DORAL, FLA. — Codina Partners has obtained a $38.8 million construction loan for the third phase of Downtown Doral’s retail expansion. Ocean Bank provided the loan. Downtown Doral is a 250-acre mixed-use district in South Florida, and the third phase will add nearly 25,000 square feet of retail space along 87th Avenue, with 932 dedicated garage parking spaces for retail visitors. UHealth – University of Miami Health System has leased 11,243 square feet on the north end of the expansion for UHealth Way, which will include comprehensive eye care from the Bascom Palmer Eye Institute and physical therapy services, such as hand therapy and pelvic floor rehabilitation. The south portion of the expansion includes 13,644 square feet of retail space divided into nine customizable units — seven on the ground floor and two on the second floor. The expansion project is scheduled to break ground in the second quarter, with an estimated completion in 2026.

Mixed-Use

ORLANDO, FLA. — Tavistock Development Co. has signed five new tenants to join Lake Nona West, a 405,000-square-foot lifestyle shopping center located within Orlando’s master-planned community of Lake Nona. The tenants include Cañonita Mexican Restaurant, Nordstrom Rack, Barnes & Noble, discount retailer HomeSense and Total Wine & More. The new round of lease signings bring the total preleased space at the property to more than 300,000 square feet, which includes a 150,000-square-foot Target anchor store. Situated on 54 acres, Lake Nona West will include wide, shaded walkways, art-lined plazas and community greenspaces. In collaboration with Mercedes-Benz High-Power charging, the center will also offer 20 Level 3 electric vehicle chargers. Tavistock, master developer of Lake Nona, expects to open Lake Nona West in spring 2026.

Lee & Associates Brokers Sale of 18,452 SF Mixed-Use Building in San Marcos, California

by Amy Works

SAN MARCOS, CALIF. — Lee & Associates has arranged the sale of a showroom and flex building located at 307 Carmel St. in San Marcos. Creative Carmel LLC, an owner-user, acquired the asset from 307 E Carmel LLC for $6 million. Situated on 1.8 acres, the 18,452-square-foot single-tenant building offers 40 percent showroom, 25 percent office and 35 percent warehouse space. Marko Dragovic, Isaac Little and Olivia Baffert of the Little Dragovic Team at Lee & Associates – North San Diego County represented the seller, while Russ Jabara and Shawn Espino of San Diego Commercial Realty represented the buyer in the deal.

Housing Trust Group Opens $100M Mixed-Use Affordable Housing Development in Hollywood, Florida

by John Nelson

HOLLYWOOD, FLA. — Housing Trust Group (HTG) has opened the Apartments at University Station, a $100 million mixed-used affordable housing community located in downtown Hollywood. The development features 216 income-restricted units of affordable and workforce housing — 108 one-bedroom and 108 two-bedroom apartments — ranging in size from 621 square feet to 899 square feet. The property’s affordable component will apply to all households earning between 22 and 80 percent of the area median income. The complex comprises two residential towers, a 635-space public-private parking garage, more than 2,000 square feet of retail space and a new 12,210-square-foot campus for Barry University’s College of Nursing and Health Services. Amenities at the complex include a multipurpose room with a catering kitchen and bar, fitness center, resort-style swimming pool and a game room, as well as elevated pedestrian bridges connecting the residential buildings to the parking garage. Developed in a public-private partnership with the City of Hollywood, the project team includes general contractor ANF Group Inc., Corwil Architects, HSQ Group (civil engineer), B. Pila Design Studio (interior design), Witkin Hults + Partners (landscape architect), BNI Engineers (structural engineer), RPJ Inc. (MEP engineer) and Kaller Architecture (Barry University interiors). Financing sources for the development …

Hendricks Commercial Properties Acquires Summit at Fritz Farm Mixed-Use Development in Lexington, Kentucky

by John Nelson

LEXINGTON, KY. — Hendricks Commercial Properties, a Wisconsin-based development and investment firm, has acquired The Summit at Fritz Farm, a mixed-use development in Lexington that opened in 2017. The development features a collection of more than 60 shops and restaurants that sit below modern offices and The Henry apartments. Some components of the development that were not included in the sale include the Origin Lexington hotel and a 192-unit seniors housing community, Legacy Reserve at Fritz Farm. Hendricks did not disclose the sales price or specific aspects of the acquisition beyond the commercial space. Hendricks acquired the development from a partnership between Swift Creek Real Estate Partners and Centennial Real Estate Management LLC, which has owned The Summit at Fritz Farm since acquiring the original developer, Birmingham, Ala.-based Bayer Properties, in 2022. “We are excited to add Fritz Farm to our portfolio,” says Rob Gerbitz, CEO of Hendricks Commercial Properties. “This acquisition aligns with our strategic vision of investing in high-quality, experiential mixed-use properties that serve as community hubs. We look forward to building upon the strong foundation established at Fritz Farm and continuing to enhance the experience for tenants and guests alike.” Whole Foods Market, Pottery Barn and Arhaus anchor …

