SAN CLEMENTE, CALIF. — CBRE has brokered the sales of two six-unit multifamily properties in the Orange County city of San Clemente. Individual private investors acquired the assets for a combined sale price of $5.5 million. Dan Blackwell, Mike O’Neill and Amanda Fielder of CBRE represented both the buyers and seller in the two transactions. In the first deal, a San Clemente-based private buyer acquired a six-unit, 3,535-square-foot multifamily building, located on a 14,500-square-foot lot at 306 Cazador Lane. A San Diego County-based seller sold the property for $2.8 million, or $470,000 per unit. Built in 1951, the residential building comprises one-bedroom units, five garage spaces and two open parking spaces. In the second transaction, the same seller sold a six-unit, two-story multifamily building, located on an 8,004-square-foot lot at 239 Avenida Pelayo. A Newport Beach-based private buyer purchased the asset for $2.7 million, or $454,167 per unit. Constructed in 1965, the 6,211-square-foot building features six two-bedroom units, residential storage lockers, laundry facilities and six carport spaces.

Multifamily

CHESTERFIELD, MO. — Shelbourne Healthcare Development Group is nearing completion of The Lumiere of Chesterfield, an upscale senior living community in the St. Louis suburb of Chesterfield. The developer has tapped Tutera Senior Living & Health Care as the operator. The 193,000-square-foot development will offer 150 units, including 96 independent living, 37 assisted living and 17 memory care units.

EDISON, N.J. — Locally based developer Garden Communities is nearing completion of Millbrook Horizon, a 40-unit multifamily project located in the Central New Jersey community of Edison. Millbrook Horizon comprises three buildings that house one- and two-bedroom units. Two buildings are complete, and the third building will be complete later this summer. Rents start at $2,600 per month for a one-bedroom apartment.

PHOENIX — ABI Multifamily has arranged the $2.6 million sale of 1011 Apartments, a multifamily community in Phoenix. The undisclosed buyer and seller are both based in Arizona. Carson Griesemer, Mitchell Drake and Dallin Hammond of ABI Multifamily represented the seller and buyer in the deal. Located at 6623, 6627 and 6631 South 10th St. and 6624 and 6632 South 11th St., 1011 Apartments features 20 two-bedroom/one-bath units each totaling 621 square feet. All units underwent interior upgrades, including new flooring, countertops, window coverings, paint, bathrooms and cabinets. Exterior upgrades include new roofing and air conditioning systems.

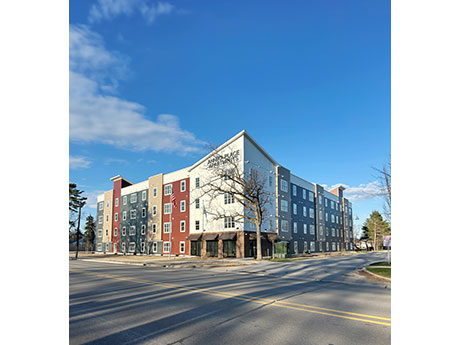

TRAVERSE CITY, MICH. — Woda Cooper Cos. Inc. has opened Annika Place, a 53-unit affordable housing community in Traverse City. The $14.7 million project offers 29 one-bedroom units and 24 two-bedroom units for residents who earn 30 to 80 percent of the area median income. Rental rates range from $377 to $1,125 per month, depending on the income restriction and size of unit. The Traverse City Housing Commission will provide rental assistance for eight units to be occupied by formerly homeless residents. The four-story development features amenities such as a community kitchen, fitness center, rooftop terrace, patio, picnic table, grill, park benches and playground. Annika Place is made possible with funding supported by Low-Income Housing Tax Credits allocated by the Michigan State Housing Development Authority. Affordable housing finance syndicator CREA LLC invested in the credits to provide equity financing. Huntington Bank provided a construction loan and permanent financing. The project honors the memory of U.S. Coast Guardsman Douglas Munro, who lost his life at the Guadalcanal on Sept. 27, 1942, because of heroic measures with his Higgins boat that shielded and saved the lives of 500 Marines. He is the only Coast Guard member to receive the Medal of Honor. …

