CHICOPEE, MASS. — Regional brokerage firm Northeast Private Client Group (NEPCG) has arranged the $10.5 million sale of Brook Edge Apartments, an 82-unit multifamily complex in the western Massachusetts city of Chicopee. The property, which according to Apartments.com was built in 1970, comprises 36 studios, 30 one-bedroom units and 16 two-bedroom apartments. Taylor Perun of NEPCG represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

Multifamily

FORT COLLINS, COLO. — Green Leaf Partners Management has purchased Alvista Harmony, a garden-style multifamily community in Fort Collins, from an affiliate of Phoenix Realty Group and its joint venture partner. Located at 2002 Battlecreek Drive, the property comprises 16 two- and three-story buildings offering 280 one- and two-bedroom units with an average size of 924 square feet. All units feature walk-in closets, private balconies or patios and a washer and dryer. Community amenities include a clubhouse, business center, fitness center, swimming pool, hot tub, grill station, playground, pet park, dog wash, onsite bike storage, 380 surface parking spaces and 96 detached garages. Phoenix Realty Group has completed renovations to the clubhouse and common areas and has fully renovated 116 units. Previous ownership upgraded 52 of the units, with 42 additional units including finish levels comparable to the classic interior scope. Shane Ozment, Terrance Hunt, Andy Hellman, Justin Hunt, Chris Hart and Brad Schlafer of CBRE represented the seller in the deal.

Greystar Divests of 589-Bed Hale Mahana Student Housing Property Near University of Hawaii at Manoa

by Amy Works

HONOLULU — Greystar has completed the fee-simple sale of Hale Mahana, a student housing property located at 2615 S. King St. in Honolulu. A joint venture between Timberline Real Estate Ventures and an Ares Management Real Estate fund acquired the asset, which is 0.2 miles from the University of Hawaii at Manoa campus, for an undisclosed price. Built in 2018, the 191-unit Hale Mahana offers 589 beds, study rooms, a computer lab, covered parking, fitness center, rooftop deck with grilling stations and ground-level retail space, including Raising Cane’s Chicken Fingers and Jersey Mike’s Subs. The complex offers one-, two-, three- and four-bedroom, fully furnished units with equipped kitchens featuring stainless steel appliances. JLL Capital Markets represented the seller and procured the buyer in the transaction.

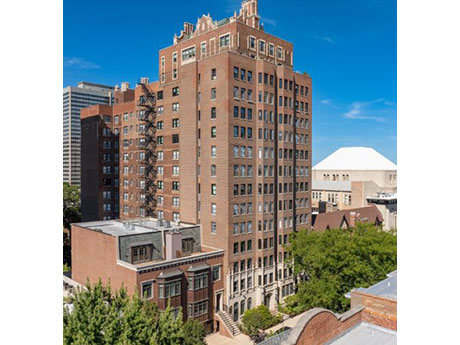

CHICAGO — Greystone has provided an $18.2 million Fannie Mae loan for the acquisition of Cornelia-Stratford in Chicago. Originally constructed in 1927, the 139-unit multifamily property features studio, one-, two-, three- and four-bedroom units. Amenities include bike storage, laundry facilities and a tenant lounge. Clint Darby and Andrew Remenschneider of Greystone originated the nonrecourse loan, which features a fixed interest rate, 15-year term and five years of interest-only payments. The borrower was undisclosed.

HIGHLAND PARK, ILL. — Colliers has arranged the $7.4 million sale of a 55,033-square-foot commercial building in the Chicago suburb of Highland Park. Located at 1770 1st St., the property features 17 apartment units on the upper three floors and 36,000 square feet of medical office space home to Robb Orthodontics, Highland Park Maxillofacial & Implant Surgery and Pediatric Dentistry of the North Shore. The apartment units are fully leased, and the medical office portion is 61 percent leased. Constructed in 1988, the building sits atop a 447-space public parking garage and is across the street from the Highland Park Metra stop. Alissa Adler, John Homsher, Tyler Hague and Lauren Stoliar of Colliers represented the seller, Fulton Design + Build. QMR Partners was the buyer.

