BRADFORDVILLE, FLA. — Mesa Capital Partners has broken ground on The Bradbury at Bannerman Village, an apartment community located on a 14-acre site in Bradfordville, a city located north of downtown Tallahassee. The property will be located at Bannerman and Bull Headley roads within the Bannerman Village master-planned community. Situated near a Publix and the Landon Hill for-sale homes, The Bradbury will comprise two-story carriage homes and three-story walk-up buildings. Amenities will include a clubhouse, fitness center, sundry market, resort-style pool with grilling stations, dog park, EV charging stations and garage parking. Cadence Bank and SouthState Bank provided an undisclosed amount of construction financing to Mesa Capital Partners for the project, which will begin leasing in mid-2026 and be fully delivered in early 2027. The design-build team includes general contractor The Crown Group and architect The Coursey Group.

Multifamily

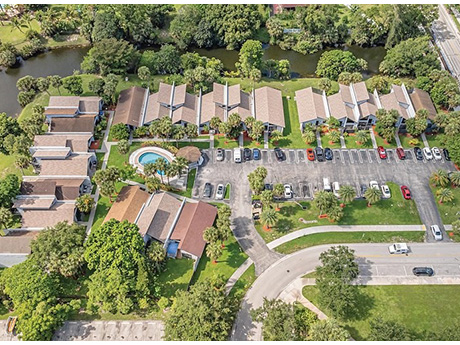

Marcus & Millichap Brokers $6.2M Sale of Multifamily Community in Royal Palm Beach, Florida

by John Nelson

ROYAL PALM BEACH, FLA. — Marcus & Millichap has brokered the $6.2 million sale of Timbercreek Townhomes and Villas, a 20-unit multifamily community located at 100 Sparrow Drive in Royal Palm Beach, about 12 miles west of West Palm Beach. Evan Kristol and Brandon Rex of Marcus & Millichap represented the seller, a private syndicator, and procured the buyer, a California-based investment group, in the transaction. The buyer purchased the community as part of a 1031 exchange. Both parties requested anonymity. Built in 1980, Timbercreek Townhomes and Villas features a gated swimming pool, gazebo and landscaped grounds.

HOUSTON — Transwestern has arranged the sale of a multifamily development site in South Houston. The site at 1500 Old Spanish Trail spans 2.1 acres within the 1500 OST master-planned development. The buyer, Houston-based developer Winther Investments, plans to develop a five-story, 280-unit building on the site. Jeff Peden and Scott Miller of Transwestern represented the seller, an entity doing business as 1500 OST LLC, in the transaction.

BOERNE, TEXAS — The Multifamily Group (TMG), a Dallas-based brokerage firm, has negotiated the sale of The Vistas, a 100-unit apartment complex in Boerne, a northeastern suburb of San Antonio. Built in 2001, the pet-friendly property offers one-, two- and three-bedroom units, as well as a pool and onsite laundry facilities. The buyer and seller were not disclosed.

WOONSOCKET, R.I. — The BLVD Group, a multifamily investment firm with offices in Los Angeles and Dallas, has purchased Rock Ridge Apartments, a 152-unit multifamily complex in Woonsocket, located on the Massachusetts-Rhode Island border. The company plans to reposition the property to add 30 new affordable housing units, restricting all residences to renters earning up to 50 or 60 percent of the area median income. The acquisition and renovation are being financed through Low-Income Housing Tax Credits and tax-exempt bonds issued by Rhode Island Housing with a permanent Fannie Mae loan. Additional funding includes equity from the sale of renewable energy tax credits, a construction loan from Merchants Bank and a permanent Fannie Mae loan. The renovation will involve the replacement of the majority of the building envelope and full interior upgrades, such as modernized kitchens and baths, as well as enhanced building systems. Additional community amenities include a renovated basketball court, clubhouse and grilling stations.

JERSEY CITY, N.J. — Bayfront Development Partners, which is a joint venture between Pennrose LLC and Paths Development LLC, has broken ground on Bayfront Promenade, a 210-unit mixed-income multifamily project in Jersey City. The development will be located on the Hackensack River Waterfront and will include 74 affordable housing units and 93 workforce housing units, as well as commercial and community space. Amenities will include a rooftop terrace, fitness center with a yoga room, coworking lounge and community room with a kitchen area. The New Jersey Economic Development Authority provided $64 million in tax credits for the project, a tentative completion date for which was not announced.

SAN JOSE, CALIF. — Marcus & Millichap has arranged the sale of Lakewood Court Apartments, a 48-unit multifamily property in San Jose. A private investor sold the property to an undisclosed buyer for $18.9 million. Adam Levin, Robert Johnston, Eymon Binesh and Mark Kis of Levin Johnston of Marcus & Millichap handled the transaction, including sourcing the buyer. Built in 1989 on 1.6 acres, Lakewood Court Apartments features 22 one-bedroom/one-bath units, four one-bedroom/one-bath lofts, 12 two-bedroom/one-bathroom units and six two-bedroom/two-bath units. In-unit amenities include granite countertops, stainless steel appliances, fireplaces, walk-in closets, balconies, patios and porches. The community includes a pool, spa, rooftop terrace and laundry facilities. Lakewood Court Apartments is located at 1953 Via Reggio Court.

CARMEL, IND. — Skender Construction has broken ground on Ardalan Plaza, a $19 million development that will serve as a gateway to the City of Carmel’s Arts & Design District. Located at 311-331 W. Main St., the property will encompass 8,000 square feet of retail and gallery space on the first floor, five luxury condominiums on the second floor and a private residence with a rooftop terrace spanning the third floor. The project, which was designed to evoke the elegance of an Italian villa, is a collaboration between the Carmel Redevelopment Commission and the Ardalan family. The project team includes Studio M Architecture and Planning and KBSO Consulting Engineers. Completion is slated for 2026.

MEDIA, PA. — CBRE has arranged a $28.5 million construction loan for Mi-Place at Media, a 132-unit multifamily project that will be located about 25 miles southwest of Philadelphia. The project will consist of three four-story buildings and 245 parking spaces. Amenities will include a lounge, fitness center, dog park and outdoor grilling and dining stations. Matthew Klauer and Cassandra Russell of CBRE arranged the loan through SteepRock Capital on behalf of the sponsor, Fernmoor Homes. A tentative completion date was not disclosed.

Affordable Housing Developers Aim to Control What They Can Control, Say InterFace Panelists

by John Nelson

ATLANTA — Interest rates. Tariffs. Natural disasters. These three factors alone frighten any developer, let alone those who are tasked with delivering our nation’s affordable housing supply. Just to get to the ribbon-cutting ceremony, developers have an uphill climb. They have to obtain the land outright or in a ground lease agreement, navigate the permitting and entitlement processes, overcome any neighborhood pushback, raise equity and borrow the necessary capital and then build these communities on time and on budget. Editor’s note: InterFace Conference Group, a division of France Media Inc., produces networking and educational conferences for commercial real estate executives. To sign up for email announcements about specific events, visit www.interfaceconferencegroup.com/subscribe. “We try to stay in control of what we’re in control of,” said Christopher Byrd, Southeast region development director of LDG Development, an affordable housing developer based in Louisville, Ky. “As long as we are in the right markets with the right growth and the right partners, we are safe and insulated.” Byrd’s comments came while on stage during the development panel at InterFace Affordable Housing Southeast, a networking and information conference held at the Cobb Galleria Centre in Atlanta on Tuesday, May 7. Kelly Williams, vice president of …