DUNWOODY, GA. — The Dunwoody City Council has approved the rezoning of Phase IV of Park Center, a 17-acre, transit-oriented office campus in metro Atlanta. The master developer of the project is KDC, a Dallas-based corporate development and investment firm. The amended zoning will allow KDC to change its plans from a standalone fourth office tower to a two-tower project that will comprise 175 hotel rooms, 300 residential units, 22,000 square feet of retail space and 300,000 square feet of office space. The plan includes two towers on a common podium with a 20-story apartment tower and a combined office and hotel tower, where six floors of hotel rooms will sit atop 12 levels of office space. Phase IV represents the final phase of Park Center and will occupy the last undeveloped portion of the development, which was originally conceived as a 2.2 million-square-foot East Coast hub for State Farm Insurance. The project team includes local architecture firm Cooper Carry. The current campus contains three office towers developed over the past 10 years: the 600,000-square-foot Park Center One, which is directly connected to the Dunwoody MARTA Station; the 621,000-square-foot Park Center Two with more than 39,000 square feet of retail …

Multifamily

ARLINGTON, VA. — Berkadia has secured a $40.6 million loan for the acquisition of Marlowe Apartments, a 162-unit multifamily community located in Arlington. Built in 1987, the property is situated directly across from the newly completed Amazon HQ2, Metropolitan Park. Brian Gould, Miles Drinkwalter and Pat Cunningham of Berkadia arranged the financing on behalf of the buyer, Washington, D.C.-based The FORTIS Cos. Additionally, Brian Crivella, Yalda Ghamarian and Bill Gribbin of Berkadia represented the undisclosed seller in the sale to FORTIS.

Pacific Urban Investors Acquires 420-Unit Viridian Apartments in Greenwood Village, Colorado

by Amy Works

GREENWOOD VILLAGE, COLO. — Palo Alto, Calif.-based Pacific Urban Investors has purchased Viridian, a multifamily property in Greenwood Village, a suburb of Denver. Terms of the acquisition were not released. The acquisition marks Pacific’s fourth investment in the Denver market with the firm’s regional portfolio now totaling 884 units. Viridian features 420 apartments with nine-foot ceilings, a resort-style pool, full-sized basketball court and parking ratio of 1.7 stalls per unit.

ARLINGTON, TEXAS — Marcus & Millichap has brokered the sale of Fielder’s Glen, a 220-unit apartment complex in Arlington. Built on 10 acres in 1985, Fielder’s Glen features studio, one- and two-bedroom units and amenities such as a pool, fitness center, outdoor grilling and dining stations and onsite laundry facilities. Al Silva and Ford Braly of Marcus & Millichap represented the seller, Canadian investment firm Western Wealth Capital, in the transaction and procured the buyer, locally based investment firm Rise48 Equity. Brandon Brown of Marcus & Millichap Capital Corp. arranged acquisition financing for the deal.

SAN ANTONIO — Dallas-based brokerage firm The Multifamily Group (TMG) has arranged the sale of Stepping Stone Apartments, an 80-unit multifamily complex in San Antonio’s Westwood Village neighborhood. Built in 1985, the property offers one- and two-bedroom units with an average size of 701 square feet. Amenities include a pool, outdoor grilling and dining stations and onsite laundry facilities. Paul Yazbeck of TMG represented the seller in the transaction, and Greg Miller of TMG procured the buyer. Both parties requested anonymity.

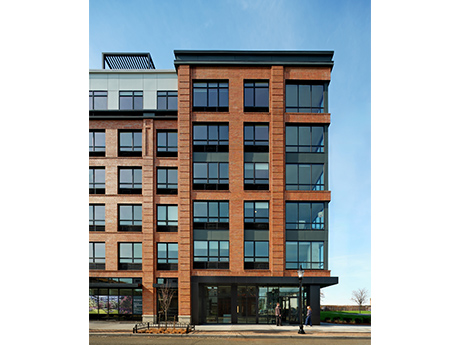

JERSEY CITY, N.J. — Locally based developer Halpern Real Estate Ventures has completed Birch House, a 337-unit apartment community located at 49 Fisk St. in Jersey City’s West Side neighborhood. Designed by Minno & Wasko Architects & Planners, the six-story building houses studio, one- and two-bedroom units and roughly 50,000 square feet of indoor and outdoor amenity space. Other project partners included JRM Construction Management and The Corcoran Group, which is marketing the property for lease. Construction began in late 2021 and topped out in spring 2023.

DANBURY, CONN. — Regional brokerage firm Northeast Private Client Group (NEPCG) has negotiated the $5.2 million sale of Willow Park Apartments, a 21-unit multifamily complex located in the southern Connecticut city of Danbury. According to Apartments.com, the property exclusively offers one-bedroom units that span 575 square feet. Jeff Wright and Rich Edwards of NEPCG represented the seller and procured the buyer, both of which requested anonymity, in the transaction.

AUSTIN, TEXAS — JLL has brokered the sale of 3Waller, a 259-unit multifamily property in downtown Austin. Built in 2022, the property offers studio, one- and two-bedroom micro-units that have an average size of 467 square feet. According to Apartments.com, amenities include a pool, fitness center, coworking space, resident lounge and a rooftop deck. Ryan McBride, Robert Arzola, Robert Wooten, Alex Fernandes and Nick Beardslee of JLL represented the seller, Transwestern, in the transaction. Placemakr acquired the asset for an undisclosed price.

TOLLESON, ARIZ. — Evergreen Devco has sold Parc Tolleson, a 258-unit multifamily property located about 15 miles west of Phoenix. The sales price was $62.7 million. Completed in 2023, the garden-style community features one-, two- and three-bedroom units with an average size of 961 square feet. Residences features nine-foot ceilings, vinyl plank flooring and full-size washers and dryers. Amenities include a pool with fireplace lounges and poolside dining areas, electric vehicle charging stations, a pet spa, 24-hour fitness center and a clubhouse with gaming tables, seating areas and a coffee bar. Asher Gunter, Matt Pesch, Sean Cunningham and Austin Groen of CBRE represented Evergreen Devco in the transaction. Troy Tegeler and Trevor Breaux, also with CBRE, arranged acquisition financing on behalf of the buyer, Millburn & Co.

American Landmark Acquires 444-Unit Pointe on Westshore Multifamily Community in Tampa

by John Nelson

TAMPA, FLA. — American Landmark Apartments has acquired The Pointe on Westshore, a 444-unit multifamily community located at 4950 W. Prescott St. in the Westshore Marina District of Tampa. Built in 2021, the property features 13 five-story apartment buildings and two-story townhomes, with residences in one-, two- and three-bedroom floor plans. Amenities at the community include a swimming pool, fitness center, pet spa, business center and barbecue and picnic area. The seller and sales price were not disclosed.