FISHERS, IND. — Thompson Thrift has broken ground on The Union at Fishers District, the final phase of the master-planned development in the Indianapolis suburb of Fishers. The mixed-use project will bring luxury residences, retail and office space and Indiana’s first AC Hotel by Marriott. Located near I-69 and 116th Street, the commercial portion is slated for completion in late 2026 and will include 57,000 square feet of retail, restaurant and entertainment space, 70,000 square feet of Class A office space and a 135-room AC Hotel. Additionally, a central event plaza will serve as a gathering place for both visitors and residents. Tenants with signed leases include Piedra, a modern upscale Mexican restaurant; Niku Sushi.Kitchen.Bar, which offers contemporary Japanese cuisine; Kitchen Social, a casual restuarnt serving international cuisine; Everbowl, a health-focused fast-casual spot; and Racha Thai, a Thai food restaurant. Medical spa Renova Aesthetics and Sweathouz, a wellness facility offering health and recovery treatments, will also be among the first tenants to open. Thompson Thrift is actively negotiating leases on the remaining spaces. The Union Flats will be a Class A multifamily community with 251 units located above ground-floor retail space. The project is slated to open in late 2026. …

Trademark, TriGate Capital Recapitalize Perkins Rowe Mixed-Use Village in Baton Rouge

by John Nelson

BATON ROUGE, LA. — Trademark Property Co. has recapitalized Perkins Rowe, a 518,830-square-foot mixed-use town center in Baton Rouge, with Dallas-based real estate investment manager TriGate Capital LLC. Terms of the recapitalization structure were not released. The property comprises 384,171 square feet of retail space and 134,659 square feet of Class A office space. Trademark and TriGate plan to refresh and revitalize Perkins Rowe with improvements to the public spaces, updated signage, modernized office common areas, fresh paint, landscaping and other placemaking enhancements. Trademark, which has operated Perkins Rowe since 2016, has recently attracted tenants such as Free People, Drago’s, Tacos del Cartel and Tecovas to the development, as well as extended leases with anchor tenants including The Fresh Market and Cinemark Theatres.

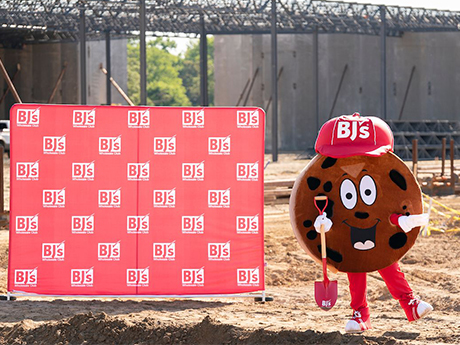

AdVenture Development Breaks Ground on 100,000 SF BJ’s Wholesale Club in Selma, North Carolina

by John Nelson

SELMA, N.C. — AdVenture Development LLC has broken ground on a BJ’s Wholesale Club located within the 400-acre master-planned community of Eastfield Crossing in Selma, about 30 miles southwest of Raleigh. The new store, which will feature an onsite BJ’s gas station, will total 100,000 square feet. Additional tenants at the 3 million-square-foot mixed-use development include Academy Sports + Outdoors, Hobby Lobby, Old Navy, Ulta Beauty, Marshalls, Ross Dress for Less, Burlington, Five Below and Chase Bank. Target is also under construction at Eastfield Crossing and anticipates opening in spring 2026. Eastfield Crossing includes a business park, retail and entertainment space, medical and office space, a hospitality component, senior living and multifamily units and single-family residences. Locally based AdVenture Development is the owner and master developer of Eastfield Crossing.

By Ashley O’Connor, executive managing director at MGAC Large-scale mixed-use developments are reshaping urban landscapes, offering opportunities to reimagine cities as more appealing places to live, work and visit. Unlike traditional single-use developments, these projects blend various real estate verticals — residential, commercial, recreational — into cohesive ecosystems. The versatility of these projects both mitigates risks during economic downturns, such as oversupply in specific sectors, and fosters resilience and adaptability, making them stand out as sustainable investments in an evolving urban environment. Enhancing Visual, Functional Landscapes The shift away from monolithic single-use buildings has transformed skylines, replacing them with dynamic, multi-purpose structures that blend into their surroundings. These projects often feature green spaces, public art installations and architectural elements that enhance aesthetics and functionality. For instance, the redevelopment of the Century Plaza Hotel in Los Angeles demonstrates how historical preservation can coexist with modern innovation. Once celebrated for its mid-century design, the property’s transformation added sleek residential towers while maintaining its iconic charm, creating a vibrant hub that reflects the city’s evolving identity. Similarly, the Etobicoke Civic Center in Toronto illustrates how well-designed mixed-use developments contribute to urban appeal. By combining civic, residential and commercial spaces into a single 800,000-square-foot …

ATLANTA — Centennial Yards Co. has executed a long-term lease with event promoter Live Nation to operate a new live music and entertainment venue in downtown Atlanta. The 5,300-seat venue will anchor the under-construction sports and entertainment district within Centennial Yards, a $5 billion mixed-use project set to transform a long-underutilized section of the city into a walkable destination. The Live Nation theater will showcase a range of performances across genres, from global touring acts to national headliners and local artists. The facility will complement the city’s existing entertainment landscape, including Tabernacle concert hall, Fox Theatre and Buckhead Theatre as well as Mercedes-Benz Stadium (home of the NFL’s Atlanta Falcons and MLS’ Atlanta United) and State Farm Arena (home of the NBA’s Atlanta Hawks). “Centennial Yards is poised to be the epicenter of sports and entertainment for the southeastern United States, where people of all ages can enjoy concerts, sporting events, bars, restaurants and retail stores — all in one vibrant mixed-use district,” says Brian McGowan, president of Centennial Yards Co. “Partnering with Live Nation brings us one step closer to creating a thriving hub where unforgettable experiences happen. This new Centennial Yards entertainment venue is exactly what our region …