BAYONNE, N.J. — CBRE has brokered the $6.1 million sale of a multifamily project that is roughly midway through construction in the Northern New Jersey community of Bayonne. The site at 90 Ave. E will eventually house a 70-unit building. Fahri Ozturk, Richard Gatto and Zach McHale of CBRE represented the seller and developer, Brooklyn-based EOM Realty Group, in the transaction. Hudson Realty represented the buyer, an undisclosed, locally based developer.

Multifamily

INVER GROVE HEIGHTS, MINN. — JLL Capital Markets has arranged mezzanine and construction financing totaling $60.1 million for Avalon Apartments and Townhomes in Inver Grove Heights, a southeast suburb of Minneapolis. The apartment and townhome project is set to break ground immediately and will include 244 luxury units as well as 193 parking spaces. Units will come in studios through three-bedroom floor plans. Amenities will include a pool, barbecue area, pickleball court, playground, yoga room, community room, speakeasy lounge, fitness center, golf simulator, business center, rooftop patio and dog run. Dan Linnell, Scott Loving, Josh Talberg and Mox Gunderson of JLL arranged a $45 million construction loan through Alerus, a provider of business and consumer banking products based in North Dakota. JLL also sourced $15.1 million in mezzanine financing from Centerspace, a real estate investment trust focused on apartment communities throughout the Midwest and Mountain West.

CHICAGO — Interra Realty has brokered the $2.6 million sale of a 31-unit apartment building in Chicago’s South Shore neighborhood. Located at 6949-6959 S. Merrill Ave., the courtyard property includes a mix of studio to three-bedroom units, some of which have been updated with new kitchens and baths. Two units were reconfigured to include an additional bedroom, which generated additional rent of $300 per month. Max Grossman of Interra represented the local confidential buyer. Joe Smazal and Lucas Fryman of Interra represented the seller, a private investor based on the East Coast. The asset was roughly 90 percent occupied at the time of sale.

Madison Realty Capital Provides $177.5M Loan to Refinance SCAPE Boylston Apartments in Boston

by Jeff Shaw

BOSTON — Madison Realty Capital has provided a $177.5 million loan to Scape, a London-based multifamily developer that opened its U.S. headquarters in Boston in 2018. The loan will refinance the $165 million construction loan for SCAPE Boylston, a 415-unit apartment development that opened earlier this month in Boston’s Fenway neighborhood. The 226,700-square-foot property offers a mix of furnished studios, one- and two-bedroom apartments with Class A retail space on the ground floor. The apartments are already 95 percent occupied, and the retail space is 80 percent leased. Retail tenants include a global bank; Immersive Gamebox; Carbon Health; Dave’s Hot Chicken; Halal Guys; and a 10,000-square-foot, 156-seat, LGBTQ-focused black box theater. Tenant amenities include a landscaped terrace, fitness center, yoga room, co-working space, lounge library and study. The site is located near prominent academic and medical institutions including Boston University and Northeastern University, as well as Fenway’s rapidly growing biotech and life sciences industries. The lights of Fenway Park, home of Major League Baseball’s Boston Red Sox, are visible from the community, which is a block away from a Red Line MBTA train station. “Fenway is a premier academic and employment hub within Boston with substantial demand for efficiently designed, …

MIAMI — JLL has arranged a $115 million loan for the refinancing of Metro Edgewater, a new 32-story apartment tower in Miami’s Edgewater neighborhood. Jesse Wright, Elliott Throne, Kenny Cutler, Joshua Odessky and J.J. Hovenden of JLL arranged the financing through MF1 Capital on behalf of the borrower, a consortium between Lujeni Corp., Camino Capital Management and Building Block Realty. MF1’s team working on the deal included Michael Squires, Phil Pesant and Connor Pensabene. The 279-unit property comprises one-, two- and three-bedroom units averaging 955 square feet in size. Amenities include a hotel-style pool with cabanas and day beds, fitness center, live-work club room, sky lounge, private dining room and a coffee bar.

Cushman & Wakefield Brokers $35M Sale of Student Housing Community Near University of Florida

by John Nelson

GAINESVILLE, FLA. — Cushman & Wakefield has brokered the $35 million sale of The Pavilion on 62nd, a 312-unit student housing community located at 1000 S.W. 62nd Blvd. in Gainesville. A joint venture between Coastline Management Group and an entity doing business as RWW Gainesville LLC purchased the property from an undisclosed Delaware limited liability company. Mike Donaldson, Nick Meoli, Travis Prince and Victoria Marks Vagnier of Cushman & Wakefield represented the seller in the transaction. Situated about three miles from the University of Florida campus, The Pavilion on 62nd offers a unit mix consisting of mostly large four-bedroom floorplans. The property also includes two large clubhouses, two swimming pools, an indoor and outdoor basketball court, volleyball courts, movie theater, study lounge, separate cardio and weight training fitness rooms, a dog park and a computer lounge.

Newrock Signs Three New Retailers to Join Oaklyn Multifamily Development in South Florida

by John Nelson

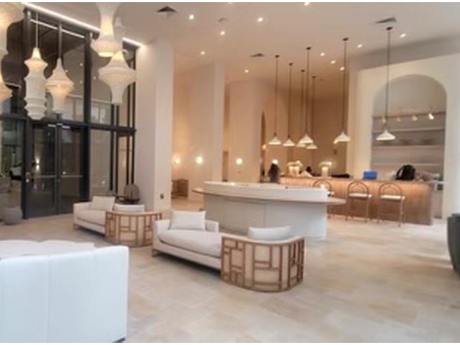

OAKLAND PARK, FLA. — Newrock Partners has signed three new retailers to join the tenant mix at Oaklyn, a multifamily development underway in South Florida’s Broward County. The new tenants include fitness brand Pure Barre, fashion boutique Monkees and wellness spa Pause Studio. Pure Barre and Monkees plan to open on the ground level at Oaklyn in the first half of 2024, and Pause Studio plans to debut next summer. Situated at 3333 N. Federal Highway in Oakland Park, Oaklyn features 274 luxury apartments and more than 19,000 square feet of retail space. Newrock delivered the property in October.

SEATTLE — Senior Living Investment Brokerage (SLIB) has arranged the sale of Emerald City, a 119-unit assisted living and memory care community in Seattle. Emerald City features 99 assisted living and 20 memory care units. It was built in 2006 with renovations in 2017. The property totals 88,839 square feet on approximately 0.8 acres of land. The seller was an out-of-state private equity group with a third-party operator. The buyer was an experienced regional owner-operator looking to expand its footprint in the Seattle MSA. The price was not disclosed. Jason Punzel, Brad Goodsell, Vince Viverito and Jake Anderson of SLIB handled the transaction.

TORRANCE AND LONG BEACH, CALIF. — CBRE has brokered the purchases of five multifamily properties in Torrance and Long Beach, totaling $17 million. The transactions fulfilled the buyer’s 1031 exchange requirement following the sale of a 3.8-acre property in Torrance. Dan Blackwell and Trey Mitchell of CBRE Multifamily SoCal represented the San Diego-based exchange buyer. The properties were sold by five different private sellers. The transactions include:

NEW YORK CITY — Boston-based developer The Davis Cos. has broken ground on a 97-unit multifamily project at 1975 Madison Ave. in Harlem. Designed by DXA Studio and built by Broadway Construction Group, the eight-story building will house one- and two-bedroom units, with 30 percent of the residences earmarked as affordable housing. Amenities will include a fitness center, resident lounge, coworking space, pet spa and a rooftop terrace. Completion is slated for late 2025.