BERWYN, ILL. — Interra Realty has brokered the $10.4 million sale of reVerb Century Station in the Chicago suburb of Berwyn. The 52-unit apartment building features 10,662 square feet of ground-floor commercial space. The sales price represents a record price for multifamily or mixed-use properties in Berwyn, according to CoStar. Constructed in 2010 and located at 3200 S. Oak Park Ave., the property features four ground-floor retail suites, 12 one-bedroom apartments and 40 two-bedroom units. Joe Smazal, Patrick Kennelly and Paul Waterloo of Interra represented the undisclosed seller. The team also represented the buyer, an investment group that assumed the loan from the seller. The buyer plans to renovate common areas and add a package system for residents.

Multifamily

IPA Negotiates Sale of 256-Unit Place at Spanish Trail Multifamily Community in Tucson, Arizona

by Amy Works

TUCSON, ARIZ. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of The Place at Spanish Trail, an apartment property in Tucson. Terms of the transaction were not disclosed. Clint Wadlund, Hamid Panahi, Steve Gebing and Cliff David of IPA represented the undisclosed seller and procured the undisclosed buyer in the deal. Completed in 1979, The Place at Spanish Trail features 256 one- and two-bedroom apartments with white Shaker-style cabinet fronts, new appliances, wood-plank laminate flooring and new electrical and plumbing fixtures. Community amenities include barbecue areas, a renovated clubhouse with full kitchen and coffee station, a renovated fitness area, Amazon package lockers, a new pool fence and furniture, and entry gate.

COSTA MESA, CALIF. — CBRE has brokered the sale of Crestview Apartments, a multifamily community in the Orange County city of Costa Mesa. An Orange County-based private investor sold the asset to a local private investor for $5 million, or $264,474 per unit. Dan Blackwell and Mike O’Neill of CBRE represented the seller, while Blackwell, O’Neill and Jack O’Connor of CBRE represented the buyer in the transaction. Located at 859 W. 19th St., the two-story, 8,931-square-foot building features 19 apartments, primarily studio units with patios or balconies. The community also has an onsite laundry facility. Recent capital improvements include new exterior paint, repaved asphalt, new decks, new windows throughout and wood replacement.

CREI Holdings Receives $41M Refinancing for Affordable Seniors Housing Community in Sweetwater, Florida

by John Nelson

SWEETWATER, FLA. — Development firm CREI Holdings has received a $41 million loan for the refinancing of Li’l Abner II apartments in Sweetwater, a South Florida city just west of Miami. Marc Suarez led the Lument team that provided the funds. The project was completed in April 2023. Designed by Burgos Lanza Architects and Planners, an architectural firm based in Coral Gables, Fla., the eight-story building is situated adjacent to its 87-unit sibling, Li’l Abner I. Li’l Abner II consists of 244 one- and two-bedroom units dedicated to affordable and workforce housing. Among these, 40 percent cater to low-income seniors, while the remainder is allocated to residents earning up to 120 percent of the area’s median income (AMI). The building is near full occupancy, according to CREI Holdings.

Landmark Properties Recapitalizes 1,364-Bed Student Housing Community Near University of Georgia

by John Nelson

ATHENS, GA. — Landmark Properties has recapitalized The Mark Athens, a 1,364-bed student housing property located at 130 Hickory St. near the University of Georgia campus. The property was developed in two phases, with the first phase completed in 2017 and the second phase completed in 2022. The community offers studio through six-bedroom apartments, alongside 67,000 square feet of retail space and 46,734 square feet of offices, with locally based Landmark occupying over 90 percent of the office space. The Mark also features 55,000 square feet of shared amenity space, including a rooftop pool and sundeck with views of the university’s campus, Sanford Stadium and downtown Athens; study spaces; a fitness center; golf simulator; racquetball court; and an indoor basketball court. Details of the refinancing were not disclosed.

