MESA, ARIZ. — Irvine, Calif.-based SB Real Estate Partners has acquired ReNew 3030, a Class B apartment community in Mesa. An undisclosed seller sold the property for $24.3 million. SB Real Estate renamed the asset Portola East Mesa and will implement a capital improvement program. Located at 3030 E. Broadway Road, Portola East Mesa features 126 garden-style apartments in a mix of one- and two-bedroom units ranging from 580 square feet to 805 square feet with walk-in closets, in-unit washers/dryers and high-speed internet. On-site amenities include a swimming pool, picnic area with grill, fitness center and bark park. Chris Canter, Brad Goff and Brett Polacheck of Newmark represented the seller the transaction. Chinmay Bhatt, Noam Franklin and Cody Kirkpatrick of Berkadia JV Equity & Structured Capital arranged joint venture equity as part of a larger program, as the buyer plans to close on more than $150 million of multifamily acquisitions during third-quarter 2021 across Arizona, California and Nevada.

Multifamily

BRIGHTON, COLO. — CP Capital US has partnered with Greystar to develop Brighton Park, a multifamily property located at the intersection of Longs Peak Street and North 42nd Avenue in Brighton, a northeast suburb of Denver. Situated on 13 acres, the three-story, garden-style property will feature 288 apartments with stainless steel appliances and stone-surface countertops. Community amenities will include a fitness center, resort-style swimming pool, dog park, detached garages and surface parking spots. Groundbreaking is slated for the fourth quarter of 2021, with the first units scheduled for delivery in early 2023. Total build out is scheduled for the second quarter of 2023. CP Capital, formerly known as HQ Capital Real Estate, has partnered with Greystar on four development projects, with the most recently projects being The Gabriel in North Pomona, Calif., and Monty in North Charleston, S.C.

KATY, TEXAS — A joint venture between global investment firm AXA IM Alts and RPM Living has acquired Grand at LaCenterra, a 271-unit apartment complex in the western Houston suburb of Katy. The Class A property was built in 2016 and offers studio, one-, two- and three-bedroom units that are furnished with stainless steel appliances, quartz countertops, walk-in closets and private balconies/patios. Amenities include a pool, fitness center, game room, conference facilities, library, outdoor kitchen and a package locker system. The seller and sales price were not disclosed.

BEAUMONT, TEXAS — Brinshore Development will build Trinity Grove, a 192-unit mixed-income community in Beaumont. Brinshore will develop the 195,000-square-foot property in partnership with the City of Beaumont Housing Authority. About half the units will be reserved for applicants earning 80 percent of the area median income or below, while the remaining 49 percent of the units will have no income restrictions. Units will feature one-, two- and three-bedroom floor plans, and amenities will include a children’s play area, fitness center, outdoor gathering and grilling stations and a computer learning center. JHP Architecture is serving as project architect, and Cadence McShane is the general contractor. Completion is slated for fall 2022.

BAY SHORE, N.Y. — JLL has arranged $113 million in construction financing and $55 million in joint venture equity for the capitalization of a 418-unit multifamily project in the Long Island community of Bay Shore. The property, which will be built in two phases, will consist of 334 market-rate apartments and 84 workforce housing units, as well as 1,650 square feet of retail space. Amenities will include a pool, outdoor grilling stations, a business center and coworking lounge, fitness center, clubrooms, game room and pet washing station. Andrew Scandalios, Rob Hinckley, Jeffrey Julien and Nicco Lupo of JLL arranged the joint venture equity with institutional investors advised by J.P. Morgan Asset Management on behalf of the developer, TRITEC Real Estate Co. Michael Gigliotti, Geoff Goldstein, Kelly Gaines and Jackie Ferrer of JLL sourced the four-year, floating-rate construction loan through Truist Financial Corp. and Santander Bank.

