NASHVILLE, TENN. — Turnberry plans to develop and operate The St. Regis Nashville and The Residences at The St. Regis Nashville, a 39-story hotel-condo tower at 805 Demonbreun St. in Nashville. The property will span 740,000 square feet and feature 177 hotel rooms and 111 for-sale residences, as well as a fine-dining restaurant, lobby bar, three-meal restaurant, full-service spa and two amenity decks — one for hotel guests and one for residents. The design team includes architectural firm Morris Adjmi, interior designer Meyer Davis and architect of record Smallwood, Reynolds, Stewart, Stewart. St. Regis Hotels & Resorts is a brand within the Marriott International family. The property will be situated adjacent to the JW Marriott Nashville, which Turnberry delivered in 2018. The South Florida-based developer plans to break ground on St. Regis Nashville in 2025.

Multifamily

Greystone Provides $18.6M Agency Loan for Keystone Apartments in Fayetteville, North Carolina

by John Nelson

FAYETTEVILLE, N.C. — Greystone has provided an $18.6 million Freddie Mac loan for the refinancing of Keystone Apartments, a 202-unit multifamily property in Fayetteville, about 64 miles south of Raleigh. Justin Hechler of Greystone originated the nonrecourse, fixed-rate loan on behalf of the borrowers, Magma Equities and Prudent Growth Partners. The financing was underwritten with a five-year term, two years of interest-only payments and a 30-year amortization schedule. Built in 1974, Keystone Apartments features one- and two-bedroom units, as well as a clubhouse, fitness center, swimming pool and a dog park.

DALLAS — BWE, the commercial lender formerly known as Bellwether Enterprise Real Estate Capital, has provided $16.8 million in Freddie Mac permanent financing for Estates at Ferguson, a 164-unit affordable seniors housing project in Dallas. The property will offer 99 one-bedroom units and 65 two-bedroom units, with the majority of residences (148) reserved for renters earning 60 percent or less of the area median income. John Killough and John Roberts of BWE originated the loan, which carries a 15-year term and a fixed interest rate. The City of Dallas HFC also issued tax-exempt bonds as part of the project’s capital stack, and The Texas Department of Housing & Community Affairs provided Low-Income Housing Tax Credit (LIHTC) equity. Construction is underway and expected to last about 15 months. The sponsor was not disclosed.

DALLAS — Marcus & Millichap has arranged the sale of a portfolio of two multifamily properties totaling 130 units in the Knox-Henderson neighborhood of Dallas. Garrett Gardens totals 66 units, and Moser Gardens totals 64 units. The seller was a private partnership from out of state that had owned the properties for 33 years. The buyer was a Dallas-based owner-operator. Al Silva and Ford Braly of Marcus & Millichap represented both anonymous parties in the deal.

DUNELLEN, N.J. — Locally based developer Prism Capital Partners has received $53.9 million in financing for The Nell, a 252-unit multifamily property in the Central New Jersey community of Dunellen. Designed by Spiezle Architectural Group, the transit-oriented, newly built property offers one- and two-bedroom units and includes 3,700 square feet of retail space. The amenity package comprises a pool, fitness center, resident lounge, community kitchen, meeting rooms, an outdoor bar with TVs and grilling and dining areas. Rodney Sherman and Greg Halvorson of KeyBank Real Estate Capital arranged the seven-year loan, which provides fixed-rate takeout financing, through New York Life Real Estate Investors on behalf of Prism Capital Partners.

LAS VEGAS — ABI Multifamily has negotiated the sale of a three-property multifamily portfolio in Las Vegas for a combined $8.9 million, or $121,431 per unit. The undisclosed buyer and seller are both based in Nevada. Jason Dittenber, Josh McDougall, Anthony Marinello and Bradley Gumm of ABI Multifamily represented the seller in the deal. The portfolio includes:

PALM DESERT, CALIF. — CBRE has brokered the purchase of an apartment property located at 73435 San Gorgonio Way in the Coachella Valley city of Palm Desert. A Los Angeles-based private investor acquired the asset from an undisclosed seller for $2.2 million, or $264 per square foot, in an off-market transaction. Dan Blackwell and Andrew Boukather of CBRE represented the buyer in the deal. Built in 1988, the two-story, 8,360-square-foot building offers 10 two-bedroom apartments with a patios or balconies, a community pool and garage parking.

COLUMBUS, OHIO — Woda Cooper Cos. Inc. has opened Lockbourne Greene, a 60-unit affordable housing community with an onsite early learning center in Columbus. Woda developed the property at 1840 Lockbourne Road in partnership with Healthy Homes, which is affiliated with Community Development for All People and Nationwide Children’s Hospital’s Healthy Neighborhoods Healthy Families Initiative. The project transformed a vacant Columbus Land Bank property. The development is available for workforce families, seniors and other general occupancy residents who earn 40 to 70 percent of the area median income, or roughly $39,680 to $69,440 annually for a family of four. Rents range from $760 to $999 per month, depending on income category and size of unit. The three-story, 71,000-square-foot building includes 12 one-bedroom, 40 two-bedroom and eight three-bedroom apartments. Five units offer features for people with disabilities. Community amenities include an onsite management office, resident fitness center and community room. Financing for the $16 million project came from a diverse mix of public, private and nonprofit sources. Equity financing was made possible through the allocation of federal Low-Income Housing Tax Credits via the Ohio Housing Finance Agency. Bank of America invested $7.3 million in the tax credits and supplied a construction …

Affordable HousingDevelopmentFloridaLeasing ActivityMixed-UseMultifamilyOfficeRestaurantRetailSeniors HousingSoutheastTop Stories

SG Holdings Completes Leasing at $350M Mixed-Use Development in Miami, Plans Summer Opening

by John Nelson

MIAMI — SG Holdings has completed leasing at Sawyer’s Walk, a 3.4-acre mixed-use development underway in Miami’s Overtown neighborhood. The project, which will feature retail space, offices and affordable housing for seniors, is set to open this summer. SG Holdings is a partnership comprising Swerdlow Group, SJM Partners and Alben Duffie. The development team broke ground on Sawyer’s Walk in summer 2021. The development costs were not disclosed, but the Miami Herald reported the price tag hovers around $350 million. “The anticipated delivery of our mixed-use development will serve as an economic catalyst for Overtown, with the creation of over 1,000 quality jobs, the opening of a new full-service supermarket and mix of national retail stores that will serve the immediate community and surrounding neighborhoods,” says Michael Swerdlow, managing partner of Swerdlow Group. Sawyer’s Walk will feature 175,000 square feet of retail space. Committed tenants include Target (50,000 square feet), Aldi (25,000 square feet), Ross Dress for Less, Five Below, Tropical Smoothie Café and Burlington. MSC Group, a global cargo ship line and the world’s third-largest cruise line, purchased the property’s 130,000 square feet of office space with plans to combine its South Florida cruise and cargo operations under one roof. …

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

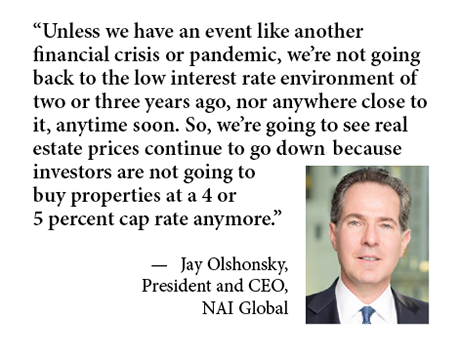

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …