MILWAUKEE — Inland Real Estate Investment Corp. has completed Evoni Apartments in Milwaukee’s Historic Third Ward district. Inland completed the 261-unit luxury apartment project in a joint venture with Kaeding Development Group LLC. Located adjacent to the Henry Maier Festival Park and Lake Michigan, the five-story property features 60 studios, 122 one-bedroom units, 66 two-bedroom units and 13 three-bedroom residences. Amenities include a pool, rooftop lounge, sky deck, outdoor fire pits, a community recreation room, fitness center, yoga room, indoor sauna, dog park, pet washing station and package room. The project marks the fourth investment and second ground-up multifamily development of which Inland Investments has partnered with Kaeding.

Multifamily

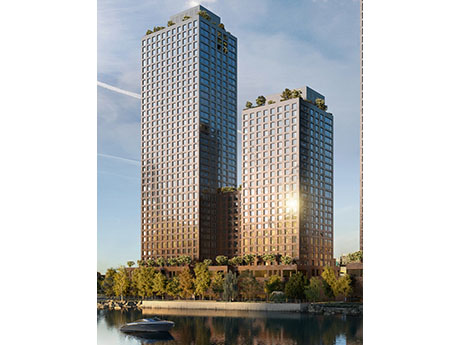

NEW YORK CITY — SCALE Lending, the debt financing arm of New York City-based Slate Property Group, has provided a $305 million construction loan for a new multifamily project in the Mott Haven area of The Bronx. The borrower is locally based development and investment firm The Beitel Group. The unnamed project will comprise two interconnected buildings that will rise 40 and 26 floors and house 755 studio, one- and two-bedroom apartments. Amenities will include an outdoor pool, large outdoor terrace, gym with sauna and steam room, pickleball court, golf simulator, coworking area, party room and children’s play room, as well as 11,500 square feet of retail space. Beitel Group bought the land at 355 Exterior St., which is situated along the Harlem River, last fall and subsequently demolished all existing structures. Prestige Construction NY is serving as the general contractor for the project, which has been vested into the city’s 421a program for inclusion of an affordable housing component. Landstone Capital Group arranged the construction loan, which carries an 18-month term with two six-month extension options, through SCALE Lending on behalf of Beitel Group. Construction is slated for a June 2026 completion. “The Mott Haven submarket of New York …

SILVERDALE, WASH. — MLG Capital has entered the Washington market with the acquisition Wellington Apartment Homes, a multifamily property in Silverdale, located approximately 30 miles west of Seattle. Terms of the transaction were not disclosed. The garden-style property features 240 apartments, bayside views, a heated pool, clubhouse, fitness center and dog park. MLG plans to implement interior and exterior renovations, including installing stainless steel appliances, granite countertops and other premium features in all units, as well as improving property curb appeal and enhancing community amenities.

Grovewood Community Development Opens 81-Unit Affordable Housing Project in Aurora, Colorado

by Amy Works

AURORA, COLO. — Grovewood Community Development has opened Sapling Grove Apartments, a mixed-income affordable housing property located at 10151 E. Jewell Ave. in Aurora. At full build-out, the two-phase Sapling Grove will offer more than 130 apartments. The 86,553-square-foot first phase features 81 one-, two- and three-bedroom floor plans with energy-efficient appliances, air conditioning, in-unit washers/dryers, walk-in closets and paid utilities. Community amenities include a fitness center, outdoor community gathering spaces with a large, covered picnic area, a playground, public art installations, a furnished rooftop patio, walking trails and an open space with native landscaping. Additionally, the community has a dedicated public space that will provide the greater community access to resources for health and wellness through an onsite Community Resource Center. The second phase will include 50 seniors housing units. Project funding was provided by 22 funding sources, including the City of Aurora, Arapahoe County, the Colorado Division of Housing, the Colorado Housing and Finance Authority, Impact Development Fund, Grow America, Sugar Creek Capital and the Aurora Housing Authority. A significant grant from the Colorado Health Foundation helped fund the property’s outdoor recreation spaces and onsite wellness initiatives.

