BOSTON — German pharmaceutical giant Bayer has opened a $140 million research and innovation center within Kendall Square, located on the Boston-Cambridge border. About 100 employees will work at the two-story, 61,200-square-foot facility, which houses a molecular oncology research center with labs and offices. In addition, the center employs a newly established research team focused on leveraging chemical biology techniques to further propel the company’s oncology drug development process.

Life Sciences

SOMERVILLE, MASS. — South Carolina-based developer Greystar is underway on vertical construction of 74 Middlesex Avenue, a 465,000-square-foot life sciences project in Somerville, a northern suburb of Boston. The site is located within the Assembly Square mixed-use district. Designed by Elkus Manfredi Architects, the transit-oriented, 15-story building will feature ground-floor retail space, a health and wellness center, conference rooms and a 2,000-square-foot rooftop deck. Completion is scheduled for spring 2024. The project marks Greystar’s initial foray into the life sciences sector.

ANN ARBOR, MICH. — Sartorius, a life sciences research and biopharmaceutical company, has broken ground on its new 130,000-square-foot research center at Ann Arbor Research Park. Sartorius currently employs about 140 people in the Ann Arbor area and expects to increase that number to about 300 employees over the next three years. The jobs will include product development, operations and other support functions. Employees at the facility will focus on providing advanced solutions to help customers develop drugs that cure, prevent and halt the progression of diseases. Sartorius expects to open the facility by the end of 2023. Hobbs+ Black Architects is the project architect and J.S. Vig Construction Co. is the general contractor.

PHILADELPHIA — BioLabs, an incubator for life sciences companies, has signed a 30,151-square-foot lease expansion at The Curtis, a facility in Philadelphia’s Center City District that is a redevelopment of a historic publishing house. The tenant’s footprint is now 53,529 square feet, and the move-in is scheduled for early 2023. Other tenants at The Curtis, which also houses traditional office space, include Aro Biotherapeutics, IMVAX Inc. and Vivodyne. Keystone Development + Investment owns the property.

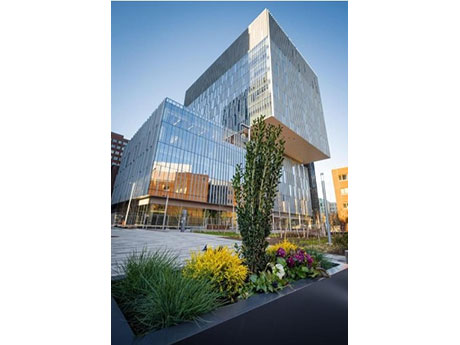

CAMBRIDGE, MASS. — Japanese pharmaceutical giant Takeda has signed a 600,000-square-foot life sciences lease in Cambridge’s Kendall Square neighborhood. Takeda will occupy the entirety of the 16-story building at 585 Third St., which is being developed by San Diego-based REIT BioMed Realty and is slated for a 2026 completion. CBT Architects designed the facility, which will include 15,000 square feet of flexible space and a 300-seat theater, both of which will be open to the public. CBRE represented BioMed Realty in the lease negotiations. Cushman & Wakefield represented Takeda.

YPSILANTI, MICH. — Michigan Innovation Headquarters (MI-HQ), a provider of life sciences and technology workspaces, has entered into a purchase agreement for Eastern Michigan University’s former College of Business headquarters building in downtown Ypsilanti for $2.6 million. The buyer plans to undertake $10 million in renovations to build shared workspaces for science, technology, engineering and mathematics (STEM) companies. Plans call for free onsite parking, research and development wet labs, medical offices, a 160-seat auditorium, exterior courtyard, café, gym and food truck area. Formerly known as the Gary Owens Building, the asset spans 130,000 square feet and is located at 300 W. Michigan Ave. The renovated building is slated to open in the first quarter of 2023 and will serve as MI-HQ’s fourth location.

WOBURN, MASS. — Locally based firm Cabot, Cabot & Forbes has filed plans with the Planning Board of the City of Woburn, a northern suburb of Boston, to develop a 300,000-square-foot life sciences campus. Plans call for a 175,000-square-foot lab and office building and a 135,000-square-foot manufacturing facility. Cushman & Wakefield has been tapped to lease the project. The developer expects to receive the necessary permits and approvals by the end of the summer.

WALTHAM, MASS. — Hobbs Brook Real Estate has delivered 225 Wyman, a 507,000-square-foot office and life sciences project located in the western Boston suburb of Waltham. The five-story building sits on a six-acre site and features 43,500 square feet of indoor amenity space, as well as outdoor event space. In addition, 225 Wyman offers an onsite parking garage with a covered walkway connector. The property was 96 percent leased at the time of its opening to tenants such as Seqirus, ElevateBio BaseCamp and Pegasystems.

PHILADELPHIA — Longfellow Real Estate Partners will undertake a $365 million expansion project at Pennovation Center, a life sciences development located across the Schuylkill River from the University of Pennsylvania in Philadelphia. The university owns the 23-acre site on which the facility will be constructed. The initial, 65,000-square-foot lab opened last year, and the expansion will add 387,000 square feet of research and development space and 68,000 square feet of biomanufacturing space to the local supply. Architectural and engineering firm Jacobs is designing the project, construction of which is scheduled to begin next year, with completion slated for 2025.

BEDFORD, MASS. — Newmark has brokered the $132 million sale of One Patriots Park, a 143,553-square-foot life sciences complex in Bedford, a northwestern suburb of Boston. The seller, Jumbo Capital Inc., redeveloped the property in 2019 to support life sciences users. At the time of sale, four such tenants — Homology Medicines Inc., N2 Biomedical, Frontera Therapeutics and Obsidian Therapeutic — occupied the entirety of the facility. Robert Griffin, Edward Maher, Matthew Pullen and Samantha Hallowell of Newmark represented Jumbo Capital and procured the buyer, Barings, in the transaction.