MIAMI — H&M has signed a 25,000-square-foot lease to occupy an anchor space at The Shops at Brickell City Centre (BCC) in Miami. Scheduled to open later this year, the global clothing retailer will occupy two levels at the property, which serves as the primary retail component of BCC, a 4.9 million-square-foot mixed-use development that first opened in 2016. Developed by Swire Properties, BCC also features two residential towers, two office buildings, food hall and the EAST Miami hotel. Other tenants at the development include a flagship Saks Fifth Avenue, Zara, Levi’s and Chanel Fragrance and Beauty Boutique.

Mixed-Use

Diversified Partners Breaks Ground on Eastgate Plaza Mixed-Use Project in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Diversified Partners has broken ground on Eastgate Plaza, a 17-acre mixed-use development at the northeast corner of Elliot and Ellsworth roads in Mesa. Confirmed tenants for the project include a drive-thru Starbucks Coffee, d’Lite Health On The Go, Pure Barre, Fix FX, Fresh Monkee, Playa Bowls, Kolache Café, Southern California-based Farmer Boys, Ono Hawaiian BBQ, Vero Chicago Pizza, Swig soda shop, Euphoria Nail Salon, Mecham Orthodontics, MB2 Dental, Andi’s Hair Salon & Barbershop AVEDA, Discount Tire and The UPS Store. Eastgate Plaza will also feature a 91,911-square-foot Cambria Hotel with 107 guest rooms on 2.11 acres. Designed with Cambria’s new prototypical plans, the hotel will include a 500-square-foot rooftop bar and kitchen, a first-floor restaurant and lounge, an outdoor seating and dining area, and an outdoor pool with a sundeck and fireplace. The hotel is slated to open on Sept. 1, 2025. Elliot & Ellsworth Investment Properties owns the site. An entity led by Brown Jr. Canyon Building & Design is the construction management group overseeing the buildout, while RKAA Architects is the architect of the project. EPS Group is serving as civil engineer.

SMYRNA, TENN. — Equitable Property Co. has purchased 44 acres in Smyrna, with plans to develop a mixed-use district dubbed Sewart’s Landing. Situated about 24 miles southwest of Nashville, the project will comprise 250,000 square feet of ground-level retail space, in addition to two medical office buildings (MOBs) totaling 400,000 square feet; a 240-room hotel; and 75 for-sale townhomes. Sewart’s Landing is named after the former Sewart Air Force Base that operated from 1941 to 1971. The groundbreaking is scheduled for next month, with completion of Phase I expected in the first quarter of 2025. Tenants at the development’s first phase will include Starbucks Coffee, Wawa, Jonathan’s Grille and an undisclosed grocer. Equitable Property acquired the land for the project from the City of Smyrna, which helped the developer formulate the master plan for Sewart’s Landing. Kipper Worthington of JLL and Land Deleot of Equitable Property will lead leasing efforts at the development.

Greystar Delivers $282M Student Housing Development at UC Law in Downtown San Francisco

by John Nelson

SAN FRANCISCO — Real estate development firm Greystar has delivered Academe at 198, a $282 million student housing property in downtown San Francisco. Located at 198 McAllister St. in the city’s Civic Center district, the mixed-use property is Phase I of the Academic Village expansion at UC Law San Francisco, formerly known as UC Hastings College of the Law. Academe at 198 spans 14 stories and features 656 units (667 beds) for students at UC Law SF, as well as faculty and staff. The property website also says students from nearby University of California San Francisco, San Francisco State University, University of San Francisco and University of the Pacific Dugoni School of Dentistry can apply for housing. The units come in a variety of layouts: efficiency (232 square feet); studio (275 square feet); one-bedroom (397 square feet); and two-bedroom (568 square feet). Monthly rental rates begin at $1,850 for an efficiency apartment, which is below market rates, according to the property website. In addition to housing, the 365,000-square-foot property includes 43,000 square feet of office and academic space that is leased and operated by UC Law, including an incubator space for start-up tech firms that doubles as event space called LexLab. …

PINECREST, FLA. — Limestone Asset Management and Orion Real Estate Group have completed the $5 million renovation of Pinecrest Town Center, a 225,255-square-foot mixed-use property located at 12651 S, Dixie Highway in the south Miami suburb of Pinecrest. Renovations at the property, which features retail and office space, included upgrades to the façade and storefronts, the installation of impact windows, improved lighting and the addition of a rooftop parking area. General contractor Tim Majors of Suncon Inc. and architect Bruce Arthur of WHA Design led the project. Pinecrest Town Center was 90 percent leased at the time of renovations to tenants including Sage Dental, Coldwell Banker, Anacapri Italian Restaurant and Sea Siam. The property was previously renovated in 1994 and 2004. Limestone purchased the property, which was built in 1985, in 2021 for $32 million.