JLL Arranges $26M Construction Loan for 132-Unit Build-to-Rent Community in Wildwood, Florida

by Abby Cox

WILDWOOD, FLA. — JLL Capital Markets has arranged a $26 million construction take-out bridge loan for Magnolia at Powell, a newly constructed, 132-unit build-to-rent residential community in Wildwood, roughly 50 miles outside Orlando. Max La Cava, Melissa Quinn, Bob Rothaug and Jade Starkey of JLL’s Debt Advisory team arranged the three-year, floating-rate loan on behalf of the borrower, Agador Spartacus Development, through a domestic investment management firm and its international mezzanine debt partner. Completed in January 2025, Magnolia at Powell is situated just outside of The Villages and is currently 40 percent occupied. The complex, which is an age-inclusive housing option, offers one-, two- and three-bedroom townhomes averaging 1,162 square feet in size. Amenities include a resort-style swimming pool, fitness center, pickleball court and a dog park. Monthly rental rates for a one-bedroom townhome at Magnolia at Powell begin at $1,350, according to Apartments.com.

Marcus & Millichap Brokers Sale of 164-Unit Apartment Community Near Mississippi State University

by Abby Cox

STARKVILLE, MISS. — Marcus & Millichap has brokered the sale of The Grove Apartments, a 164-unit community located in Starkville near Mississippi State University. Originally built in 1975, the property is situated on 10 acres and features a mix of one-, two- and three-bedroom floorplans ranging in size from 704 square feet to 1,028 square feet, according to ForRent.com. Amenities include laundry facilities and a dog park, as well as onsite management and maintenance. Josh Jacobs and Lloyd Escue of Marcus & Millichap marketed the property on behalf of the seller, MRKT Capital, and procured the buyer, Emerald City Associates, in the transaction. Mickey Davis was the firm’s broker of record in Mississippi.

WHITE PLAINS, N.Y. — A partnership between New York City-based owner-operator RXR and Korman Communities has begun leasing 5 Cottage, a 307-unit apartment building in White Plains. The building represents the second phase of a larger development known as AVE Hamilton Green that also features 515 underground parking spaces, 55,000 square feet of open space and 26,000 square feet of commercial space. Units are available in studio to three-bedroom floor plans, as well as in penthouses and live/work loft apartments. Specific residential amenities include indoor gaming areas, coworking spaces, a speakeasy bar, golf simulator, children’s playroom, private chef’s dining room, indoor pool and outdoor grilling and dining stations. RXR and Korman have also leased 85 percent of the 170 units at the first building within AVE Hamilton Green, 25 Cottage. Rents start at $2,366 per month for a studio apartment.

LIVINGSTON, N.J. — New York City-based Kushner has broken ground on Livana Livingston, a 280-unit multifamily project in Northern New Jersey. Designed by Lessard Architecture, Livana Livingston will feature two buildings, one of which has been designed for renters age 55 and above, that will be developed on the adjacent sites of the former Westminster Hotel and Somerset Regal Bank. Units will come in one- and two-bedroom formats, and both unit types will offer floor plans that include dens. Amenities will include a fitness center, sauna and steam rooms, coworking space, a clubroom, private dining room, game room, rooftop terrace, pickleball courts, pet spa and a community garden lawn. Completion is slated for 2027.

BEVERLY, MASS. — A partnership between two nonprofit owner-operators, Beacon Communities ad Harborlight Homes, has completed a multifamily adaptive reuse project in Beverly, a northeastern suburb of Boston. Beverly Village for Living & The Arts is a redevelopment of the former Briscoe School, which was originally built in 1923 and closed in 2018, into an affordable seniors housing complex. Of the complex’s 91 units, 85 are subject to income restrictions, while the other six units will be rented as live-work studios at market rates. The conversion involved preserving historic elements of the building, such as the windows and façade, while also installing sustainable utility systems.

INDIANAPOLIS — CBRE has arranged the sale of Riverbend Apartments, a 996-unit multifamily property in Indianapolis. Pensam Capital purchased the community from Pepper Pike Capital Partners for an undisclosed price. Located at 8850 River Bend Parkway, the property has undergone more than $20 million in renovations since 2020. Amenities include a pool, fitness center, tennis and basketball courts, a movie theater and golf simulator. Units average 895 square feet. Hannah Ott, George Tikijian, Cam Benz, Claire Hassfurther, Ryan Stockamp and Sean Pingel of CBRE represented the seller.