NEWPORT BEACH, CALIF. — JLL has arranged $52 million in refinancing for Atria Newport Beach, a seniors housing community located at 393 Hospital Road in Newport Beach. The borrower is a partnership between a national REIT and Atria Senior Living. Aaron Rosenzwieg and Dan Baker of JLL Capital Markets arranged the financing. MidCap Financial provided the floating-rate, first-mortgage loan. Built in two phases with the north building fully renovated in 2023 and the south building purpose-built and opened in 2021, the three-story buildings offer a total of 168 studio, one- and two-bedroom independent living, assisted living and memory care units. Community amenities include 24-hour support staff, all-day dining, valet and concierge services, fitness classes, car services, housekeeping, a salon and spa, yoga studio, theatre, library, game room and underground parking garage.

Multifamily

By Derrick Barker, founder and CEO, Nectar Many founders and CEOs in commercial real estate have seen their fair share of market cycles. Analyzing today’s affordable housing crisis within the current multifamily rental market lends itself to sharing personal insights and most importantly, discussing how we can address these challenges head-on. A Cautionary Tale from 2013 Consider this personal story as anecdotal evidence. In 2013, this writer, a private investor at the time, acquired an apartment complex in Austell, Georgia, a suburb of Atlanta. It was a prime investment: cash-flowing and competitively priced due to it being a buyer’s market. For a while, we were the crown jewel of the submarket, which gave us a competitive advantage when leasing. But the tide turned quickly. Neighboring properties that were previously underperforming sold at discounts. New owners used their cost savings to renovate and undercut our rental rates. Suddenly, our competitive edge vanished, and we found ourselves with overpriced, outdated units. This experience imparted a crucial lesson: In real estate, you must always be prepared for market shifts — because the market ALWAYS shifts. Fast forward to today, and we’re seeing some eerily familiar patterns in the following areas: The Developer’s Dilemma …

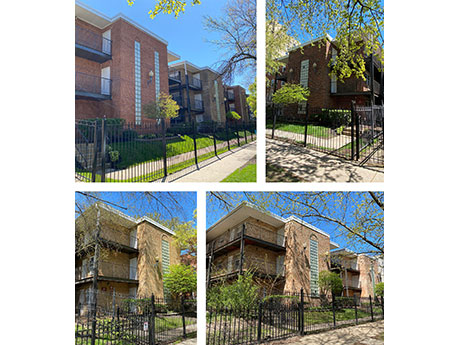

CHICAGO — Kiser Group has brokered the $17.2 million sale of Ravenswood Gardens, a multifamily portfolio consisting of 151 units across seven buildings in the Sheridan Park Historic District of Chicago’s Uptown neighborhood. Katie LeGrand, Lee Kiser and Jacob Price of Kiser brokered the transaction. Initially marketed in summer 2023, the portfolio went under contract but did not close due to market volatility. The seller, continuing its strategic exit from Chicago, revisited the sale in 2024. The buyer plans to reposition the units and rebrand them as Sheridan Park. The buyer assumed the seller’s existing loan, which features an interest rate below 4 percent for the next five years. The buyer now owns more than 400 units in the Uptown neighborhood.

Landmark Properties Delivers 759-Bed Student Housing Community Near University of South Florida

by John Nelson

TAMPA, FLA. — Landmark Properties has delivered The Metropolitan Tampa, a 759-bed student housing development located at 2701 E. Fowler Ave. near the University of South Florida (USF) campus in Tampa. The community offers 276 fully furnished units in studio through four-bedroom configurations. Shared amenities at the property include an outdoor rooftop swimming pool, jumbotron, grilling areas, a gaming lawn, two courtyards, fitness center, study centers and onsite parking. The development also features 1,700 square feet of retail space at the ground level. The development team for the five-story project included Niles Bolton Associates and Landmark Construction, the in-house construction arm of Athens, Ga.-based Landmark Properties.

DAVENPORT, FLA. — JLL has arranged a $69.6 million loan for the refinancing for Phase I of Atlantica at Town Center, a multifamily community located at 1121 Loblolly Lane in the Orlando suburb of Davenport. Phase I of the property, which was delivered in December 2022, comprises 360 units. Gregory Nalbandian, Kenny Cutler and Josh Odessky of JLL arranged the two-year, floating-rate bridge loan through Timbercreek Capital on behalf of the borrowers, Sovereign Properties and Invest Capital Group. Atlantica at Town Center features one-, two- and three-bedroom units ranging in size from 683 to 1,435 square feet, as well as a resort-style pool, gaming lawn, dog park, pet spa, fitness center, yoga and spin room, demonstration kitchen and coworking space.