AUSTIN, TEXAS — Merchants Capital has provided debt and equity financing for Travis Park Apartments, a 199-unit affordable housing complex in south-central Austin. The sponsor, Sena Affordable Communities, will use the proceeds to acquire and rehabilitate the property, which comprises 22 buildings. Merchants provided a $69.1 million Freddie Mac 4 Percent Low-Income Housing Tax Credit (LIHTC) Immediate TEL loan and $37.6 million in LIHTC equity as the syndicator, as well as a $29 million equity bridge loan for the rehabilitation period. Renovations are expected to take about 18 months to complete and will include the addition of new outdoor recreation areas and playgrounds; accessibility upgrades; window replacement; new boiler and cooling towers; kitchen and bathroom improvements; new energy star appliances; replacement of original fan coil units for heating and cooling; building envelope upgrades; and roof replacement and new signage. Michael Milazzo led the transaction for Merchants Capital.

SAN ANTONIO — Dallas-based developer Palladium USA has broken ground on a $79 million, 321-unit mixed-income multifamily project in San Antonio. Palladium Old FM 471 will be located on an 11-acre site on the city’s west side and will offer one-, two- and three-bedroom units that will be reserved for households earning between 30 and 80 percent of the area median income. Amenities will include a pool, fitness center, conference room, dog park, business center and a children’s playroom. Cross Architects is designing the project, and Brownstone Group is serving as the general contractor. HPA Design Group is handling interior design. Palladium is developing the project in partnership with the Bexar Management Development Corp. PNC Bank provided $32 million of equity and more than $35 million in long-term debt to the development team, and Texas Department of Housing and Community Affairs issued $36 million in tax-exempt bonds to finance the project. Preleasing is scheduled to begin next fall.

Walker & Dunlop Arranges $72.8M HUD-Insured Loan for Apartment Development in Panama City Beach

by John Nelson

PANAMA CITY BEACH, FLA. — Walker & Dunlop has arranged a $72.8 million construction loan for Vintage Lake Powell, a 289-unit apartment development located at 24000 Panama City Beach Parkway in Panama City Beach. Keith Melton and David Strange of Walker & Dunlop originated the HUD 221(d)(4) loan on behalf of the developers, Oldacre McDonald LLC and TDK Construction LLC. Planned amenities at Vintage Lake Powell include a clubhouse and leasing center, fitness facility, package/storage center, resort-style pool and sundeck, arbor with outdoor seating and grilling station, pickleball and bocce ball court, playground, dog park and a lakefront amenity area on Lake Powell. Additionally, the property will include 19,783 square feet of ground-level retail spaces fronting Panama City Beach Parkway. The construction timeline was not disclosed.

MOORESVILLE, N.C. — Berkadia has brokered the $14.5 million sale of Townes at Lake Norman, a 116-lot townhome development site located at 752 River Highway in the northern Charlotte suburb of Mooresville. The seller is North Carolina-based Evolve Cos., which is developing an apartment community that includes the 116-lot townhome site called Evolve at Lake Norman. The developer plans to deliver first units later this month and has tapped Hawthorne Residential to operate the community. Caleb Troop, Thomas Colaiezzi and Matt Robertson of Berkadia represented the seller in the transaction. The buyer was not disclosed.

Senior Resource Group Acquires, Rebrands 199-Unit Seniors Housing Property in Los Angeles

by Amy Works

LOS ANGELES — Senior Resources Group (SRG) has purchased Fountainview at Gonda, a seniors housing community in the Playa Vista submarket of Los Angeles, from Los Angeles Jewish Health (LAJHealth) for an undisclosed price. In conjunction with the acquisition, SRG has renamed the property Avocet Playa Vista. A continuing-care retirement community (CCRC), the 199-residence Avocet Playa Vista offers 175 independent living, 12 assisted living and 12 memory care units. Built in 2017 and designed by Gensler, Avocet Playa Vista residences are part of the Playa Vista homeowners association, enabling access to a full-service community with a full-service restaurant, bar/bistro, performing arts theatre, arts center, indoor pool and fitness center, mind and body programs, cultural events and onsite rehabilitative health care. SRG is committed to maintaining the Jewish values foundational to the community and its residents.