that will house both traditional office and lab/research and development space. SGA is designing the conversion projects. Cushman & Wakefield is handling leasing. Construction is expected to begin in the third quarter.

DEDHAM, MASS. — Global investment management firm Invesco Real Estate has purchased a 422,117-square-foot life sciences facility in Dedham, a southern suburb of Boston. The single-story building sits on 53 acres and was fully leased at the time of sale to tenants such as General Dynamics and the American Red Cross. Robert Griffin, Edward Maher, Matthew Pullen and Samantha Hallowell of Newmark represented the seller, a partnership between locally based investment firm RJ Kelly Co. and Independencia Asset Management, in the transaction.

TARZANA, CALIF. — Instil Bio Inc. has received an $85 million construction loan for the development of Instil Bio Life Sciences Campus in Tarzana. Greg Grant of CBRE arranged the five-year, floating-rate, interest-only, non-recourse loan for the borrower. CBRE’s Andrew Riley and Jeff Pion facilitated Instil Bio’s original acquisition of the site in October 2020. Located at 18404-18412 Oxnard St., the campus will feature 102,000 square feet of lab, office and good manufacturing practice space. Instil Bio is a clinical-stage biopharmaceutical company focused on developing innovative cell therapies in the fight against cancer.

BOSTON — A fund sponsored by CBRE Investment Management has acquired a majority interest in a 132,000-square-foot life sciences building located at 300 Third St. in Boston’s Kendall Square neighborhood. The six-story building was originally constructed in 2000 and includes both traditional office and lab space that was recently renovated, as well as ground-floor retail space. The property was fully leased to an undisclosed pharmaceutical company at the time of sale. The percentage of the interest was not disclosed.

Colliers Arranges $192.5M Construction Financing for 208,616 SF Life Sciences Project Near Boston

by Jeff Shaw

SOMERVILLE, MASS. — Colliers Capital Markets has arranged $192.5 million in construction financing for the development of 100 Chestnut Street. The life sciences project totals 208,616 rentable square feet in the Brickbottom District of Somerville, a first-ring suburb of Boston. The plans also call for nearly 8,500 square feet of ground-floor retail space and two levels of below-grade parking. The borrower, North River Leerink (NRL), is developing the property as part of a larger mixed-use “campus for discovery and innovation,” which will include labs, creative offices and retail space on 4.5 acres of contiguous land. Scheduled for completion in summer 2023, the four-story, Gensler-designed facility will be built to LEED Platinum standards. Square Mile Capital Management provided the construction funds. Jeff Black, Kevin Phelan, Sean Burke and Bryan Koop led the Colliers Capital Markets team representing the borrower. “This financing marks a major milestone for the transformation of Somerville’s Brickbottom District into a world-class hub for innovation and wellness,” says Black. “Metro Boston remains the most active and liquid life sciences market in the world, and 100 Chestnut Street is well-positioned to catalyze the region’s next great ecosystem.” The site runs parallel to 150 & 200 Inner Belt Road, a …

BOSTON — Diversified Healthcare Trust (NASDAQ: DHC) has sold a 10 percent equity interest in a two-building life sciences complex located at 11 Fan Pier and 50 Northern Ave. in Boston’s Seaport District for $108 million. The property comprises two 15-story buildings with a combined 1.1 million square feet of lab, office and retail space. The locally based REIT, which still owns another 10 percent stake, sold its interest to an existing joint venture partner that now owns 45 percent of the property. Diversified Healthcare Trust intends to use the proceeds from the sale to fund capital expenditures, reduce outstanding indebtedness and address other general business needs. At the time of sale, the property was 95 percent leased to Vertex Pharmaceuticals.