LENEXA, KAN. — Walker & Dunlop Inc. has arranged $29.6 million in federal Low-Income Housing Tax Credit (LIHTC) equity for the financing of Canyon Creek East, an affordable housing project in Lenexa. The development will include 212 units across five buildings. Jennifer Erixon led the Walker & Dunlop team that arranged the LIHTC equity, which will finance approximately 40 percent of the total development costs, on behalf of MRE Capital. Canyon Creek East is part of the larger Cedar Canyon West development plan, which encompasses a mix of residential, commercial and recreational facilities. MRE’s development will provide units for households earning between 30 and 80 percent of the area median income.

Multifamily

CHICAGO — Interra Realty has brokered the sale of a 30-unit multifamily property in Chicago’s Uptown neighborhood for $5 million. Built in 1927 and renovated in 2014, the asset at 5051 N. Kenmore Ave. was fully leased at the time of sale. Joe Smazal of Interra represented the buyer, East Superior Real Estate Partners, and the seller, an East Coast-based investment company. The buyer assumed the property’s existing mortgage, which carries an interest rate below current market levels.

SEATTLE — Washington Federal Bank, the wholly owned subsidiary of WaFd Inc. (NASDAQ: WAFD), has consummated the sale of approximately $2.8 billion of multifamily commercial real estate loans to Bank of America, which in turn is selling the loans to funds managed by Pacific Investment Management Co. The sale of the multifamily loans was executed at no loss to WaFd and provides immediate liquidity, according to the seller. The packaged loans all came from WaFd’s acquisition of Luther Burbank Savings in March. The sale of the CRE loans was not a condition of the merger.

SEATTLE — Kidder Mathews has negotiated the sale of Uptown Queen Anne Apartments, a mid-rise multifamily property at 315 First Ave. W. in Seattle. The seller, which originally developed the building in 2001, sold the asset to Trinity Real Estate for $19.9 million, or $331,000 per unit. Situated in the Queen Anne neighborhood, Uptown Queen Anne Apartments features 60 apartments and two commercial spaces. Jerrid Anderson and Winslow Lee of the Simon and Anderson team, a multifamily investment team based at Kidder Mathews’ Seattle headquarters, represented the seller in the off-market transaction.

DENTON, TEXAS — A partnership between two Dallas-based firms, Town Cos. and BC2 Capital, and New Orleans-based Benson Capital Partners has purchased Panhandle at Rayzor Ranch, a 105-unit multifamily property located in the North Texas city of Denton. The complex is part of the 400-acre Rayzor Ranch mixed-use development. Information on floor plans and amenities was not disclosed. The seller and sales price were also not disclosed.

Klotz, Longleaf to Develop $250M Residential Project in North Myrtle Beach, South Carolina

by John Nelson

NORTH MYRTLE BEACH, S.C. — The Klotz Group of Cos. and Longleaf Real Estate plan to soon break ground on The Preserve, a $250 million residential development in the coastal city of North Myrtle Beach. The plans for the 110-acre project call for 370 luxury apartments, 207 build-to-rent homes, 227 paired villa lots and 10,000 square feet of commercial space. Situated between the Intercoastal Waterway and the Carolina Bays Parkway, The Preserve will eventually be a part of a planned development district (PDD) that will feature more than 3,500 dwelling units and 1 million square feet of commercial space, including a 165,000-square-foot Amazon delivery facility. The construction timeline was not disclosed, but Klotz and Longleaf plan to break ground on The Preserve this summer.

COLUMBIA AND MYRTLE BEACH, S.C. — Berkadia has arranged the sale of two assisted living and memory care communities in South Carolina. Berkadia Seniors Housing & Healthcare, led by Mike Garbers, Cody Tremper, Dave Fasano and Ross Sanders, closed the 156-unit transaction on behalf of a publicly traded REIT. The properties, located in the Columbia and Myrtle Beach MSAs, were purchased by a regional owner-operator. The sales price and specific locations were not disclosed.

MERIDEN, CONN. — KeyBank has provided $51.5 million in financing for a multifamily conversion project in Meriden, located roughly midway between New Haven and Hartford. The sponsor, Trinity Financial, will redevelop the former manufacturing facility of musical instrument maker Aeolian Co. into an 82-unit mixed-income housing complex. The historic building is located at 85 Tremont St. and was originally constructed in 1887. Units will be subject to a range of income restrictions, with 11 residences to be rented at market rates. Amenities will include a fitness center, community room and a children’s play area. KeyBank provided a $24.5 million construction loan as the primary debt component of the financing package, and Trinity secured another $27 million in equity financing from a multitude of different sources. A tentative completion date was not disclosed.

ANOKA, MINN. — Volunteers of America National Services has opened Nolte River Place, an 80-unit affordable seniors housing community in Anoka, a northern suburb of Minneapolis. The property features one- and two-bedroom units, eight of which are reserved for formerly unhoused senior veterans and 10 are designated units for Project Rental Assistance Contracts vouchers. Amenities include a community room, exercise room, underground parking, hair salon and library. Volunteers of America is a faith-based nonprofit with programs in 46 states.

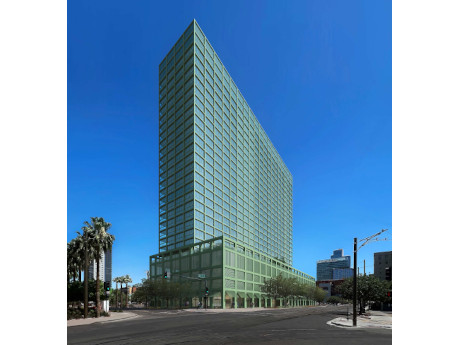

PHOENIX — JLL Capital Markets has arranged $120 million in construction financing for the development of Ray Phoenix, a 26-story residential building in downtown Phoenix. Michael Gigliotti, Brad Miner and Frank Choumas of JLL Capital Markets Debt Advisory secured the financing for the borrower, VeLa Development Partners and Ray, through an affiliate of RXR Realty Investments LLC. Located at 777 N. Central Ave., Ray Phoenix will offer 401 studio, one- and two-bedroom apartments, including duplex and penthouse units with floor-to-ceiling windows, custom cabinetry and luxury flooring and bathroom tiles. The property will feature 20,000 square feet of amenity space, including a large fitness center, yoga studio, resort-style pool, communal kitchen, fireplace lounge, sunken lounge with theater experience, dog wash stations, indoor and outdoor gardens, and workspaces. Situated within an Opportunity Zone, Ray Phoenix will be located on the Phoenix light-rail line and less than a mile north of the Footprint Center and Chase Field.