SAVANNAH, GA. — Berkadia has secured a $24.4 million loan for the refinancing of River Walk Savannah, a 220-unit apartment community located at 101 Saint George Blvd. in Savannah. Mitch Sinberg, Scott Wadler, Brad Williamson, Matthew Robbins and Hugo Hernandez of Berkadia arranged the Freddie Mac Loan on behalf of the borrower, Vantage Point Acquisitions, a real estate private equity firm. The loan features a five-year term and a fixed interest rate. Built in 1988, River Walk Savannah features one- and two-bedroom apartments, as well as a clubhouse, gated access, pickleball court, pet park, swimming pool and a fitness center.

IPA Brokers $87.2M Sale of Paragon at Old Town Multifamily Property in Monrovia, California

by Amy Works

MONROVIA, CALIF. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Paragon at Old Town, an apartment community in Monrovia, northeast of Los Angeles. Sequoia Equities sold the asset to SCS Development Co. for $87.2 million, or $535,276 per unit. Paragon at Old Town features 163 apartments in six floor plans with units ranging from 744 square feet to 1,247 square feet, a resident lounge, fitness center, game room, and elliptical swimming pool and spa with private cabanas, outdoor lounges and courtyards. The 6,077-square-foot ground-floor retail space offers four suites that are fully occupied by The UPS Store, eateries and a sporting goods store. Joseph Grabiec, Kevin Green and Gregory Harris of IPA represented the seller and procured the buyer in the deal.

PCCP Provides $41M Senior Loan for the Development of 210-Unit Overlook Apartments in Johnstown, Colorado

by Amy Works

JOHNSTOWN, COLO. — PCCP has provided a $41 million senior loan to Journey Homes for the construction of Overlook Apartments, a garden-style multifamily community located at 2530 Bearberry Lane in Johnstown, just south of Fort Collins. Construction is underway with completion slated for first-quarter 2025. Situated on 16 acres, Overlook Apartments will feature 210 one-, two- and three-bedroom units spread across 10 residential buildings. The community will offer a clubhouse, fitness center, resort-style pool, coworking lounge, resident lounge, children’s playground and picnic areas with outdoor firepits and grills.

Bell Partners Divests of 306-Unit Bell Cherry Hills Multifamily Property in Englewood, Colorado

by Amy Works

ENGLEWOOD, COLO. — Bell Partners has completed the disposition of Bell Cherry Hills, an apartment community in Englewood. Terms of the transaction were not released. Terrance Hunt, Shane Ozment, Chris Hart and Brad Schlafer of CBRE represented the seller in the deal. Located at 3650 S. Broadway St., the four-story, two-building property offers 306 studio, one-, two- and three-bedroom apartments. Each unit features granite countertops, Energy Star-rated appliances, energy-saving programmable thermostats and a private balcony or patio. Community amenities include a fitness center, resort-style pool and spa, outdoor kitchen, sky deck, resident lounge, game room, business center, dog park and grooming station, ski and bike repair shop, electric vehicle charging stations and two controlled-access parking garages.

BOLINGBROOK, ILL. — JRK Property Holdings has acquired Brook on Janes Apartments, a 288-unit multifamily community in the Chicago suburb of Bolingbrook. The purchase price was undisclosed. JRK utilized its JRK Platform 5 Fund, a $1 billion multifamily value-add and core plus fund that targets higher-quality, well-located multifamily investments built after 1990. The fund’s portfolio is comprised of institutional-quality assets with an average year built of 2019 located in Illinois, Florida, Kansas and California. Built by the undisclosed seller in 2017, Brook on Janes rises three stories at 401 Janes Ave. Units come in studio, one-, two- and three-bedroom layouts. Amenities include a pool, clubhouse, fitness club, cookout area and gated dog park. Kevin Girard, Roberto Casas and Matt Lawton of JLL represented the seller. Annie Rice and Brandon Smith of JLL arranged agency acquisition financing with a 10-year, fixed-rate loan.