Marcus & Millichap Brokers Sale of 2,867 SF Fifth & Penn Mixed-Use Property in San Diego

by Amy Works

SAN DIEGO — Marcus & Millichap has arranged the sale of Fifth & Penn, a mixed-use property in San Diego. Tom Fine of TJF 5th Ave LLC sold the asset to Daniel Heimler of DAH Penn LLC for $1.6 million. Located at 441-43 Pennsylvania Ave., the 2,867-square-foot property offers ground-floor restaurant space and an apartment and creative office space on the second floor. The buyer plans to occupy the apartment, while the restaurant and office tenants will remain at the building. Ross Sanchez and Nick Totah of The Totah Group in Marcus & Millichap represented the seller and procured the buyer in the deal.

Aztec Group Arranges $55.6M Financing for Active Adult Community in Palm Beach Gardens, Florida

by John Nelson

PALM BEACH GARDENS, FLA. — Aztec Group has arranged $55.6 million in bridge financing for Arcadia Gardens, an active adult community located in Palm Beach Gardens. MetLife provided the loan to the borrowers, affiliates of the United Group of Cos. and Sina Cos. United Group also manages the property, which was developed in 2021. Situated on 10.6 acres, the age-restricted apartment community comprises 220 units reserved for residents age 55 and older. Amenities at Arcadia Gardens include a fitness center, salon, movie theater, swimming pool, spa, community garden, walking trail, onsite dining facilities and pickleball, bocce and croquet courts.

TEMPE, ARIZ. — Transwestern Development Co. has completed Vero, a seven-story multifamily property within Novus Innovation Corridor in Tempe. Greystar is managing the Class A community. Globe Corp. and University Realty are investment partners on the project. Located at 651 E. 6th St., Vero offers 199 apartments with washers/dryers, stainless steel appliances and hardwood-style flooring. Select units offer custom built-ins, balconies and Murphy beds. Onsite amenities include a resort-style pool with lounge area; fitness center; coworking space with conference rooms; a resident clubhouse with a pool table and wet bar; and secure bike storage.

MOUNTAIN VIEW, CALIF. — Cityview and Greystar have completed the disposition of Elan Mountain View, a mixed-use property at 1030 Castro St. in the Bay Area city of Mountain View. Terms of the transaction were not released. Developed in 2018, Elan Mountain View offers 164 apartments and 11,000 square feet of fully occupied ground-floor retail space. The community features studio, one-, two- and three-bedroom floor plans with smart thermostats, keyless entry, quartz countertops, modern cabinetry, full-tile kitchen backsplashes, wood vinyl plank flooring, stainless steel appliances and full-size washers and dryers. Select units feature street-level walk-up entrances, as well as private patios and balconies. Community amenities include a fully equipped fitness center; two-level club room with billiards table and chef’s kitchen; hammock lounge; edible garden pathway; private business center; and a courtyard with lounge seating, an outdoor kitchen, fireplaces and a fruit garden. Additionally, the property offers 164 storage units to residents and secured access parking. Current onsite retailers include Rose International Market, Mr. Sun, Le’s Alterations, Tanya’s Hair Design and Oh! Honey Macaron.

Gantry Arranges $4.3M Refinancing for Parkside La Palma Apartments in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — Gantry has secured a $4.3 million permanent loan to refinance Parkside La Palma Apartments, a garden-style multifamily community in Anaheim. Located at 1000 E. La Palma Ave., Parkside La Palma features 79 studio, one- and two-bedroom floor plans. Originally built in 1973, the community offers modern unit interiors, a community pool, onsite laundry, children’s playground and landscaping. George Mitsanas, Stefan Malmlund and Keegan Bridges of Gantry’s Los Angeles and Irvine offices represented the borrower, a private real estate investor. One of Gantry’s correspondent life company lenders provided the 10-year loan, which features a 20-year amortization and prepayment options. Gantry will service the loan.