MARLBORO, N.Y. — A partnership between Baxter Development and Rieger Homes has completed Hudson West, a 104-unit apartment complex in Marlboro, about 80 miles north of New York City. Hudson West comprises five buildings that house 84 two-bedroom units and 20 three-bedroom units. Residences range in size from 1,100 to 1,400 square feet. Amenities include a fitness center, clubroom and outdoor green space. Rents start at $2,500 per month for a two-bedroom apartment. Hudson West was 70 percent preleased at the time of completion.

Multifamily

MonticelloAM Provides $87M Bridge and Working Capital Financing for Skilled Nursing Portfolio in Florida

by John Nelson

NEW YORK CITY — Multifamily and seniors housing bridge lending platform MONTICELLOAM LLC (MonticelloAM) has provided $87 million in bridge and working capital financing for a portfolio of skilled nursing facilities located in Florida. The portfolio comprises 450 skilled nursing beds across four properties. Proceeds from the loan, which features a 24-month term and two six-month extensions, were used to refinance existing debt on the properties. A $7 million working capital revolver will fund day-to-day operational expenses for the facilities. The borrower was not disclosed.

OXFORD, FLA. — JLL has brokered the sale of The Mark at Wildwood, a newly built, 294-unit apartment community located at 3795 Bismark Court in Oxford. The property sits at the northwest corner of The Villages master-planned community in Central Florida’s Sumter County. Cliff Taylor, Joe Ayers, Ryan Hixon, Tucker Brooks and Mike Scott of JLL represented the sellers, Varden Capital Properties and Tellus Partners, in the transaction. TriBridge Residential purchased the property for an undisclosed price. Completed in 2023, The Mark at Wildwood features a mix of one-, two- and three-bedroom flat and carriage home-style units. Amenities include a resort-style pool and a clubhouse.

JLL Secures $45M Acquisition Financing for Garden Village Student Housing Community Near UC Berkeley

by Amy Works

BERKELEY, CALIF. — JLL Capital Markets has secured $45 million in financing for Hawkins Way Capital’s acquisition of Garden Village, a student housing community in Berkeley. Located at 2201 Dwight Way, Garden Village offers 77 residential units for students. The property will be operated as the FOUND Study Southside Berkeley and will be managed by FCL Management. Built in 2016 near the University of California, Berkeley (UC Berkeley), the mid-rise property offers a mix of two- and four-bedroom floor plans, a rooftop farm and flower garden, secured access, outdoor patios, an indoor lounge, laundry room, fitness center and bike storage. The community consists of 18 buildings, totaling 64,301 square feet. Brandon Smith, Annie Rice and Gyasi Edmondson of JLL Capital Market’s Debt Advisory arranged the two-year, floating-rate loan through Limekiln Real Estate Investment Management. The financing package includes an initial funding of $36 million, with an additional $9 million available for future funding.

LOMBARD, ILL. — SVN Chicago Commercial has brokered the sale of a seven-unit multifamily property in the Chicago suburb of Lombard for $1.2 million. The sales price marked one of the highest price-per-door transactions in Lombard to date, according to SVN. The 5,950-square-foot property is located at 143 E. Grove St. Joe Connelly of SVN represented the seller, while David Szymanowski of SVN represented the all-cash buyer.

— By Ben Galles, senior vice president of CBRE — Interest rates have been the biggest factor for Reno’s multifamily market this year, reaching some of the highest levels seen in a long time. The market for multifamily properties in Northern Nevada has been slow to adjust to the new lending environment, with sellers unwilling to price assets at a rate of return that would provide most buyers with positive leverage. In other words, the interest rate on loans used to purchase many of the current listings is higher than said property’s cap rate. Multifamily sales volume in Northern Nevada is down 14 percent compared to the same time last year. One of the major drivers for the drop in sales volume is that only three deals have secured bank debt, with the average loan to value (LTV) of those loans being roughly 48 percent. While cash transactions have represented more than 58 percent of the transactions, a large percentage of deals have involved owner financing. Some owners who needed to move their assets over the past 12 months found that offering below-market interest rate owner financing was a significant selling point. Many of the deals that closed with owner …