Redwood West Joins Owners of Lido Marina Village Shopping Center in Newport Beach, California

by Amy Works

NEWPORT BEACH, CALIF. — JLL Capital Markets has arranged the recapitalization of Lido Marina Village, a 3.1-acre mixed-use shopping center in Newport Beach. The firm represented the existing ownership, DJM Capital and Arc Capital Partners through a partnership with Belay Investment Group, in the transaction that added Redwood West to the partnership. Built in 1971 and renovated in 2016 and 2022, Lido Marina Village features 77,922 square feet of retail space, 28,694 square feet of office space and a 47-slip marina. Current tenants include Nobu, Zinque, Malibu Farm, Circle Hook Fish Co., Aesop, Warby Parker, Elyse Walker, Faherty, Curl Fitness, Eberjay and LoveShackFancy. The property is currently 100 percent occupied. As part of the transaction, Arc Capital Partners and Belay Investment Group exited the original partnership. JLL also secured an undisclosed amount of financing through a life insurance company for the transaction. Bryan Ley, Geoff Tranchina, Gleb Lvovich, Tim Kuruzar and Daniel Tyner led the JLL Capital Markets investment sales advisory team. Jeff Sause, John Marshall and Alex Olson led the JLL Capital Markets debt advisory team.

BEVERLY HILLS, CALIF. — Alagem Capital Group and Cain International have broken ground on One Beverly Hills, a $2 billion mixed-use project in the Los Angeles suburb of Beverly Hills, according to Foster + Partners, the project’s master architecture and planning firm. One Beverly Hills will be a 17.5-acre “urban resort” that will feature two new condominium towers, an eight-acre botanical garden and a 10-story tower comprising 42 luxury hotel rooms, 37 shared-ownership condos and a fine dining restaurant. One Beverly Hills also includes the revitalization of the adjacent Beverly Hilton and Waldorf Astoria Beverly Hills, two luxury hotels that Alagem Capital and Cain purchased in 2018. In June 2021, the Beverly Hills City Council approved a historic development agreement in which the developers would pay the City of Beverly Hills a $100 million public benefit fee in lieu of including an affordable housing component in the project. Alagem Capital and Cain will pay the fee over the course of eight years, according to the Beverly Hills Courier. Specific plans for One Beverly Hills were unveiled shortly thereafter, at which time the development team said it was targeting a 2026 delivery. One Beverly Hills’ hotel-condo tower will include a private …

ST. PETERSBURG, FLA. — PTM Partners has purchased land in the Tampa suburb of St. Petersburg, with plans to develop a 500,000-square-foot mixed-use project at the site. PTM acquired a parcel on Central Avenue for the development, which will comprise a portion of Phase II of the EDGE Collective. Tricera Capital and Eastman Equity sold the land for $14.8 million. Phase I of EDGE includes a nearly completed 163-room Moxy by Marriott Hotel, as well as the redeveloped 1246 Central Avenue building with 16,000 and 8,000 square feet of food-and-beverage and office space, respectively. Plans for Phase II are still being determined, according to PTM Partners.

Window Nation Signs 50,698 SF Office Lease at Maple Lawn Mixed-Use Community in Baltimore

by John Nelson

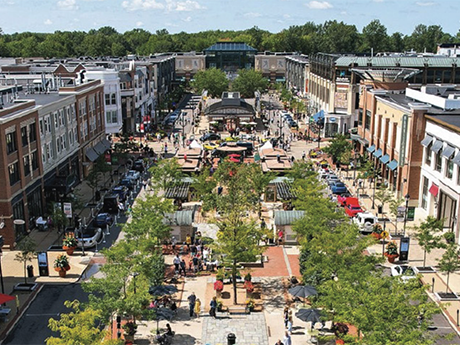

BALTIMORE — Window Nation has signed a 50,698-square-foot lease at 8110 Maple Lawn Blvd., a 104,412-square-foot office building situated within the Maple Lawn mixed-use community in Baltimore. Maple Lawn, which is being developed by Greenebaum Enterprises and St. John Properties, comprises 1,300 residences and 150,000 square feet of retail space, in addition to more than 1 million square feet of office space. Bill Jautze of St. John Properties represented the landlord in the lease negotiations on an internal basis, and Rick Williamson of St. John Properties represented the tenant.

Southern Realty Trust Funds $56.4M Mezzanine Loan for Mixed-Use Development in Sarasota, Florida

by John Nelson

SARASOTA, FLA. — Southern Realty Trust has provided a $56.4 million mezzanine loan for Aster & Links, a mixed-use development underway in downtown Sarasota. Situated at the intersection of Main Street and Links Avenue, the development will include two 10-story residential buildings housing 424 luxury apartments, 778 parking spaces and 51,000 square feet of ground-level retail space, including a Sprouts Farmers Market grocery store. Lantern Real Estate arranged the financing on behalf of the borrower, Belpointe PREP LLC, an affiliate of Belpointe OZ. Last year, the developer obtained a $130 million construction loan from Bank OZK for the project. Belpointe OZ plans to deliver Aster & Links in the second half of the year.