FREEHOLD, N.J. — Ziegler has arranged $42.5 million in bond financing for the acquisition of Applewood, a continuing care retirement community (CCRC) in Freehold, an eastern suburb of Trenton. Located on approximately 44 acres, Applewood opened in 1990 and offers 300 independent living units, 37 assisted living units, 11 memory care units and 60 skilled nursing units. The acquisition was completed utilizing a mix of tax-exempt and taxable debt. The borrower is FellowshipLIFE, a nonprofit owner-operator of CCRCs in New Jersey.

Multifamily

ELLISVILLE, MO. — Midas Construction has topped off MILA Apartments in Ellisville, a far west suburb of St. Louis. The four-story, 227-unit luxury apartment complex is slated for completion in summer 2025. Midas Hospitality and Balke Brown are developing the project with affiliates Double Eagle Development and Diamond Income Fund. Designed by Rosemann & Associates, the property will feature a 141,000-square-foot parking garage. There will be eight floor plans ranging in size from 552 to 1,363 square feet. Amenities will include a courtyard, pool, bike storage, dog park, business center and fitness room. The project site was formerly home to a car dealership.

INDIANAPOLIS — Dwight Mortgage Trust (DMT), the affiliate REIT of Dwight Capital, has provided a $26.8 million bridge loan for Fountain Parc Apartments in Indianapolis. The 241-unit, garden-style multifamily property consists of 14 buildings on 15 acres. Amenities include a fitness center, pet wash station, dog park, playground, pool and firepit. The loan proceeds will retire existing debt and finance interior improvements. David Scheer of Dwight originated the loan on behalf of the borrower, Pepper Pike Capital Partners.

BUCKS COUNTY, PA. — Walker & Dunlop has arranged the sale of a 146-unit seniors housing property in Bucks County. The unnamed property, which was developed in 2022 and is located about 30 miles north of Philadelphia, offers independent living, assisted living and memory care services. The buyer was a public healthcare REIT. The seller and sales price were not disclosed. Joshua Jandris, Mark Myers and Brett Gardner led the Walker & Dunlop team on the transaction.

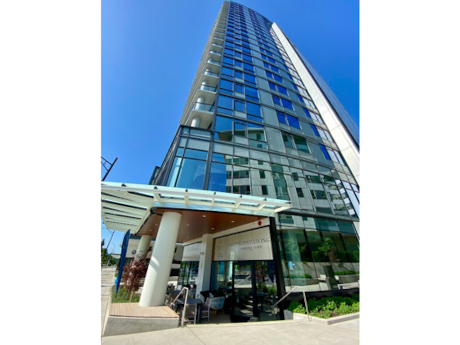

BELLEVUE, WASH. — Watermark Retirement Communities and Alliance Residential Co. have completed construction of a new independent living tower at Watermark at Bellevue in the Seattle suburb of Bellevue. The community now offers a continuum of care, with its existing assisted living and memory care spaces. The property features 110 assisted living apartments and 26 memory care units. The expanded Watermark at Bellevue, now totaling 360,000 square feet, spans an entire city block. The 155-unit, 22-story independent living tower features studios, one-bedroom and two-bedroom apartments. Watermark at Bellevue is adjacent to the 190-unit Broadstone Savoie, which is a luxury multifamily project featuring studios, one-bedroom and two-bedroom apartments, as well as townhomes.

DENVER — NorthPeak Commercial Advisors has arranged the sale of 995 Corona St., an apartment building in Denver. The 11-unit asset traded for $2.3 million, or $205,454 per unit. Greg Johnson and Conner Piretti of NorthPeak Commercial represented the undisclosed seller in the deal. The name of the buyer was not released.

BRYAN AND COLLEGE STATION, TEXAS — Austin-based developer Teeple Partners has broken ground on Brazos Oaks, a 315-unit multifamily project that will be located in the Bryan/College Station area of Central Texas. Brazos Oaks represents the first of three phases of a larger development that will consist of more than 1,000 units on a 53-acre site. Units will come in one-, two- and three-bedroom floor plans and will feature stainless steel appliances, granite countertops, custom cabinetry and private yards. Amenities will include a pool, fitness center, conference room, great room lounge, mini-offices, a package locker system, two pickleball courts, a bocce ball court and two dog parks. The first units at Brazos Oaks are expected to be available for occupancy in summer 2025, and completion of the entire development is slated for summer 2026. RVK Architecture designed the project, and Interwest Construction is serving as the general contractor. San Antonio-based Mason Joseph Co. provided construction financing.

HOUSTON — Senior Living Investment Brokerage (SLIB) has arranged the sale of Treemont Health Care Center, a 112-bed seniors housing property in Houston. Built in 1974, the 39,058-square-foot community sits on approximately 1.3 acres and offers 42 assisted living beds and 70 skilled nursing beds The buyer was a local seniors housing owner-operator, and the seller was a regional owner-operator. Vince Viverito, Matt Alley, Jason Punzel, Brad Goodsell and Jake Anderson of SLIB brokered the deal.

OMAHA, NEB. — Colliers Mortgage has provided a $29.9 million Fannie Mae loan for the refinancing of Highline Apartments in Omaha. The 306-unit apartment complex consists of two buildings connected by a covered parking garage. Amenities include rooftop decks, basketball courts, a business center, fitness center, outdoor pool and clubhouse. Brett Olson and Jeff Witt of Colliers Mortgage originated the 10-year loan, which features interest-only payments for the full term.

LAWRENCE, KAN. — Tailwind Group has acquired The Reserve on West 31st, a 192-unit student housing property located 1.5 miles from The University of Kansas in Lawrence. Built in 1999, the community features a mix of three- and four-bedroom floor plans. Amenities include a study lounge, pool, fitness center and picnic area. Ryan Lang, Jack Brett and Ben Harkrider of Newmark arranged a structured equity facility on behalf of Tailwind to finance student housing acquisitions nationwide. Tailwind leveraged the facility to complete the acquisition of The Reserve on West 31st and plans to make capital improvements to the property.