REDMOND, WASH. — JLL has arranged the $286 million sale of Parkside Apartments, a 664-unit apartment community in Redmond, a northeastern suburb of Seattle and home market of Microsoft. The seller was a partnership between a Texas-based group of investors, previously associated with Dallas-based Lincoln Property Co. Residential and Daiwa House Texas. The buyer was Lakevision Capital, a Silicon Valley-based multifamily investment firm that was founded in 2018. David Young, Corey Marx and Chris Ross of JLL represented the seller and procured the buyer in the transaction. Puget Sound Business Journal reports that the sale is the largest multifamily transaction in 2024 for Washington’s Puget Sound region. Buil in 2021 on 4.5 acres within the Esterra Park master-planned community, Parkside Apartments consists of four five- to eight-story buildings that house studio, one- and two-bedroom units. Residences feature quartz countertops, stainless steel appliances, private balconies, walk-in closets and individual washers and dryers. Amenities include multiple rooftop decks and fitness centers, as well as a pet wash station, entertainment suite and a game lounge. “Parkside Apartments exemplifies the vibrant, well-connected living experience that is highly sought after in this thriving tech region,” said Jason Byrne, who is managing member for the investment. — …

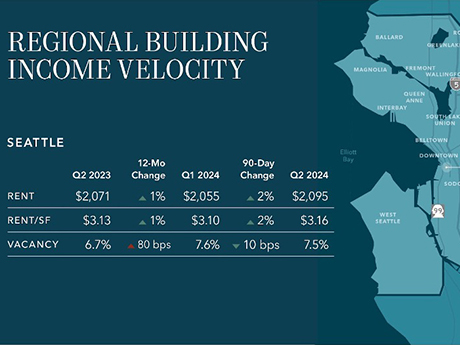

— By Dylan Simon, executive vice president, Kidder Mathews — This summer marked a major milestone in Seattle’s apartment market, demonstrating signs of vibrancy with increases in rental rates, growing liquidity and clarity in pricing in capital transactions. The city is gaining momentum and continues to bounce back from recent market fluctuations and the harsh impacts of the pandemic. Urbanization is here to stay — corporate employers are voting against Zoom as an effective tool — as we trend back toward human nature, which requires community and proximity. With limited new construction breaking ground, the stage is set for sustained rental rate growth, which will invariably result in a surge in sales prices. Transaction Activity on the Rise Transaction activity is steadily on the rise in Seattle’s multifamily market, proving conviction from the investment community. This uptick offers greater clarity on property values as the market adjusts from peak interest rates back in fall 2023. For owners and potential sellers, this shift suggests pricing hit a bottom in the past nine months and the only direction in pricing from here is upward. In our recently launched third-quarter Seattle market report, we’ve uncovered key sales insights that underscore this resurgence. During the …

PETALUMA, CALIF. — MBK Rental Living has completed the development of The Haven at Deer Creek, a Class A apartment property located at 495 N. McDowell Blvd. in Petaluma. The Haven at Deer Creek offers 134 three-story garden-style and three-story podium-style apartments. The community features 93 one-bedroom units and 41 two-bedroom units ranging from 715 square feet to 1,206 square feet, with rents ranging from $2,350 for a one-bedroom to $2,858 for a two-bedroom. The units offer open floor plans with ample natural light, stainless steel appliances, wood-style plank flooring, quartz countertops, ceiling fans, kitchen tile backsplashes, undermount stainless steel sinks, private patios or balconies, in-unit washers/dryers and double-pane, low-E windows. Community amenities include an outdoor living area featuring a spa, grilling stations, a pizza oven and fireplace. The resident lounge offers a fireplace, communal tables, dedicated work-from-home areas, a pool table and a fully equipped entertainer’s kitchen.

MBA: Third-Quarter Commercial, Multifamily Borrowing Increased 59 Percent Year-Over-Year

by John Nelson

WASHINGTON, D.C. — Commercial and multifamily mortgage loan originations increased 59 percent in the third quarter of 2024 compared to a year ago, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. The third-quarter volume also represents a 44 percent increase from the second quarter. There was a 510 percent year-over-year increase in the dollar volume of loans for healthcare properties, a 99 percent increase for hotel properties, 82 percent increase for retail properties, 57 percent increase for industrial properties and a 56 percent increase for multifamily properties. Office real estate originations decreased 3 percent from a year ago. Among investor types, the dollar volume of loans originated for commercial mortgage-backed securities (CMBS) increased by 260 percent year-over-year. There was a 69 percent increase for depository (i.e. bank) loans, a 62 percent increase for investor-driven lender loans, 31 percent increase in loans for life insurance companies and a 28 percent increase in loans from government-sponsored enterprises (GSEs, namely Fannie Mae and Freddie Mac). Jamie Woodwell, MBA’s head of commercial real estate research, says that lower interest rates due in part to the Federal Reserve’s 50-basis-point decrease in September were “a key driver” for the uptick …