THE WOODLANDS, TEXAS — Marquette Cos., an Illinois-based developer, has begun leasing The Sylvan, a 300-unit residential project located about 30 miles north of Houston in The Woodlands. The Sylvan consists of 188 single-family rentals and townhouses and 112 apartments. Single-family homes feature three- and four-bedroom floor plans, range in size from 1,495 to 1,805 square feet and include private yards and garages. Ranging from 1,456 to 1,581 square feet, townhomes have two- and three-bedroom floor plans with attached garages and private outdoor space. Apartments come in one-, two- and three-bedroom formats and range in size from 650 to 1,574 square feet. Amenities include a clubhouse, pool, fitness center and walking paths. Rents start at $1,700 per month for a one-bedroom unit. Construction of The Sylvan began in October 2023.

Multifamily

NEW YORK CITY — A partnership between Brisa Builders Development LLC and PMG Affordable has received $51.7 million in financing for a 92-unit affordable housing project that will be located in the Far Rockaway area of Queens. The financing package primarily consists of $28.4 million in construction financing from Bank of America; a $12.9 million supportive housing loan from the New York City Department of Housing Preservation & Development; and $8.3 million from the New York State Homes & Community Renewal. The capital stack also includes $23.7 million in Low-Income Housing Tax Credit equity. The nine-story building at 19-19 Cornaga Ave. will offer studio, one- and two-bedroom residences ranging in size from 331 to 652 square feet, with 60 units to be designated as supportive housing units and the other 30 to serve as Federal Housing Trust units. Amenities will include a fitness center, lounge, computer room and a multi-purpose room to accommodate community programs, classes and recreational activities, as well as an outdoor courtyard with a playground. Urban Atelier Group is the general contractor for the project, and Paul Castrucci Architects is handling design. Completion is slated for late 2026.

Muinzer, Kayne Anderson Recapitalize 1,356-Bed Student Housing Portfolio Near University of Tennessee

by John Nelson

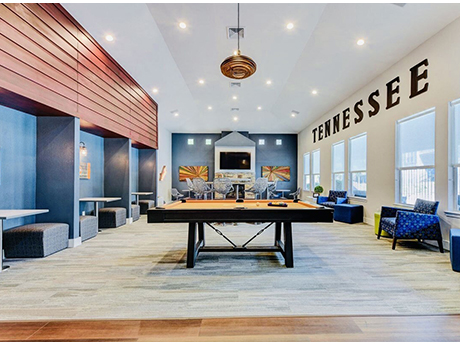

KNOXVILLE, TENN. — Private equity investment firm Muinzer has partnered with Kayne Anderson Real Estate to recapitalize a two-property student housing portfolio near the University of Tennessee in Knoxville. The 1,356-bed portfolio, which includes The Heights of Knoxville and University Park, was fully occupied at the time of the transaction. Scott Clifton, Kevin Kazlow and Teddy Leatherman of JLL arranged the recapitalization. Los Angeles-based Muinzer originally acquired the two student housing properties in 2021 in a partnership with T2 Capital Management. Further details of the company’s recapitalization with Kayne Anderson were not released.

VIRGINIA BEACH, VA. — Alexandria, Va.-based Bonaventure has purchased Solace Apartments, a 250-unit multifamily community located at 400 S. Military Highway in Virginia Beach. The acquisition was made as an UPREIT transaction, an investment strategy where property owners contribute real estate to a REIT’s operating partnership in exchange for ownership interest in that partnership. Robert Prodan served as a contributor with Bonaventure’s REIT, Bonaventure Multifamily Income Trust (BMIT), in the UPREIT acquisition. The seller and sales price were not disclosed. Built in 2014, Solace features one- and two-bedroom apartments, as well as a pool, fitness center, grilling stations and a community clubhouse.

DUARTE, CALIF. — MBK Rental Living has opened Solana at Duarte Station, a five-story apartment community located at 1740 Fasana Road in Duarte. The community offers 292 studio, one-, two-, three- and four-bedroom apartments, ranging from 534 square feet to 2,802 square feet. Each unit features open floor plans, natural light and oversized low-E windows. Select floor plans feature private patios or balconies and walk-in closets. Community amenities include a clubhouse, fitness center and yoga studio, coworking spaces, a pool, game lounge, dog lounge, spa and park, a cabana club and social courtyard equipped with outdoor kitchen and dining areas, fire pits and lounge chairs.