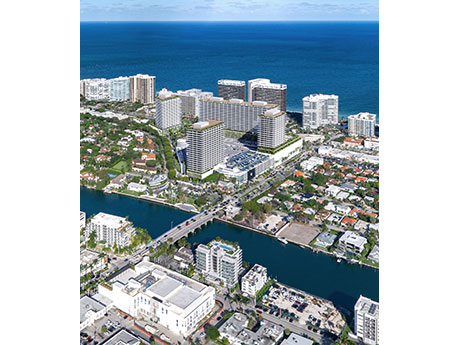

MIAMI — Whitman Family Development has submitted plans for a mixed-use project at its Bal Harbour Shops in Miami’s Bal Harbour village. Plans call for 600 apartment units, 40 percent of which are earmarked for workforce housing and 60 percent of which will be luxury housing. There will also be a 70-room, 20-story hotel and an additional 45,700 square feet of retail space. Bal Harbour Shops comprises more than 100 shops, restaurants and entertainment options. The open-air, luxury retail center, which is home to brands such as Chanel, Gucci, Tiffany & Co. and Valentino, is currently undergoing a $550 million retail expansion that will add about 250,000 square feet, nearly doubling the center’s current retail space. The expansion will accommodate the addition of 35 new upscale stores and restaurants. The new housing development is made possible by Florida’s Live Local Act, a bipartisan bill passed by the Florida legislature last year in response to the critical need for affordable and attainable housing statewide. The legislation enables developers to build at higher density and building heights, so long as they commit to including attainable housing units. The law requires that local municipalities approve mixed-use residential projects in any area zoned commercial …

By Michael Brookshier, vice president of development, Keystone The COVID-19 pandemic sent renters flocking to spacious apartments in the suburbs. Now, in this post-pandemic world, just as companies revert to in-office work and homeownership becomes increasingly unattainable, renters are moving back to cities and seeking an urban lifestyle. This re-acceleration to urban centers drives another trend in commercial real estate: converting outdated and vacant office buildings into stylish, amenity-filled residential buildings. To keep up, developers must strategically identify the right building, location and amenities in order to meet renters’ demands. Philadelphia is a perfect example of an 18- to 24-hour city in which a large residential population in the central business district drives foot traffic outside of regular office hours. The Center City area also boasts an attractive downtown landscape of diverse uses such as office, residential, retail, award-winning restaurants and nightlife. Find the Right Building The ideal candidate for a successful office-to-residential conversion in an urban setting is often an office building constructed before World War II. These types of properties feature intricate designs, high-level finishes, ample natural light, outstanding views and beautiful and inviting lobbies that lend historical architectural details that are conducive and appealing to residential living. …

EAST CANTON, OHIO — BWE has arranged a $1.1 million loan for the construction of HOPE Senior Village in East Canton, about 30 miles southeast of Akron. Bob Morton of BWE structured the USDA RHS 538 GRRHP loan, which features a 40-year, fixed-rate term and a 40-year amortization schedule. The development will consist of eight buildings, each containing five one- and two-bedroom units. Of the 40 units, seven are designated for residents earning up to 30 percent of the area median income (AMI), 17 are reserved for those earning up to 50 percent AMI and 16 are designated for residents earning up to 60 percent AMI. The project received additional financing through the use of 9 percent Low-Income Housing Tax Credits.

FRISCO, TEXAS — Hillwood has completed The Casey at Frisco Station, a 300-unit multifamily project located on the northern outskirts of Dallas. Designed by JHP Architecture, the five-story building is Hillwood’s third multifamily project within the 242-acre Frisco Station mixed-use development and follows The Cadence at Frisco Station, which opened in September 2021. Units come in studio, one- and two-bedroom floor plans, range in size from 513 to 1,375 square feet and feature built-in desks, stainless steel appliances, walk-in closets and private patios/balconies. Amenities include a coworking lounge with private offices and conference facilities, pool, fitness center and a library. Rents start at roughly $1,600 per month for a studio apartment.

HUMBLE, TEXAS — Texas-based investment firm Momentum Multifamily has acquired The Henry at Lake Houston, a 296-unit apartment community in the northeastern suburb of Humble. The property, formerly known as The Cobalt at Lake Houston, consists of 14 three-story buildings that house a mix of one-, two- and three-bedroom units. Residences feature granite countertops, stainless steel appliances and individual washers and dryers. Amenities include a pool, business center, game room, clubhouse, fitness center, putting green and storage lockers. Timbercreek Capital provided the senior acquisition loan for the deal that was arranged by Taylor Coy of JLL, with Chicago-based Pearlmark supplying mezzanine financing. The loan amounts and the name of the seller were not disclosed.