NEWTON, MASS. — MassHousing has provided $23.5 million in financing for the expansion of Golda Meir House in the western Boston suburb of Newton. The project will expand the existing 199-unit affordable seniors housing property, adding 68 new apartment homes that will be reserved for renters at various income levels that fall below the area median income. The capital stack includes $17 million in Low-Income Housing Tax Credit equity allocated by the Massachusetts Department of Housing & Community Development, as well as various other subsidies. The borrower and developer is 2Life Communities. Prellwitz Chilinski Associates is the project architect, and Colantonio Inc. is the general contractor. Construction is expected to be complete in spring 2023. Golda Meir House was originally built between 1978 and 1995 and was renovated in 2018.

NORTHBRIDGE, MASS. — Blueprint Healthcare Real Estate Advisors has arranged the sale of a seniors housing campus featuring 154 skilled nursing beds and 26 assisted living units in the Worcester suburb of Northbridge. The community, which was not named, was built in 1970 on 13 acres. It totals 93,000 square feet following expansions in 1995 and 2005. Owner-operator Salmon Health and Retirement sold the property as a non-core community in its portfolio. A Massachusetts-based investor acquired the asset for an undisclosed price.

NORTH KINGSTON, R.I. — New Jersey-based investment firm Tryko Partners has purchased Scalabrini Villa, a 120-bed skilled nursing facility in North Kingston, about 25 miles south of Providence. The property opened in 1994 at a site along Narragansett Bay and consists of 60 two-bed units. The seller and sales price were not disclosed. Tryko Partners plans to make capital improvements to the facility, which offers memory care, long-term and sub-acute care services.

Affordable HousingContent PartnerFeaturesLumentMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasVideoWestern

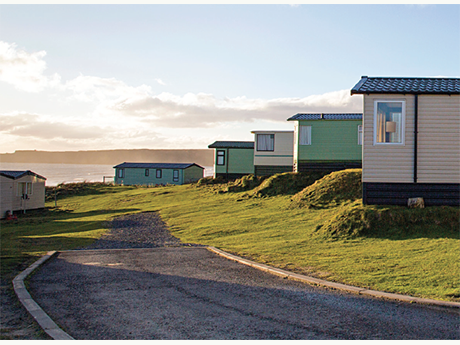

Manufactured Housing Communities Garner Investor Interest

Interest in affordable paths to homeownership and the growing popularity of lower density living are raising the profile of the manufactured housing option among American households and investors. At the same time, the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac are making concerted efforts to better serve this historically underfinanced market at both the individual homeowner and community levels. The combination of robust cash flow growth (particularly in Sunbelt and Western markets), cap rate compression, and liquidity provided by the GSEs makes a compelling case for manufactured housing community (MHC) acquisitions and refinances. As increased competition has left market participants looking for an edge amidst compressing cap rates, the importance of working with an experienced MHC lender with access to short- and long-term loan programs has become more apparent. The following provides an in-depth analysis of the recent performance of rental MHCs, sales volume and pricing trends, and loan and underwriting trends in the MHC space. The Performance of the Site Rental Market The COVID-19 pandemic affected American housing preferences in profound ways. Increasingly, households are seeking lower density options with larger floor plans, home offices, and dedicated space for entertaining or distanced learning. This phenomenon …

RALEIGH, N.C. — Capital Square plans to develop a 20-story multifamily tower at 320 W. South St. in Raleigh’s Warehouse District. The 297-unit development is slated for completion by June 2024. Capital Square plans to break ground on the approximately $121 million project in April 2022. The development will offer studios, one-, two- and three-bedroom units. The apartment community will also feature 8,384 square feet of ground-floor commercial space, as well as an adjacent, standalone parking tower with 437 parking spaces. Community amenities will include a swimming pool, rooftop lounge, coworking space and a fitness center. The property is situated at the intersection of the Boylan Heights neighborhood, Dorothea Dix Park and downtown Raleigh. The apartment community will be close to the RedHat Amphitheater and Raleigh Convention Center and will be situated adjacent to U.S. Highway 70. CSRA Opportunity Zone Fund VI, Capital Square’s project-specific fund seeking to raise $48.5 million from accredited investors and a minimum investment of $100,000, will provide part of the financing for the project.