WEST BEND, WIS. — CBRE has brokered the sale of Cast Iron Luxury Living, a 129-unit multifamily property in West Bend, about 39 miles northwest of Milwaukee. A partnership of local buyers purchased the asset from Hendricks Commercial Properties for $21 million. The property was formerly home to The West Bend Co., a cookware and appliance manufacturing-based business that had occupied the site since 1911. The asset was renovated in 2015 and converted into a mixed-use apartment community in 2017 with 45,748 square feet of ground-floor commercial space. Current tenants include Kettle Moraine YMCA, West Bend Pediatrics-Children’s Wisconsin and the West Bend Area Chamber of Commerce, along with restaurants Café Floriana and The Grün Hexe Kitchen & Catering. Cast Iron Luxury Living features a range of studio through three-bedroom units. Amenities include a business center, club and media room, garage parking, car spa and a self-service canteen convenience shop. Matson Holbrook, Patrick Gallagher, Gretchen Richards, Sean Beuche and Peter Langhoff of CBRE represented the seller.

Late last summer, optimism ran steady across the multifamily investment sales market. Prior to the Federal Reserve’s initial rate cut in September 2024, interest rates had remained stable throughout the year. The outlook was positive. But that more ebullient market proved temporary. The Fed’s interest rate cut had a positive effect on the secured overnight financing rate (SOFR), which fell from 5.3 percent on Sept. 18, 2024, to 4.3 percent in early February 2025. The U.S. 10-year Treasury yield rose during the same period. On Sept. 18, 2024, the 10-year yield closed at approximately 3.7 percent, and it stands at 4.5 percent as of Feb. 17. As a result of these factors, a bid-ask spread between apartment buyers and sellers has re-emerged, and transactions largely continue to follow the lackluster pace emblematic of the market since the cost of capital skyrocketed over a roughly 18-month period beginning in early 2022. The lack of sales has also suppressed the plans of property investors who want to take advantage of Section 1031 of the U.S. Internal Revenue Code. The provision allows sellers to defer paying capital gains taxes by using the sales proceeds to buy a similar, or “like-kind,” asset. But upon …

Subtext, Larson Capital Management to Develop 1,738-Bed Student Housing Project Near Texas A&M University

by John Nelson

COLLEGE STATION, TEXAS — Subtext, a student housing and multifamily owner-operator based in St. Louis, has partnered with Larson Capital Management for a two-phase student housing development near Texas A&M University in College Station. The project will include EVER College Station (176 units, 545 beds) and VERVE College Station (382 units, 1,193 beds), which will be situated across the street from one another in the city’s Northgate Entertainment District, less than two blocks from campus. EVER will rise seven stories at 401 Stasney St. and include 420 parking spaces, while VERVE will rise 21 stories at 311 Stasney St. and feature 882 parking spaces. The properties will feature layouts ranging from studios to five-bedroom apartments, as well as a combined 55,000 square feet of amenity space (29,000 square feet of indoor and 26,000 square feet of outdoor). The specific amenity offerings will include open lounges, study rooms, a coffee bar, mini market, fitness center, sauna, meditation rooms, outdoor fitness spaces, multi-sport simulator, indoor/outdoor bar and kitchen. Other amenities will include a resort-style pool with poolside cabanas, a jumbotron TV and a sky lounge with a spa, as well as outdoor grilling stations, fire pits, a dog run and a game …

THE COLONY, TEXAS — Multifamily developer JPI has broken ground on Jefferson Morningstar, a 373-unit project in The Colony, a northern suburb of Dallas. The garden-style property will offer studio, one-, two- and three-bedroom apartments. Amenities will include a pool, fitness center, dog park, coworking spaces and a clubhouse. JPI is partnering with Nomura Real Estate Development Co. Ltd. and Yoram Avneri, the original owner of the land, on the project. The first residences are expected to be available for occupancy by early 2027.

BURLESON, TEXAS — San Antonio-based developer Vantage Communities has sold a 288-unit apartment complex in Burleson, a southern suburb of Fort Worth. Vantage at Burleson was completed in 2024 and offers one-, two- and three-bedroom units with an average size of 856 square feet. Amenities include a pool, fitness center, clubhouse and two dog parks. Will Balthrope, Drew Garza, Drew Kile, Taylor Hill, Joey Tumminello, Michael Ware and Cameron Purse of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented Vantage Communities in the transaction. The team also procured the undisclosed buyer, which has since rebranded the property as Fairmount Oaks.